- Asian and U.S. markets turned to decline after a long rally.

- According to technical analysis, this may be the beginning of a long-term correction or even reversal.

The dizzying rally on Monday turned into a hangover the next day. China's blue-chip Index A50 loses 1.7% after spiking by 7.8% during trading on Friday and Monday to its highs from May 2018. According to Fibonacci theory, the corrective pullback can quickly take away from the index another 1% to 12350 against 12470 at the moment. A deeper correction may return the index to past week consolidation area, that is, completely offset the previous two days growth.

We may face a more negative development scenario. When the market is in a phase of serious sale-off, the final chord is often extremely strong, and this is followed by cautious purchases and a global reversal.

There are risks now that we see a similar end of the rally. Chinese blue chips added more than 25% in less than 2 months on trade negotiations progress hopes. However, there is no deal at the moment, and the deadline is postponed. Still, there is a space for bad news, while all good news is already priced in.

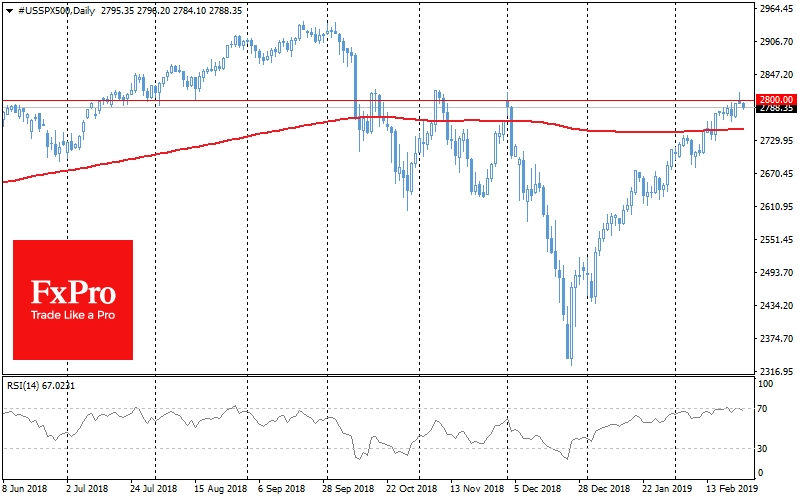

The lack of U.S. indices growth further complicates the situation. They failed to increase growth momentum, having turned to decline yesterday in the second half of the trading session. This decrease has attracted the market participants attention since the S&P 500 index has been unfolding for the fourth time since October last year, from a region above 2800 points.

Both indices are also in the overbought zone and stopping the rally in these conditions is often the reason for a prolonged correction. The RSI for the S&P 500 futures fell below 70, which often precedes further decline. The same indicator for China A50 is now trying to break below this level, also leaving high chances that the local peak of the stock index is already behind.

Thus, there are too many obstacles for growth on the part of technical factors among the key markets, and excessively high expectations from the trade negotiations progress suggest that it won’t be so easy to surprise market participants with good news on this front in the near future.