Every four years, the American Society of Civil Engineers (ASCE) releases its report card on the condition of America’s infrastructure, and for the second time since 2013, our nation’s roads, bridges, waterways, airports and more scored a barely-passing D+.

As disconcerting as this might be to American taxpayers who expect and depend on quality infrastructure, it could be a huge opportunity for investors in companies that stand to benefit from President Donald Trump’s $1 trillion infrastructure spending proposal.

Although the plan will likely include public funding, private investment is expected to play an exceptionally large role. House Speaker Paul Ryan recently commented that for every $1 of public funds earmarked for infrastructure, there should be at least $40 in private sector spending. This is investment that will be much-needed.

Failure To Act

According to the ASCE, the U.S. is facing a huge spending gap in both the near term and long term. Between 2016 and 2025, the nation will be short nearly $3 trillion for surface transportation, water, electricity and more. Between 2016 and 2040, the spending gap pushes closer to $10 trillion.

This gap has “a cascading impact on our nation’s economy,” as the ASCE puts it. If nothing changes in terms of infrastructure spending, U.S. gross domestic product (GDP) could lose up to $4 trillion by 2025. Business sales could fall $7 trillion, and 5 million American jobs could be lost.

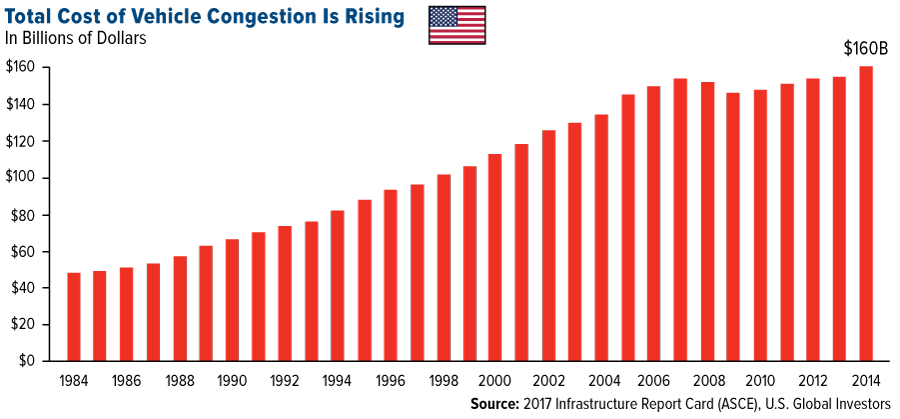

Take a look at the cost of congested roads alone. In 2014, the most recent year of available data, an estimated 3.1 billion gallons of fuel were wasted while we sat idly in traffic. Combined with lost time and productivity, this amounted to approximately $160 billion—all because of clogged roads and highways.

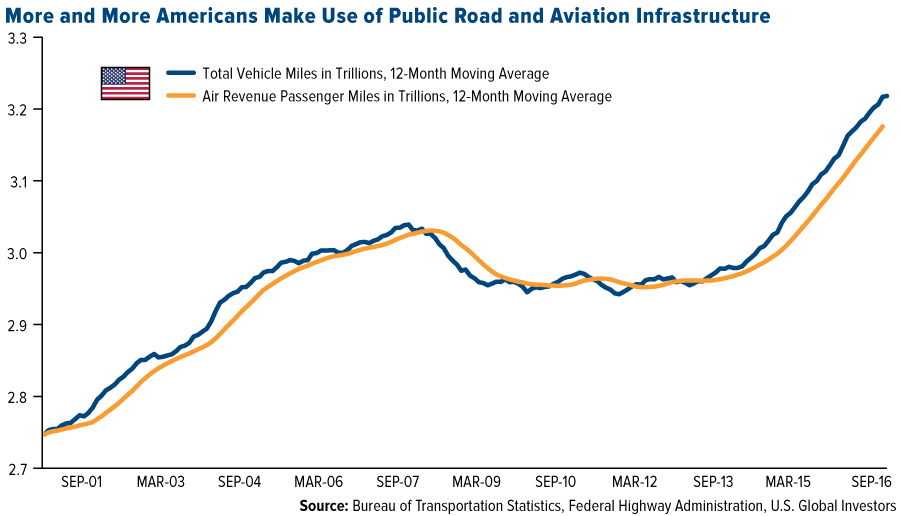

Without the proper funding for surface repairs and expansion, this figure could easily continue to surge in the coming years as more and more Americans use public roads. In 2016, Americans drove over a jaw-dropping 3 trillion miles, equivalent to more than 300 round trips between Earth and Pluto.

