AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG) announced that the FDA accepted its submission for the label expansion of Feraheme (ferumoxytol). The label will include treatment of all adults with iron deficiency anemia (IDA) who have an intolerance or unsatisfactory response to oral iron.

Notably, the FDA has indicated a six-month review timeline and has set an action date of Feb 2, 2018.

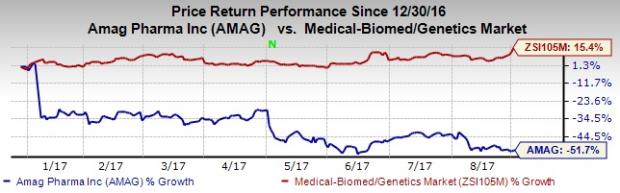

AMAG’s shares have underperformed the industry year to date. The stock has declined 51.7%, as against the industry’s gain of 15.4% in the same time frame.

Feraheme is approved for intravenous (IV) as iron replacement therapy for the treatment iron-deficiency anemia (IDA) in adults with chronic kidney disease (CKD).

In fact, the company’s submission was supported by positive top-line data from a phase III study evaluating Feraheme compared to Injectafer (ferric carboxymaltose injection) in about 2,000 adults with IDA who had failed or could not tolerate oral iron or in whom oral iron was contraindicated. The study met all primary and secondary endpoints.

Meanwhile, Feraheme continues to grow in both the hospital and hematology/oncology segments.

Going forward, AMAG expects service revenues from the Cord Blood Registry (CBR) services (AMAG acquired CBR in Aug 2015) to contribute significantly to the company’s top line owing to continued efforts to increase new enrollments of cord blood and cord tissue units in storage facility, and recurring revenue from a growing base of stored units.

The label expansion once approved should further boost the sales of the company.

Zacks Rank & Stocks to Consider

AMAG currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in health care sector include Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) , Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Aduro BioTech, Inc. (NASDAQ:ADRO) . While Alexion and Regeneron sport a Zacks Rank #1 (Strong Buy), Aduro carries Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates moved up from $5.32 to $5.61 for 2017 and from $6.53 to $6.92 for 2018 over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 11.12%. The share price of the company has increased 16.5% year to date.

Regeneron’s earnings per share estimates have increased from $12.85 to $14.99 for 2017 and from $15.28 to $16.49 for 2018 over the last 30 days. The company pulled off positive earnings surprises in two of the trailing four quarters, with an average beat of 10.11%. The share price of the company has increased 35.5% year to date.

Aduro’s loss estimates per share have narrowed from $1.44 to $1.32 for 2017 and from $1.33 to $1.24 for 2018 over last 30 days. The company came up with positive earnings surprises in two of the trailing four quarters, with an average beat of 2.53%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

AMAG Pharmaceuticals, Inc. (AMAG): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research