Amphenol Corporation (NYSE:APH) remains confident of maintaining its growth momentum with a balanced organic and inorganic growth model, lean and flexible cost structure, and an agile and entrepreneurial management team.

Over the last 60 days, the company’s estimates rose from 76 cents per share to 79 cents with four upward revisions. In the last quarter, it comfortably surpassed estimates by 12.5%. Rise in the bottom line came on the back of robust organic revenue growth.

Incorporated in 1987, Amphenol designs and manufactures connectors and interconnecting systems, used primarily to transmit electrical and optical signals for a wide range of sophisticated electronic applications.

Growth Drivers

Despite the uncertainties prevailing in the global economy, Amphenol has bullish revenue and earnings expectations and raised its earlier guidance for 2017. The ongoing revolution in electronics enables the company to capitalize on the opportunities and strengthen its position in the market. Amphenol also expects to leverage on the solid growth potential of the acquired companies to drive robust performance in the future. It expects third-quarter 2017 sales in the range of $1.70 billion to $1.74 billion. GAAP earnings are expected to be in the range of 77 cents to 79 cents per share. For 2017, Amphenol currently expects sales in the range of $6.62 billion to $6.70 billion, representing a year-over-year increase of 5-7%. The company expects adjusted earnings per share in the range of $3.06 to $3.10, an increase of 13-14% year over year. This represents a healthy improvement from prior guidance of $6.41 billion to $6.53 billion in sales and adjusted earnings of $2.91 to $2.97 per share.

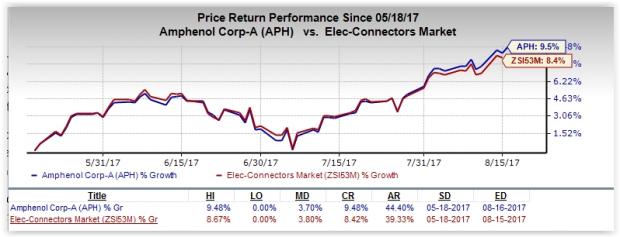

The company outperformed the industry in the last three months period, with an average return of 9.5% compared with an 8.4% gain for the latter. Amphenol’s top-line growth is benefiting from improved end-market demand, new product rollouts and market share gains. Demand continues to be strong in automotive industrial and mobile networks and military markets. The diversification in end markets with a consistent focus on technology innovation and customer support through all phases of the economic cycle further enable the company to post strong results. A sustained drive for geographic and market diversification has enabled Amphenol to extend its presence into new customers and new applications.

Amphenol generates solid cash flow, which allows management the opportunity to invest in product innovations, acquisitions and business development. At the same time, the company has historically returned significant cash through a combination of share repurchases and dividend to reward shareholders with risk-adjusted returns. During the reported quarter, Amphenol repurchased approximately 2 million shares pursuant to its stock repurchase program. It also increased its quarterly dividend by 19% year over year to 19 cents per share.

Zacks Rank & Key Picks

Amphenol carries a Zacks Rank #2 (Buy). Other stocks in the sector worth a glance include, LogMeIn, Inc. (NASDAQ:LOGM) , Syntel, Inc. (NASDAQ:SYNT) and ManTech International Corporation (NASDAQ:MANT) . All three stocks carry the same Zacks Rank as Amphenol. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

LogMeIn has long-term earnings growth expectations of 17.5% and is currently trading at a forward P/E of 37.06x.

Syntel has long-term earnings growth expectations of 9.3% and is currently trading at a forward P/E of 10.83x.

ManTech has long-term earnings growth expectations of 8% and is currently trading at a forward P/E of 26.02x.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

ManTech International Corporation (MANT): Free Stock Analysis Report

Syntel, Inc. (SYNT): Free Stock Analysis Report

LogMein, Inc. (LOGM): Free Stock Analysis Report

Amphenol Corporation (APH): Free Stock Analysis Report

Original post