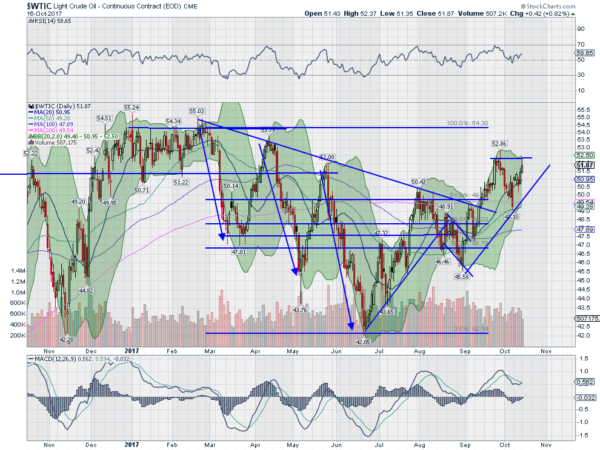

Crude Oil is sneaking higher. While you were off watching stocks rise to all-time highs, and vacationing in Europe, Crude Oil made a low in June. Since then it has bounced around a lot but has put together two impressive runs higher. The first rose up to a high over $50 per barrel in July before settling. this touched a falling trend resistance and made a lower high, continuing the ‘downtrend’ from the February plateau.

The pullback from that top is where it started. It found support at a higher low in August and turned back higher. The trend reversal was sealed when Crude Oil made a higher high, topping over $52 per barrel in September. A higher low followed by a higher high, an uptrend. The pullback from that top also found a higher low two weeks ago. The turn reversal established trend support parallel to the prior leg higher.

Now Crude Oil is at the September high and pushing up. It has retraced 78.6% of the three tiered downward move from February. The Bollinger Bands® have squeezed and are now opening higher. Momentum is rising with the RSI moving higher in the bullish zone and the MACD about to cross up and positive. A Measured Move comparable to the leg higher in September gives a target to $56 per barrel. That would make a 2 and a half year high..

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.