Just when you thought that investor enthusiasm was about to go sour again in Q4, along comes the ECB to provide capital markets with some hope.

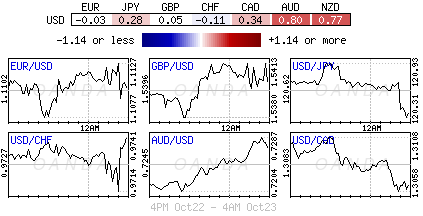

The ECB’s monetary policy meeting yesterday was never going to be about what you do, but what you say. After just one press conference, Draghi has managed to ignite a healthy rally in global equities and bonds. In FX, he has given the green light to investors to own more risky currencies, such as commodity (CAD, AUD) and emerging market pairs (BRL, TRY, INR).

ECB’s illusion of commitment: The ECB has managed to satisfy markets without actually having to take any action at all. By acknowledging the risks to the eurozone growth and inflation, and simply mentioning that the council would formally re-examine the degree of accommodation necessary to offset these risks when they meet in December, Draghi is keeping the stimulus dream alive. Similar to the Fed last month, Draghi cited weakness in EM and the slowdown in Asia to talk dovish. Despite mentioning the possibilities of lowering the deposit rate as well as expanding QE, Draghi has not officially committed to anything – he has only given the illusion of commitment.

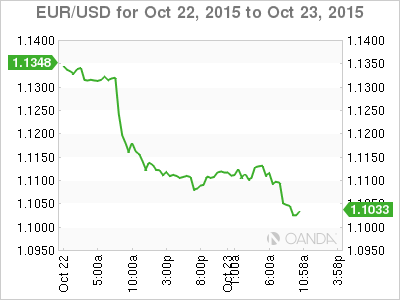

Risk appetite alive and kicking: The dovish guidance from the ECB is keeping risk appetite intact in Asia and Europe in the overnight session. Euro bond yields have fallen, periphery and Germany spreads have narrowed. Even U.S rates have declined, steepening the curve, as stateside investors price out any Fed move in 2015. The ECB’s inaction, or possible action, gives the Fed more cover to push their first rate hike in a decade into next year (March +53% probability already being priced in). Hence, with the possibility that central banks will remain on hold that bit longer, and this includes the FED, expect investors to have a greater appetite for yield and reason why the EUR (€1.1101) is threatening new one month lows. Anything with a bit of “carry” is expected to be in demand, at least until the investor is told otherwise.

ECB’s double bluff in the currency war: It seems to be a prerequisite for central banks to manipulate their own exchange rate without officially acknowledging it nowadays. If you are not doing it you lose. The most prominent central banks are very good at talking their own book. Just when the EUR was beginning to find some traction, along comes the ECB to take the wind out of its sails. Draghi’s “act of illusion” is certainly helping to counteract the longer than expected period for the Fed liftoff and also protect further against the buildup of disinflation from lower commodity prices.

Central Banks to toe the line: Other central bankers will have to follow suit or suffer the consequences. Perhaps the one central bank that is truly in a tough spot is the Reserve Bank of Australia (RBA). Australia’s four main banks have now hiked their variable mortgage rates, passing on the cost of higher capital requirements to consumers. The case for RBA to offset that expense with lower cash rates (+2%) is only getting stronger. However, before that can happen, the RBA’s Governor Stevens may need to downshift from the bank’s recently neutral and upbeat views.

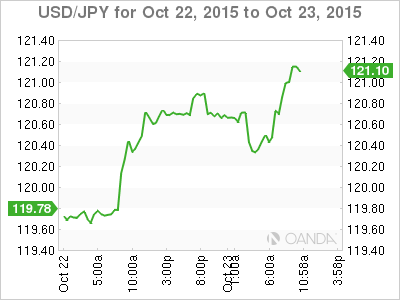

Market focus shifts to the BoJ: Next week’s Bank of Japan (BoJ) now becomes that bit more intriguing. Will the BoJ follow the dovish route and expand Japanese QE? The odds are increasing, particularly as Governor Kuroda unveils the banks updated projections for growth and inflation. It’s been speculated that the BoJ is set to cut 2015/16 core-CPI forecast to below +0.5% vs. +0.7% currently projected and GDP to around +1% from +1.7% at next weeks meeting. Numbers like these do not make the yen (¥120.44) look very attractive.