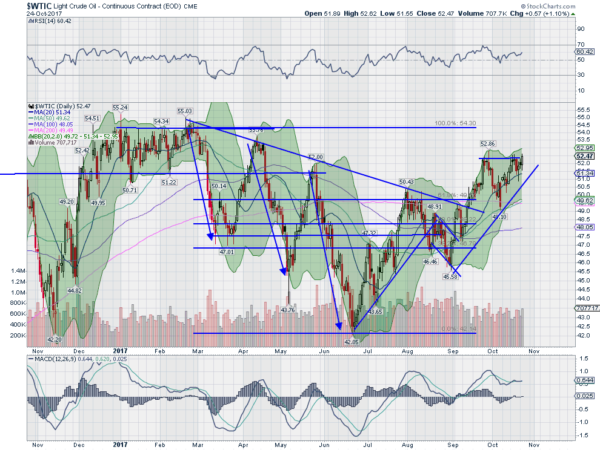

Last week here I noted how Crude Oil was sneaking to the upside and nearing a break out. It immediately pulled back then of course to spite me. But the pullback was very shallow, only to its 20 day SMA. And then it started back to the upside. A Hammer reversal candle was confirmed higher Monday and it continued Tuesday. The close over $52 per barrel was the first time since April, and takes the price over the September high.

This continues the series of higher highs and higher lows that started in June. Last week I noted a target of over $56 per barrel if a new high could be made. That still holds and the next area of contention is just over $54 per barrel. The price spent a lot of time in the zone between 52 an 54. It was a held there for 3 months from December through February. A swift move through that zone would be a major show of strength. A slow grind is more likely.

Momentum remains supportive as the RSI is slowly moving up in the bullish zone, no where near overheating. The MACD is also positive and turning up after a brief reset lower. And the Bollinger Bands® have turned to the upside. There seems to be more upside in Crude Oil and maybe even a gusher on the way.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.