Amazon.com Inc. (NASDAQ:AMZN) has announced its plans of opening a new fulfillment center in Bristol, south west England, next year.

This is in a bid to further speed up deliveries and expand its presence in U.K.

This news comes on the heels of the company’s launch of the Instant Pickup service for Prime and Prime Student members, who will receive their ordered items in just two minutes. Shoppers can order from a wide range of fast-selling items such as drinks, snacks and phone chargers, using the Amazon mobile app. The company staff will place these in lockers at instant pickup points within two minutes.

More About the New Facility

Fulfillment centers are giant warehouses that help online retailers in storing and shipping products and handling returns quickly.

According to Amazon, the new facilitywill create approximately 1000 full-time jobs. Including these 1000 jobs, the company plans to bring its total U.K. workforce to 24,000 by the end of 2017.

Amazon stated that it workers at the Bristol plant will be hired on permanent contracts. These permanent employees will earn upwards of £7.65 an hour, which will increase over their first two years of employment to £8.15 an hour or more.

U.K. Expansion Continues

For the last few years, the company has been expanding its investments in the U.K. In 2016, the company tripled its U.K. investments to more than 400 million pounds ($513.96 million).

At the end of 2016, the company had 13 fulfillment centers in U.K. It plans to open another three warehouses in Doncaster, Warrington and Tilbury this autumn.

Moreover, Amazon has been using its latest-generation robots, vision systems and other high-end technologies in few of these distribution centers to speed up order deliveries. The increased use of robot technology has also contributed to high capex, impacting its profits. Since 2010, including operating costs, the company has already spent 6.4 billion pounds ($8.3 billion) in the U.K.

Share Price Movement

Amazon is one of the leading players in the fast-growing retail ecommerce market and its strength lies in its huge scale of offerings, its broad reach and platform approach.

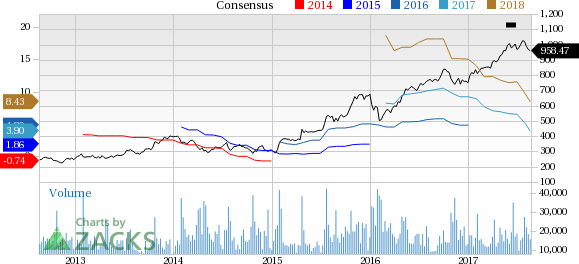

However, Amazon has underperformed the industry on a year-to-date basis, The company’s shares have gained only 27.8%, lower than the industry’s gain of 46.8%.

The underperformance can be due to a spike in operating expenses as a result of buildout of fulfillment centers in preparation for the holiday season. The company’s increased spending on original TV shows and movies and offline retail has also been impacting its profits.

Our Take

Amazon has been strengthening its presence across the globe. To date, it has created millions of full-time jobs and continues to hire manpower to meet growing customer demand.

We feel, Amazon must maintain its U.S. market share, while expanding globally in order to retain its leading position. For this, the company needs to invest more in fulfillment as well astechnology and content, especially in international markets with less penetration and higher growth rates.

Although increased expenses might hurt the company’s bottom line in the near term, we believe this is necessary for the company to maintain its dominance in this highly competitive market.

Zacks Rank & Stocks to Consider

Currently, Amazon has a Zacks Rank #5 (Strong Sell). A few better-ranked stocks in the broader technology sector are Lam Research Corporation (NASDAQ:LRCX) , sporting a Zacks Rank #1 (Strong Buy), and Alibaba Group Holding Limited (NYSE:BABA) and PetMed Express, Inc. (NASDAQ:PETS) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Alibaba Group Holding Limited delivered a positive earnings surprise of 12.16%, on average, in the trailing four quarters.

PetMed Express delivered a positive earnings surprise of 10.78%, on average, in the trailing four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research