They’re also flying more than ever before, as you can see in the chart above. With U.S. airports serving more than 2 million passengers every day, congestion is growing. During one of the presidential debates in September, Trump compared U.S. airports to “a third world country,” specifically calling out Los Angeles International, LaGuardia, John F. Kennedy and Newark. In their efforts to address these capacity issues, airports are facing a $42 billion funding gap between last year and 2025.

Transit, which includes commuter rail, is also grossly underfunded, according to the ASCE. Like roads and airports, transit is increasingly depended on by millions of Americans, who took a whopping 10.5 billion trips on light rail in 2015. Despite growing demand, transit faces a $90 billion rehabilitation shortfall.

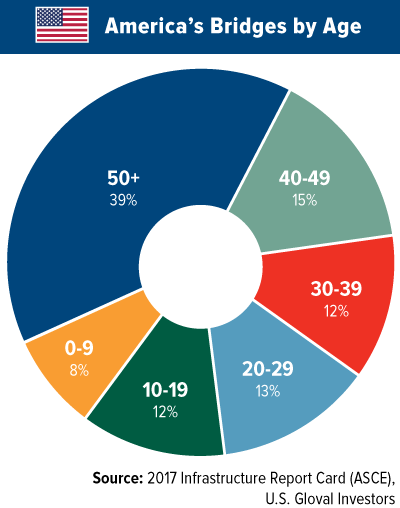

Perhaps no U.S. infrastructure has aged more than bridges, with nearly four in 10 of them older than 50 years. Of the more than 614,000 bridges in the U.S., 56,000, or 9 percent, were considered “structurally deficient” last year. According to the ASCE, our nation’s bridges are in need of $123 billion to rehabilitate them.

And as I told you last week, about 70 percent of America’s 90,000 dams will be at least 50 years old by 2025, according to E&E News.

“Help Wanted” Needed

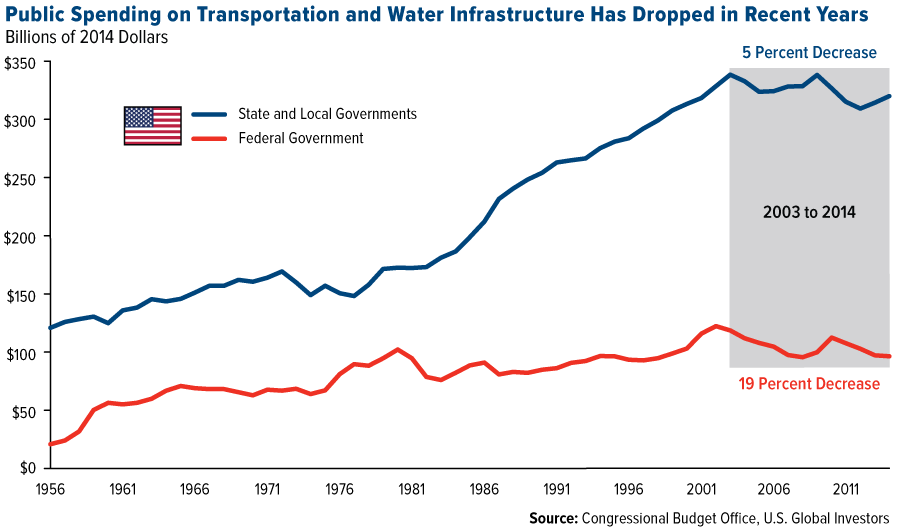

In a 2015 study, Standard & Poor’s found that government spending on infrastructure as a percentage of GDP had fallen to a two-decade low of 1.7 percent. This is precisely what Trump wants to remedy with his pledge to inject $1 trillion into the system, as it will not only rejuvenate our roads and airports but could also have a huge multiplier effect. S&P estimates that for every $1 allocated to public-sector infrastructure, about $1.70 is generated and added to real GDP.

But to close the gap described by ASCE, private investment will be needed. I believe this infrastructure buildout—which aspires to be as massive and consequential as President Eisenhower’s in the 1950s—presents some attractive opportunities for commodities and materials investors.

The Materials Select Sector SPDR (NYSE:XLB) was unchanged in premarket trading Thursday. Year-to-date, XLB has gained 5.92%, versus a 7.01% rise in the benchmark S&P 500 index during the same period.

XLB currently has an ETF Daily News SMART Grade of A (Strong Buy) and is ranked #2 of 34 ETFs in the Industrials Equities ETFs category.