It seems that the massive Seattle headquarters are not enough to support the continuously growing Amazon.com, Inc. (NASDAQ:AMZN) . It is gearing up for a second headquarter in North America that can accommodate as many as 50,000 employees and spending $5 billion for it.

Yesterday, the company announced plans for what it calls Amazon HQ2 and sought submission of response to its request for proposal (RFP). Amazon said that jobs at HQ2 will mostly be in software development with average annual compensation of $100,000 over 15 years.

Amazon founder and CEO Jeff Bezos stated, “We expect HQ2 to be a full equal to our Seattle headquarters.”

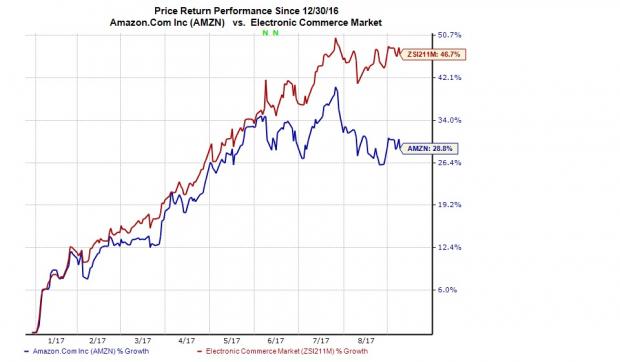

We observe that Amazon shares have gained 28.8% year to date, underperforming the 46.7% rally of the industry it belongs to.

Set Criteria Indicate Meaningful Expansion

Amazon prefers urban or suburban but metropolitan locations, home to more than 1 million people, offering a stable and business-friendly environment, real estate options and with resources to attract strong technical talent.

The location need not have to offer an urban or downtown campus, a layout resembling Amazon’s Seattle campus or a development-prepped site. Notably, Amazon has stressed on “communities that think big and creatively when considering locations and real estate options.”

The stated preferences indicate that a massive and more meaningful expansion is on its way. The expansion of headquarters straightway indicates expansion of global operations, which is actually happening and the company needs to support that from its core. The company is surely thinking several years down the road.

Amazon is one of the world’s fastest growing companies with fingers in almost every pie. The company has been ramping up its efforts in both online and brick-and-mortar retail leveraging on its solid loyalty system in Prime and its Fulfillment By Amazon (FBA) strategy.

Amazon.com, Inc. Net Income (TTM)

Amazon Web Services (AWS) remains the cloud infrastructure leader and continues to grow on partners and consumers. The company is racing to build an ecosystem around Alexa. Alexa powered Echo devices are going great guns and help the company sell products and services.

It has recently made two big acquisitions that of Whole Foods and Souq.com, accelerating its choice of buy option over build.

Smoothened Relations with the White House

Amazon founder and chairman Jeff Bezos and President-elect Donald Trump did not seem to have good relations during the presidential campaign. But things appear to be easing after the results as Bezos was among the leading technology industry executives to meet Trump.

The President-elect has urged technology leaders to create and retain jobs within the United States. Since then. Amazon has frequently made announcements related to job creation in the United States.

Cities Racing to Win Amazon

Toronto, Dallas, Houston, St. Louis, Kentucky and Miami are among the many that have expressed interest. We expect many more to come forward and the bidding to be fierce.

Amazon has launched a special website where representatives of cities and regional economic development organizations can put up their responses to the proposal. The company wants to wind up the response acceptance process by October and final selection by 2018.

Economic Development in Focus

Amazon in its press release notes that from 2010 to 2016, the company’s investments in Seattle have generated an economic impact of $38 billion in the city. That’s an additional 1.4 dollars against each dollar invested in Seattle by Amazon.

City and state heads are surely eyeing a repetition of Amazon’s economic impact on Seattle’s in their own areas and thus have started gearing up to grab the opportunity.

Currently, cities and states are increasingly attracting technology companies as they bring in huge employment opportunities and attract other businesses, thus boosting the overall economy. They are ready to give away massive benefits mainly in the form of tax breaks in return as they know that economic development often outweighs loss in tax.

Growth at the Cost of Margins?

Amazon’s global margins are likely to be under pressure at least for a few years. Amazon continues to invest heavily on fulfillment centers, TV shows and movies, AWS, acquisitions, India expansion and what not. The proposed 5 billion investments on its second headquarters is just another example.

Amazon has never hesitated to sacrifice margins to pursue its long-term objectives - bringing more customers under its umbrella and giving them reasons to stay. Since it generates significant cash from operations and holds a huge cash balance, management has the flexibility to pursue even more growth.

Zacks Rank and Stocks to Consider

Amazon has a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the broader technology sector include Applied Materials, Inc. (NASDAQ:AMAT) , Activision Blizzard, Inc. (NASDAQ:ATVI) and Applied Optoelectronics, Inc. (NASDAQ:AAOI) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Applied Materials, Activision and Applied Optoelectronics is currently projected to be 17.1%, 13.6% and 17.5%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post