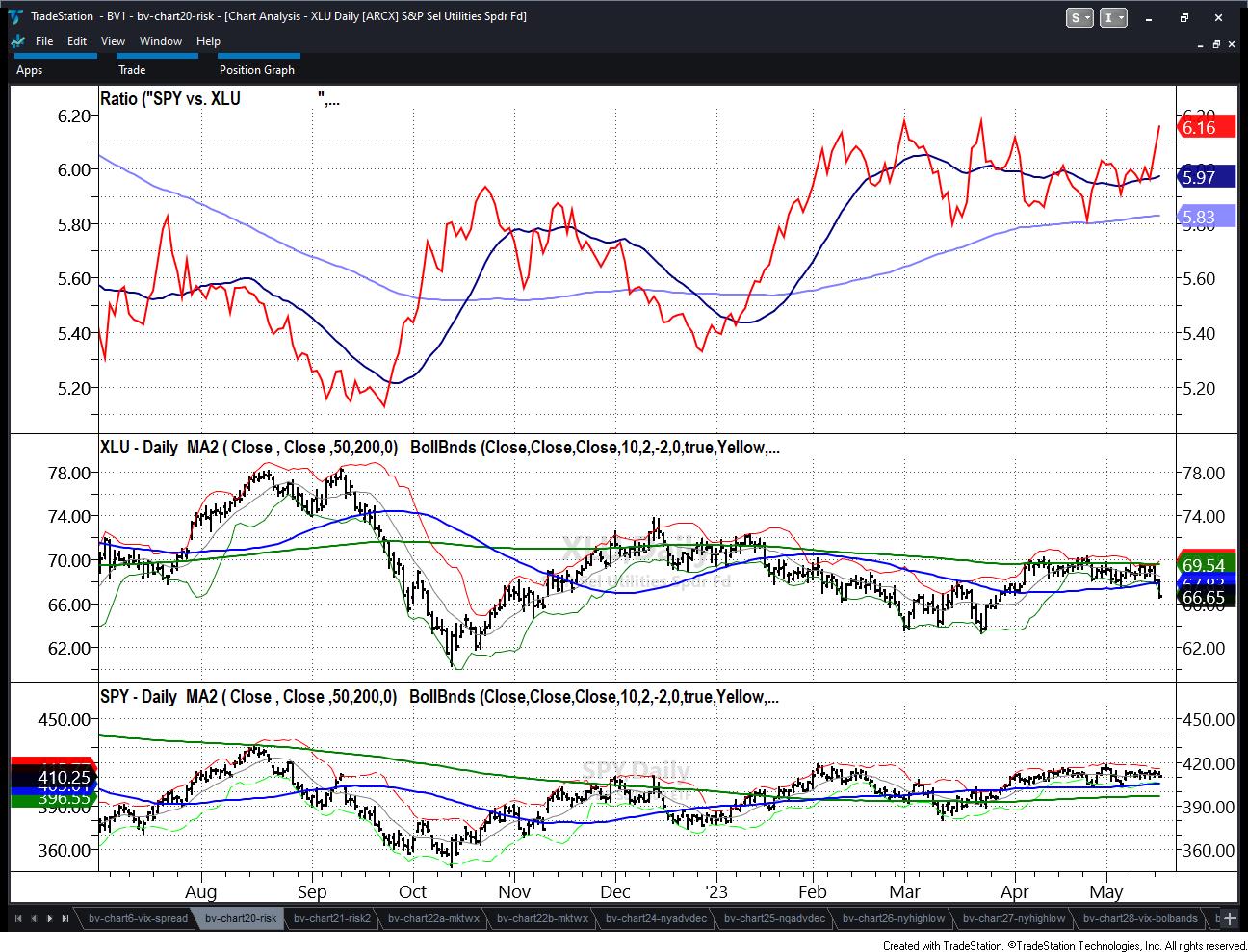

The four ratio indicators track key intermarket relationships which identify risk on/off market conditions.

These four indicators can be used together to confirm or identify the strength of the core risk on/off indicator, which is the S&P 500 v. Utilities.

As clearly illustrated, all the ratios are flashing 100% risk-on. Is it time to put your cash to work?

The bottom of the recent trading range appears to be holding at this point.

And, what led to more confidence in our recent picks (USO), Global X Lithium & Battery Tech ETF (NYSE:LIT), GME, 3 most recent examples) was the ratio between SPDR® S&P 500 (NYSE:SPY) and Long Bonds (iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT)).

I have been vocal in the media about junk bonds (HYG) versus long bonds (TLT). When a high yield outperforms long bonds, making a case for recession is hard.

Furthermore, we have mentioned that gold appeared to be in for a rest.

As you can see, SPY and WOOD outperform gold, a good thing for the stock market.

These ratios gave us a comfort level as bulls want SPY in the lead. However, let us not lose sight of the ratios, for first, they could flip.

Secondly, the trading range is still very much so a trading range.

Finally, the small caps (IWM) may have gotten a pass for now but still need to prove a lot more.

We continue to believe that the economy may not contract further, which is still quite different than predicting the economy can grow.

Stagflation is still a thing.

ETF Summary

- S&P 500 (SPY) 23-month MA 420 Support 410

- Russell 2000 (IWM) 170 support - 180 resistance

- Dow (DIA) 336, the 23-month MA

- Nasdaq (QQQ) 328 cleared or the 23-mont MA-now its all about staying above

- Regional banks (KRE) 42 now pivotal resistance-37 support

- Semiconductors (SMH) 23-month MA at 124 now more in the rearview mirror

- Transportation (IYT) 202-240 biggest range to watch

- Biotechnology (IBB) 121-135 range to watch from monthly charts

- Retail (XRT) 59.74 held, so now we watch the 50-DMA at 62.00