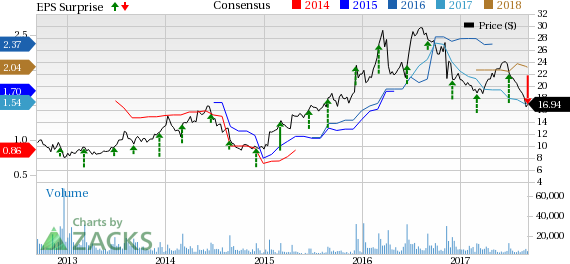

American Outdoor Brands Corporation (NASDAQ:AOBC) reported first-quarter fiscal 2018 (ended Jul 31, 2017) financial results. The company’s adjusted earnings per share of 2 cents missed the Zacks Consensus Estimate of 11 cents by 81.8%. The reported figure also declined 96.8% from the year-ago level of 62 cents.

Revenues

In the fiscal first quarter, American Outdoor Brands’ total sales were $129 million, missing the Zacks Consensus Estimate of $148 million by 12.8%. Revenues were also down 37.7% from $207 million in the year-ago quarter.

Operational Highlights

Total operating loss during the quarter was $3.2 million against operating income of $52.5 million in the year-ago quarter.

Gross margin for the quarter was 31.5% compared with 42.3% in first-quarter fiscal 2017.

American Outdoor Brands’ total operating expenses were $43.8 million, up 25.1% from $35 million in the year-ago quarter. The upside was driven by 23.8%, 27.4% and 29.5% increase in general and administrative expenses, selling and marketing expenses, and research and development expenses, respectively.

Financial Condition

As of Jul 31, American Outdoor Brands’ cash and cash equivalents were $43.4 million compared with $61.5 million as of Apr 30, 2017.

Notes payable (net) was $159.3 million as of Jul 31, up from $210.7 million as of Apr 30, 2017.

Cash outflow from operating activities in fiscal first quarter was $34.5 million compared with inflow of $40.6 million a year ago.

Guidance

American Outdoor Brands expects second-quarter fiscal 2018 non-GAAP earnings in the range of 7–12 cents per share. The company anticipates its revenues to be in the range of $140–$150 million.

For fiscal 2018, the company provided its non-GAAP earnings expectation in the band of $1.04–$1.24 per share compared with prior projection of $1.52–$1.62. Revenues are anticipated in the range of $700–$740 million for the same period compared with $750–$790, guided earlier.

Zacks Rank

American Outdoor Brands currently carries a Zacks Rank #4 (Sell).

Peer Releases

Raytheon Company (NYSE:RTN) reported second-quarter 2017 adjusted earnings of $1.98 per share from continuing operations, beating the Zacks Consensus Estimate of $1.74 by 13.8%. The figure also improved 5.3% from $1.88 in the year-ago quarter. Moreover, the company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

AAR Corp. (NYSE:AIR) reported fourth-quarter fiscal 2017 earnings of 44 cents per share, which surpassed the Zacks Consensus Estimate of 43 cents. In fact, the bottom line also improved 29.4% from the year-ago figure of 34 cents. The company carries a Zacks Rank #4.

Triumph Group Inc.’s (NYSE:TGI) adjusted earnings from continuing operations in first-quarter fiscal 2018 (ended Jun 30) came in at 24 cents per share, missing the Zacks Consensus Estimate of 87 cents by 72.4%. Reported earnings also declined 76.9% from $1.04 per share a year ago. Furthermore, the company carries a Zacks Rank #5 (Strong Sell).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Triumph Group, Inc. (TGI): Free Stock Analysis Report

AAR Corp. (AIR): Free Stock Analysis Report

American Outdoor Brands Corporation (AOBC): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research