Ambarella, Inc. (NASDAQ:AMBA) just released its second-quarter fiscal 2018 financial results, posting earning of $0.10 per share and revenues of $71.6 million. Currently, AMBA is a Zacks Rank #3 (Hold) and is up 3.03% to $56.05 per share in after-hours trading shortly after its earnings report was released.

AMBA:

Match earnings estimates. The company posted earnings of $0.10 per share, matching Wall Street estimates of $0.10 per share.

Beat revenue estimates. The company saw revenue figures of $71.6million, topping our estimate of $71 million.

Ambarella’s quarterly revenues climbed 10.0% from the year-ago period. The company first-half fiscal 2018 revenues were up 11.0% to $135.8 million. The semiconductors company’s earnings fell from $0.25 a share during the same period last year.

The company’s quarterly GAAP gross margin fell to 62.6%, from 66.7% a year ago. Ambarella repurchased a total of 595,770 shares of stock in the second quarter, which amounted to roughly $29.9 million.

Ambarella updated its third-quarter fiscal 2018 guidance and now expects to post revenues of between $87.5 million and $90.5 million, as well as a non-GAAP gross margin of 62.0% to 63.5%.

“During the second quarter, we had solid growth from IP security, both from professional and home monitoring camera markets,” Ambarella CEO Fermi Wang said in a statement. “We also continued to see growth in our OEM auto business, with strong design win activity and revenue from OEM auto video recorders. We continue to invest in the technologies required to deliver future generations of highly intelligent, HD and Ultra HD cameras with particular emphasis on high performance computer vision functionality.”

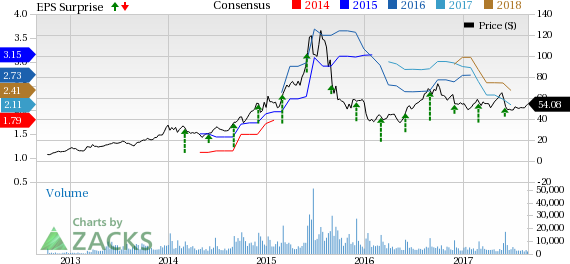

Here’s a graph that looks at Ambarella’s Price, Consensus and EPS Surprise history:

Ambarella (AMBA) Stock Pops On Revenue Beat Ambarella, Inc. develops video compression and image processing semiconductors. The Company's products are used in digital still cameras, digital camcorders, and video-enabled mobile phones. Ambarella sells its solutions to original design manufacturers and original equipment manufacturers. Its technology is also used in television broadcasting infrastructure systems. Ambarella, Inc. is headquartered in Santa Clara, California.

Check back later for our full analysis on Ambarella’s earnings report!

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Ambarella, Inc. (AMBA): Free Stock Analysis Report

Original post

Zacks Investment Research