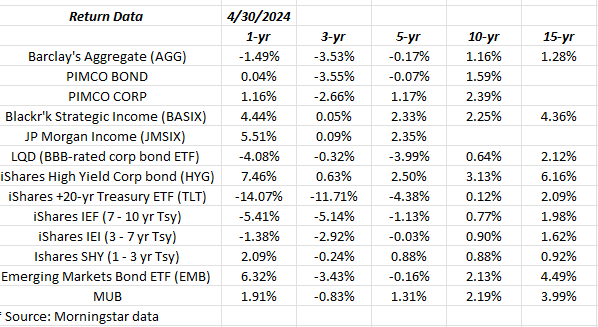

The one return stat that jumped out at me, was the +0.12% 10-year annual return for the TLT.

That’s pretty grim.

This is a table updated once a month. The only asset not included is mortgage-backed securities (MBS), which has very similar returns to Treasuries.

The 3 – 5 year returns are pretty horrid with the exception of taxable high yield.

Conclusion:

After so many years of zero interest rates (ZIRP) following 2008 and then again with Covid and the pandemic in 2001 and 2002, a reversion to the mean was expected, but the paltry annual returns on fixed-income are now as bad as when interest rates were at zero. It’s been 9 months since the Fed and Jay Powell’s last rate hike, so after July ’24, some of the 1-year annual returns will start to turn positive.

The S&P 500’s total return for April was -4.08%, while the 60% / 40% benchmark balanced portfolio returned -3.46%, and the Barclay’s Aggregate returned -2.48%.

Unless you are really overweight high-yield credit, the bond market’s annual returns are not much to speak of.

Today’s April ’24 jobs report is expecting “net, new” jobs of a little over 200,000 and private sector jobs growth of 180,000.

For Treasuries to break the string of poor returns, some weaker economic data is expected.

None of this is advice or a recommendation. The data is tracked so turning it into an article helps think about the topic at hand. Past performance is no guarantee of future results. Investing can involve the loss of principal, even over short time periods. Most if not all the return data is sourced from Morningstar or Ycharts.

Thanks for reading.