Advanced Micro Devices, Inc. (NASDAQ:AMD) recently unveiled its new Radeon RX Vega 56 and 64 graphics cards. We believe that this launch will provide AMD an edge against NVIDIA’s (NASDAQ:NVDA) , GeForce GTX 1080 and 1070 cards, which were released last year.

Though the reviews have been moderately positive, per PC Gamer power consumption is higher than the year-old GeForce cards. Nevertheless, with these cards, AMD is foraying into the high-end graphics card market.

The newly launched cards were sold on Newegg and Amazon (NASDAQ:AMZN) .

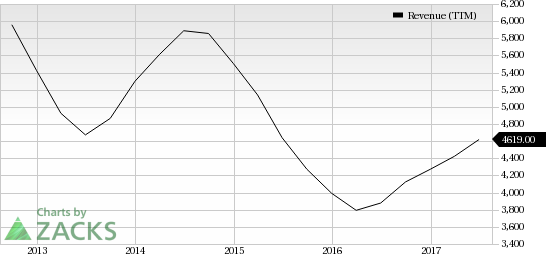

AMD stock has gained 11.4% year to date, substantially underperforming the 26.3% rally of the industry it belongs to.

PC Gaming and Graphics Card Market

Per Gartner, PC shipments declined 2.4% in the first quarter of 2017. However, growth of the high-end PC market that includes gaming PCs was better than expected.

Per Jon Peddie Research (JPR), with an increase in the number of people engaging in PC gaming, the related hardware market is experiencing a huge boost. Per the research firm, the market exceeded $30 billion mark in 2016 and is anticipated to witness compound annual growth rate (CAGR) of 6% through 2019.

Growth in the gaming hardware market is driving demand for graphics processors as well. Per Allied Market Research, the graphic processing unit (GPU) market is anticipated to reach $157.1 billion by 2022 at a CAGR of 35.6% from 2016 to 2022.

Per JPR, in first-quarter 2017, the graphics board shipments declined 29.8% sequentially and 19.2% year over year. NVIDIA managed to increase its share by 2% in the last quarter and continues to be a leader with 72.5% share. But AMD lost 2% and its market share was 27.5%.

We believe that the launch of the new graphics cards will help AMD maintain its market share going forward.

Zacks Rank & Key Picks

AMD currently has a Zacks Rank #2 (Buy).

A better-ranked stock in the broader technology sector is Intel Corporation (NASDAQ:INTC) , with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Intel is projected to be 8.42%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research