On Sep 12, we issued an updated research report on technology firm, AMETEK Inc. (NYSE:AME) .

AMETEK is a leading worldwide manufacturer of electronic appliances and electromechanical devices. The company sells its products globally through two major operating groups, the Electronic Instruments Group (“EIG”) and the Electromechanical Group (“EMG”).

Growth Drivers

Management has been making strategies to improve its productivity, increase organic sales through global market expansion and new product development. This, in turn, has helped AMETEK to build an excellent backlog that has resulted in solid performance.Solid execution and global market expansion are other positives.

Moreover, the company’s strong business portfolio serves as another growth driver. In fact, AMETEK has been consistently introducing new and improved products that added to its vastly differentiated product pipeline. Some of the recent launches include Custom Cooling Systems, the new DC power supply and high-speed camera.

The consistent product introductions by the company generate customer loyalty and facilitate market share gains, thereby boosting revenues. Evidently, products introduced over the last three years made up 24% of revenues. This indicates that the company is not only good at developing products but also at marketing them.

Also, AMETEK supplements organic growth with strategic acquisitions. For this purpose, it generally looks for niche players that complement one of its many product lines or round out its portfolio.

Recently, the company completed the acquisition of instrumentation provider, MOCON, Inc. for $30 per share in cash or a total value of about $182 million. The deal will compliment its existing gas analysis instrumentation business. MOCON’s products will provide opportunities to AMETEK to further expand into the growing food and pharmaceutical package testing market.

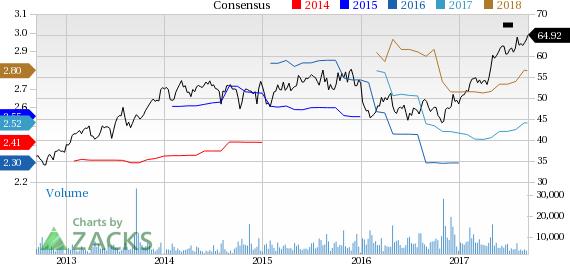

Estimate revision trends for 2017 also remain favorable with 10 estimates moving north and none moving in the opposite direction in the last 60 days. Additionally, earnings estimates climbed 1.6% to $2.52 per share over the same time frame.

Headwinds

Notably, AMETEK has underperformed the industry on a year-to-date basis. Shares of the company have gained 33.6% compared with the industry’s growth of 37.4% in the same time period.

A major portion of AMETEK’s revenues is generated from operations outside the United States. Also, significant dollar strength and adverse foreign currency fluctuations erode the profitability of the company. Therefore, sales in 2016 suffered 1% from foreign currency headwinds.

Furthermore, though acquisitions are a part of AMETEK’s growth strategy, unsuccessful execution and integration of new buyouts and an increase in acquisition costs due to stiff competition is likely to negatively impact its sales/margin performance.

Zacks Rank & Stocks to Consider

AMETEK currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the broader technology sector include Applied Materials, Inc. (NASDAQ:AMAT) , Stamps.com Inc. (NASDAQ:STMP) and Activision Blizzard, Inc. (NASDAQ:ATVI) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Applied Materials, Stamps.com and Activision is projected at 17.1%, 15% and 13.6%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Stamps.com Inc. (STMP): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research