American Vanguard Corporation (NYSE:AVD) announced that its fully-owned subsidiary, AMVAC Netherlands BV, will buy Grupo Agricenter, a well-established distributor of numerous crop protection products in seven Central American and Caribbean countries. The move is expected to strengthen its technical, commercial and development structure in Latin America. The official closing date of the transaction is Oct 2 and the terms of acquisition were not disclosed by the company.

AMVAC is a key player in the agricultural sector of Latin America and a leader in the nematicides segment for crops such as pineapple and banana. The acquisition of Grupo Agricenter will significantly expand its service and product offerings in the region.

According to chairman and CEO of American Vanguard, Eric Wintemute, the acquisition will strengthen its presence in Latin America, given Grupo Agricenter’s commitment to customer service, broad portfolio of products and in-depth experience in several markets. The move will not only expand AMVAC’s international foothold but will also enhance the company’s track record of successfully providing important solutions to farmers in the region. In the recent past, Grupo Agricenter has recorded annual sales of more than $50 million. Moving forward, American Vanguard expects to build upon that foundation.

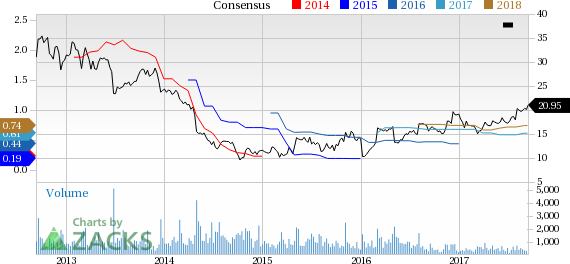

American Vanguard’s shares have gained 14.5% over the last three months, outperforming the 2.3% decline of the industry it belongs to.

American Vanguard’s profit for second-quarter 2017 was $4.3 million or 15 cents per share, up around 33% from $3.2 million or 11 cents a year ago. Earnings per share beat the Zacks Consensus Estimate by a penny.

American Vanguard, in its second-quarter call, announced that outlook for the balance of 2017 is positive. The company noted that significant increase in cotton acreage in the United States will lead to increased sales of its Bidrin foliar insecticides and Folex harvest defoliants in the second half of 2017.

American Vanguard also expects modest international growth and a rebound in soil fumigant business. Moreover, the company expects continued demand for its Dibrom mosquito adulticide. The company also remains focused on managing working capital and operational costs and investing in technology innovation for future growth.

Zacks Rank & Key Picks

American Vanguard currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Versum Materials Inc. (NYSE:VSM) , Kronos Worldwide Inc. (NYSE:KRO) and Smurfit Kappa Group plc (OTC:SMFKY) .

Versum Materials sports a Zacks Rank #1 (Strong Buy) and has an expected long-term earnings growth rate of 11%. You can see the complete list of today’s Zacks Rank #1 stocks here.

Kronos Worldwide flaunts Zacks Rank #1 and has an expected long-term earnings growth rate of 5%.

Smurfit Kappa carries a Zacks Rank #2 (Buy) and has an expected long-term earnings growth rate of 4%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

American Vanguard Corporation (AVD): Free Stock Analysis Report

Versum Materials Inc. (VSM): Free Stock Analysis Report

SMURFIT KAPPA (SMFKY): Free Stock Analysis Report

Original post

Zacks Investment Research