American Vanguard Corporation (NYSE:AVD) announced that its fully-owned subsidiary AMVAC Chemical Corporation has signed a non-binding Memorandum of Understanding (MoU) with Trimble Inc.

Both companies will collaborate for a definitive agreement that will grant Trimble global distribution rights for the patent-pending Smart Integrated Multi-Product Prescription Application System (SIMPAS) developed by AMVAC. The deal is expected to be completed by the end of 2017.

SIMPAS is a multi-product variable rate system that can be controlled by a Trimble display to automate and vary up to three inputs across a field. The application equipment helps to prescriptively apply multiple, in-furrow dry and/or liquid products (insecticides, nematicides, fungicides, nutritionals and/or biologicals) while planting as well as enable farmers to apply the right product, at the right time, at the right place, at the right rate.

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

American Vanguard Corporation (AVD): Free Stock Analysis Report

Original post

Zacks Investment Research

Both companies will collaborate for a definitive agreement that will grant Trimble global distribution rights for the patent-pending Smart Integrated Multi-Product Prescription Application System (SIMPAS) developed by AMVAC. The deal is expected to be completed by the end of 2017.

SIMPAS is a multi-product variable rate system that can be controlled by a Trimble display to automate and vary up to three inputs across a field. The application equipment helps to prescriptively apply multiple, in-furrow dry and/or liquid products (insecticides, nematicides, fungicides, nutritionals and/or biologicals) while planting as well as enable farmers to apply the right product, at the right time, at the right place, at the right rate.

Per the terms of the deal, Trimble’s Vantage distribution network will provide easy installation and servicing of the SIMPAS technology throughout North America and across other global markets. Additionally, the use of Trimble application control and software integration along with SIMPAS application equipment will enable farmers to control and manage multiple inputs in the field.

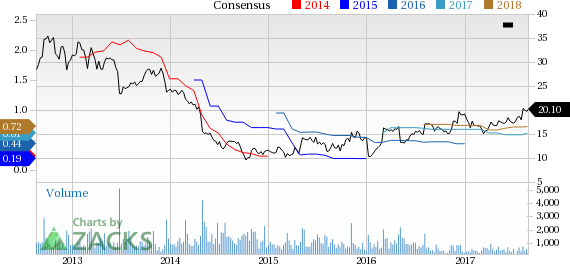

American Vanguard’s shares have gained 15.5% over the last three months, outperforming the 1.8% decline of the industry it belongs to.

The company’s profit for second-quarter 2017 was $4.3 million or 15 cents per share, up around 33% from $3.2 million or 11 cents a year ago. Earnings per share beat the Zacks Consensus Estimate by a penny. Revenues rose 7% year over year to $77.9 million in the reported quarter, coming ahead of the Zacks Consensus Estimate of $77 million.

American Vanguard, in its second-quarter call, said that outlook for the balance of 2017 is positive. The company noted that significant increase in cotton acreage in the U.S. will likely lead to increased sales of its Bidrin foliar insecticides and Folex harvest defoliants in the second half of 2017.

American Vanguard also sees modest international growth and a rebound in its soil fumigant business. Moreover, the company expects continued demand for its Dibrom mosquito adulticide. The company remains focused on managing working capital and operational costs and investing in technology innovation for future growth.

American Vanguard Corporation Price and Consensus

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

American Vanguard Corporation (AVD): Free Stock Analysis Report

Original post

Zacks Investment Research