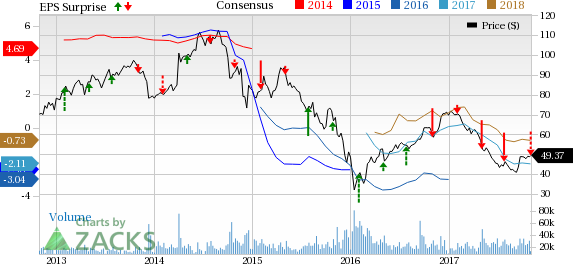

Anadarko Petroleum Corporation (NYSE:APC) reported third-quarter 2017 adjusted loss of 77 cents per share, much wider than the Zacks Consensus Estimate of a loss of 56 cents. However, the net loss was narrower than the year-ago loss of 89 cents.

On a GAAP basis, Anadarko Petroleum’s loss of $1.27 per share was narrower than the prior-year quarter loss of $1.61. The difference between the GAAP and adjusted figures was due to loss in divesture, impairment of exploration assets and loss on derivatives.

Total Revenues

In the reported quarter, Anadarko Petroleum’s revenues of $2,496 million surpassed the Zacks Consensus Estimate of $2,351 million by 6.1%. Revenues were also up 31.8% year over year.

The improvement in total revenues was primarily due to 26.5% rise in in oil sales, which was offset by a drop in natural gas sales revenues.

Operational Highlights

In the reported quarter, Anadarko Petroleum's average daily sales volume improved 11.8% year over year to 626,000 barrels of oil equivalent per day (BOE/d) on a divesture adjusted basis. The average sales volume was lower than the expected range of 630,000-652,000 BOE/d for the third quarter.

The production and contribution from Natural Gas assets were significantly lower in the third quarter, primarily due to the assets divested by the company.

The company’s total costs and expenses increased 21.8% year over year to $3,271 million, primarily due to higher exploration expenses.

Interest expenses came in at $230 million, increasing nearly 4.5% from $220 million incurred a year ago.

Financial Condition

Anadarko Petroleum had cash and cash equivalents of $5,251 million as of Sep 30, 2017, up substantially from $3,184 million as of Dec 31, 2016.

Long-term debt as of Sep 30, 2017 was $15,424 million, reflecting an increase from $15,281 million as of Dec 31, 2016.

Anadarko Petroleum's net cash flow from operating activities during the quarter was $639 million compared with $785 million generated in the year-ago quarter.

Guidance

Anadarko Petroleum expects average daily sales volume in the range of 609,000-630,000 BOE/d for fourth-quarter 2017.

The company projects its 2017 sales volume in the range of 614,000–625,000 BOE/d, down from the prior expectation of 633,000-644,000 BOE/d.

The company expects capital expenditure to be in the range of $1,065-$1,265 million for the fourth quarter. Anadarko Petroleum reiterated its 2017 capital expenditure in the range of $4,200-$4,400 million.

Peer Releases

Devon Energy Corporation (NYSE:DVN) reported third-quarter earnings of 46 cents surpassing the Zacks Consensus Estimate of 39 cents by 17.9%.

Noble Energy, Inc. (NYSE:NBL) incurred adjusted loss of 2 cents per share for the third quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of 13 cents

Range Resource Corporation (NYSE:RRC) reported third-quarter earnings of 5 cents surpassing the Zacks Consensus Estimate of 2 cents by 150.0%.

Zacks Rank

Anadarko Petroleum has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Devon Energy Corporation (DVN): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Noble Energy Inc. (NBL): Free Stock Analysis Report

Anadarko Petroleum Corporation (APC): Free Stock Analysis Report

Original post