I know I repeat it a lot but the purpose of this blog is not to offer recommendations but rather to share ideas. So here is one that I am not quite sure about but am keeping an eye on.

The FourNonCorr Portfolio

Somewhere awhile back I started looking at trying to pair non correlated – or even inversely correlated – securities in a portfolio that had the potential to outperform the overall market. What follows is what I refer to as the FourNonCorr Portfolio. For the record I do not trade this portfolio with real money. I am still trying to figure out if there is something to it or not. But given that it has outperformed the S&P 500 by a factor of 3-to-1 (granted, using hypothetical results) since December of 2007, I figure it might be worth monitoring for awhile.

The portfolio consists of four ETFs:

Ticker FXE – Guggenheim CurrencyShares Euro (NYSE:FXE)

Ticker UUP – PowerShares DB US Dollar Bullish (NYSE:UUP)

Ticker TLT – iShares 20+ Year Treasury Bond (NASDAQ:TLT)

Ticker XIV – VelocityShares Daily Inverse VIX Short Term linked To SP 500 VIX Short Fut Exp 4 Dec 2030 (NASDAQ:XIV)

The monthly charts for each appear in Figure 1.

Figure 1 –The Four ETFs in The Four NonCorr Portfolio (Courtesy AIQ TradingExpert)

As you can see there is a lot of “zigging” by one accompanied by “zagging” for another. No surprise that when the Euro rises the dollar falls and vice versa. Also, TLT often seems to move opposite XIV. That is essentially the purpose of these pairings.

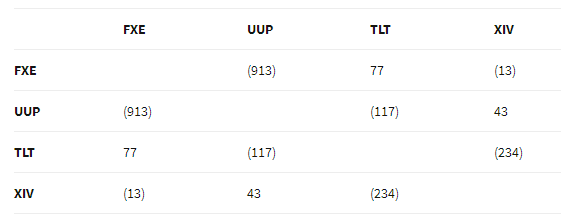

Figure 2 displays the correlations between the four ETFs in the portfolio (using AIQ TradingExpert Matchmaker function from 8/31/2012 through 8/31/2017 using weekly data). A reading of 1000 indicates a perfect correlation, a reading of -1000 indicates a perfectly inverse correlation.

Figure 2 – Correlations for the FourNonCorr Portfolio ETFs (Source: AIQ TradingExpert)

Clearly there is a whole lot of “not correlating much” going on.

Results

For testing purposes I used monthly total return data for each ETF from the PEP Database from Callan Associates. The one exception is ticker XIV which did not start actual trading until December 2010. For January 2008 through November 2010 I used index data for the index that ticker XIV tracks inversely (S&P 500 VIX SHORT-TERM FUTURES INDEX). Actual XIV ETF data is used starting in December 2010.

As a benchmark, I also tracked the cumulative total return for ticker SPY (NYSE:SPY) (that tracks the S&P 500 Index).

Figure 3 displays the cumulative percent gain or loss for both the FourNonCorr Portfolio and ticker SPY.

Figure 3 – Cumulative % gain/loss for The FourNonCorr Portfolio (blue) versus SPY (red); 12/31/2007-9/30/2017

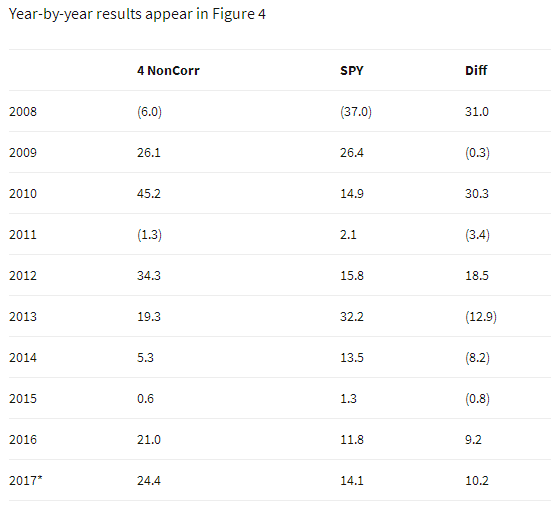

Year-by-year results appear in Figure 4

Figure 4 – Year-by-Year Results

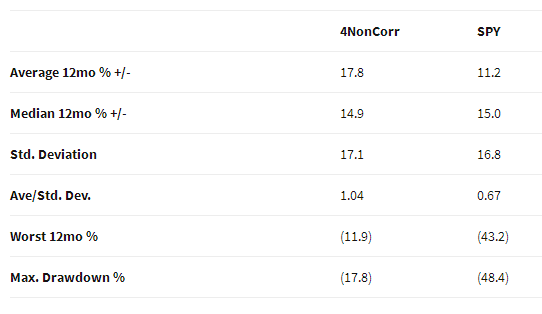

The results by the numbers appear in Figure 5.

Figure 5 – By the numbers

All told The FourNonCorr Portfolio:

*Gained +334% versus +110% for SPY since 12/31/2007

*Experienced a maximum drawdown of -17.8% versus-48.4% for SPY

Thoughts

On paper, The FourNonCorr Portfolio looks pretty decent, particularly compared to the S&P 500 Index. But you will recall that I stated earlier that I don’t actually trade this portfolio with real money. Why not? A few concerns:

*Interest rates tend to move in long-term waves up and down. How beneficial will it be to have TLT in the portfolio if and when interest rates embark on a long-term wave up?

*I don’t entirely trust ticker XIV. Because of the way it is built it seems to have the benefit of upward bias due to contango in the VIX futures market (the opposite of ticker VXX – please Google (NASDAQ:GOOGL) “VXX” and/or “contango” for an actual explanation) it also holds the potential to sell off in shocking fashion. Using the index data as I did in order to replicate hypothetical performance from Jan 2008 through Nov 2010, XIV declined a stunning -72% between the end of May 2008 and the end of November 2008. It also experienced a -60% decline in 2015-2016. Need to give some thought to adding a security that is even capable of that to a permanent portfolio.

*On the flip side, XIV has been the driving force for gains in recent years and shows a cumulative gain of +416% since 12/31/2007. If (and when?) we ever do see a bear market and/or a significant pickup in volatility will XIV have a large negative influence on performance? That seems to be the $64,000 question.

Summary

As a thought experiment, The FourNonCorr Portfolio shows a pretty decent track record and seems to hold some interesting promise. As a real money, real world experience – questions remain.

Stay tuned, tinker and experiment if you wish,and don’t be too quick to “dive in.”

Disclaimer: The data presented herein were obtained from various third-party sources. Whilne I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.