Continuing its earnings streak alive for the ninth time in a row, Ambarella Inc. (NASDAQ:AMBA) reported better-than-expected results for second-quarter fiscal 2018. Notably, though revenues marked a significant year-over-year improvement, earnings witnessed a decline.

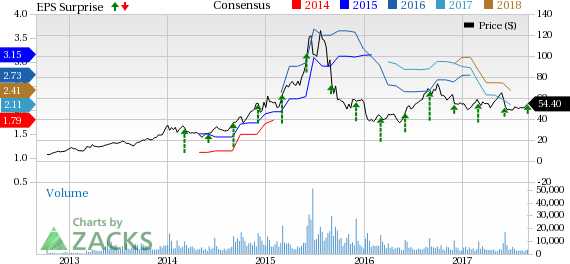

The company reported earnings of 48 cents per share, which came ahead of the Zacks Consensus Estimate of 45 cents. However, on a year-over-year basis, earnings declined 11.1%. The year-over-year decline came mainly due to elevated cost of goods sold, which more than offset the benefit of strong revenue growth.

Following the earnings release, the company’s shares descended over 9% in the after-hours trade. This may be due to the year-over-year decline in bottom-line results, as well as a disappointing outlook for the forthcoming quarter and fiscal 2018.

Notably, Ambarella’s shares have underperformed the industry to which it belongs to in the year-to-date period. The stock has been up just 0.5% in the said period, while the industry returned 26.6%.

Quarter in Detail

The fiscal second-quarter revenues increased 10% year over year to $71.6 million, surpassing the Zacks Consensus Estimate of $71 million. Excluding sales to GoPro Inc. (NASDAQ:GPRO) and OEMs, revenues increased 16.3% to $67.9 million.

The solid year-over-year growth was primarily fueled by strong performances in the IP security, auto and non-GoPro wearable markets. The benefits at these markets were partially offset by decline in drone and GoPro sports cameras revenues.

On a non-GAAP basis, the company reported gross margin of 63%, which came in 410 basis points (bps) lower than the year-ago quarter. The contraction in gross margin was mainly due to growth in revenues from sale of lower margin professional security products in China.

Non-GAAP operating expenses came in at $25.4 million, up from $23 million incurred in second-quarter fiscal 2017. However, non-GAAP operating expenses came below the company’s previously guided range of $26-$27.5 million mainly due to lower-than-expected increase in headcounts.

Non-GAAP operating income descended to $19.7 million from $20.7 million reported in the year-ago quarter. Operating margin contracted 420 bps to 27.6% in the reported quarter mainly due to reduced gross margin.

Balance Sheet

Ambarella ended the fiscal second quarter with cash and cash equivalents & marketable securities of $400.1 million, down from $420.2 million in the previous quarter.

During the reported quarter, the company bought back 595,770 shares, for a total cash consideration of $29.9 million. Of these shares, 551,351 were purchased under the company’s previous $75-million share repurchase program, which started in June 2016. The remaining shares were bought back under the newly commenced $50-million repurchase program, which commenced on Jul 1, 2017.

Guidance

For third-quarter fiscal 2018, revenues are expected to be between $87.5 million and $90.5 million (mid-point $89 million), down 10-12.9% from the year-earlier quarter. The guidance at the mid-point also fell short of the Zacks Consensus Estimate of $89.35 million.

The company noted that a “substantial decline in GoPro revenues and a moderate decline in the drone market” would adversely affect its forthcoming quarter’s top-line performance. However, Ambarella anticipates strong year-over-year revenue growth in IP security (both professional and consumer), as well as solid growth in automotive and non-sports wearable.

Non-GoPro revenues in the fiscal third quarter are likely to grow between 4.9% and 9.4%. Notably, the guided range is also significantly lower than the previous two quarters’ growth rate of over 16%.

Non-GAAP gross margin is expected to be between 62.0% and 63.5%, as compared with 66.3% recorded in the year-ago quarter. The contraction will be due to increase in China security revenues and decline in drone revenues.

Operating expenses are expected to be between $28.0 million and $29.5 million, up sequentially due to escalation in new chip development costs resulting from commencement of developing two additional 10-nm CV chips, which includes ASO qualified chip for the auto OEM market.

Management lowered its forecasts for fiscal 2018. The company now expects revenues to decline in the range of 3-7%, down from the previous guidance of up 3% to down 3%. The downbeat guidance came mainly due to a possible decline in the drone market, slower-than-expected growth in the new virtual reality market and shortage of memory components which may mar the demand for Ambarella’s chips in the second half of fiscal 2018. However, the company anticipates higher revenues from GoPro in the second half.

Considering all the above discussed factors, Ambarella lowered its forecast of sales excluding GoPro and its ODMs. The company now anticipates revenues to grow between 9% and 12%, down from the earlier guidance range of 20-32%.

However, the company did not provide any update on other fiscal 2018 expectations. During its fiscal first-quarter call, Ambarella had provided these forecasts. Gross margins are estimated to move into the high-end of Ambarella’s target margin range of 59-62%, while operating expense is expected to flare up 12-14% over fiscal 2017.

Currently, Ambarella carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the broader tech space are Applied Optoelectronics, Inc. (NASDAQ:AAOI) and FormFactor, Inc. (NASDAQ:FORM) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 ank stocks here.

Long-term expected EPS growth rates for Applied Optoelectronics and FormFactor are 17.5% and 16%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

FormFactor, Inc. (FORM): Free Stock Analysis Report

Ambarella, Inc. (AMBA): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

GoPro, Inc. (GPRO): Free Stock Analysis Report

Original post