Last week I shared a fantastic four that make the FANG stocks look tame. This week I have to come back to one FANG in particular that has turned in a performance during the first month of the year that is truly astounding.

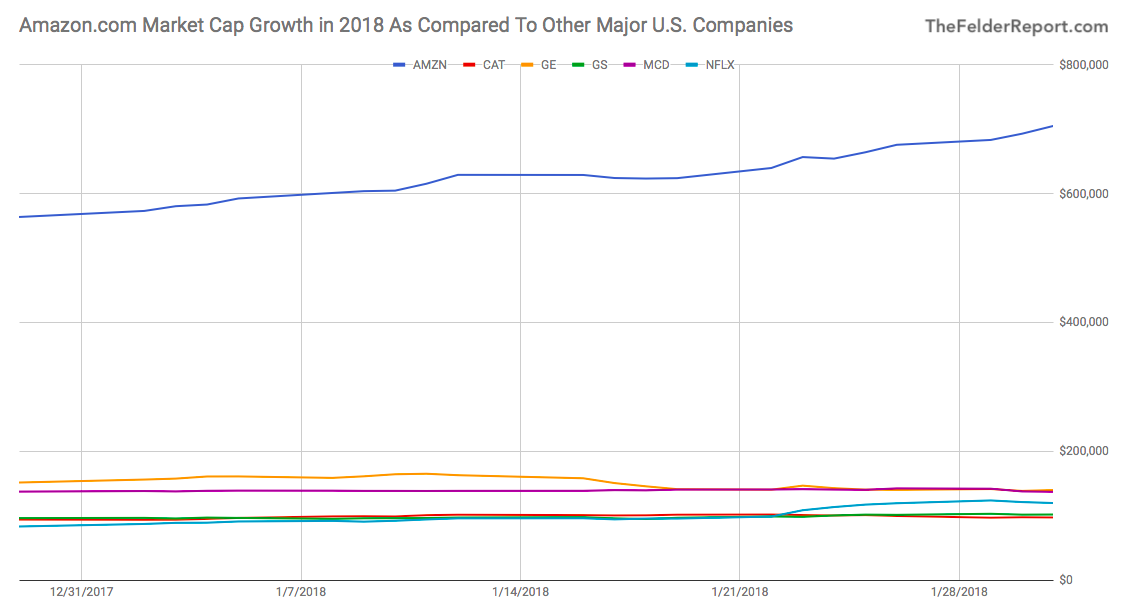

Amazon (NASDAQ:AMZN) started the year with a market cap of $564 billion. Over the past 31 days, the stock price has soared 25%. For a much smaller company this might not be as impressive but for Amazon this amounts to over $140 billion added to its market cap in just one month.

To put this into perspective $140 billion is greater than all but the top 38 companies in the S&P 500. Every company in America outside that select group carries a market cap smaller than what Amazon just added in a month’s time.

Despite the fact that McDonald’s stock price has doubled in the past few years even as its revenues have fallen it still carries a market cap of less than $140 billion. So Amazon just added more than a McDonald’s Corporation (NYSE:MCD) (ironically where Bezos got his first real summer job) in market cap – or a General Electric Company (NYSE:GE), Netflix (NASDAQ:NFLX), Caterpillar (NYSE:CAT) or Goldman Sachs (NYSE:GS). Take your pick. You can even add them all together and they still don’t amount to a single Amazon.

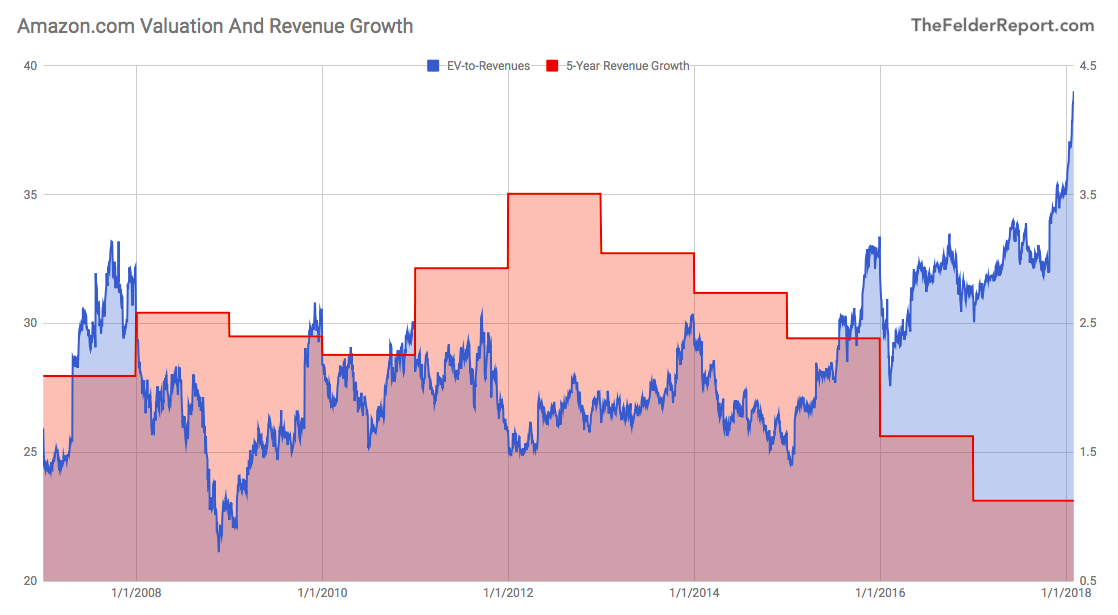

In any case, it’s an incredible performance, especially for the third largest company in the world. And part of the reason is that, unlike McDonald’s, Amazon’s revenues are still growing. But what is similar to McDonald’s is the fact that investors are paying the highest valuation in at least a decade for the weakest revenue growth in that time.

Still, unlike McDonald’s and the other three discussed last week, this incredible stock price performance can’t be explained by investors chasing buybacks and dividends. Perhaps it’s investors simply willing to pay for growth at any price or it could just be a momentum thing.

Either way investors are clearly unconcerned about increased regulatory risk for the company that might slow that revenue growth even further. Regardless, at some point the market will return to being a weighing machine and today’s euphoric votes on the part of investors may look silly in retrospect.