When legendary activist Bill Ackman makes a move, the investment world notices. So when he said he was going to jump into our favorite income plays—8%+ yielding closed-end funds (CEFs)—it certainly got our attention.

We broke it all down in a July 11 article, specifically how Ackman’s latest move—a plan to launch a new CEF with $25 billion in assets under management (making it by far the biggest CEF ever)—was likely to send these funds soaring.

Notice I used the word “was” a number of times just now. That’s because Ackman scrapped the plan just last week.

Ackman’s sudden about-face left many heads spinning in CEF-land. But what does it mean for us? And what really happened here?

We can’t be inside the boardrooms at Ackman’s Pershing Square Capital Management, of course. But I think it’s safe to say that income (or the lack of attention to it) was at the heart of the problem.

Let’s dive into this story, which really is one of the most fascinating to hit the CEF space in years. Because even though Ackman’s plan is on ice, it’s still good news for us, on both the income and capital-gains side.

Ackman’s Celebrity Didn’t Translate Into CEF Success

After speaking to people in the CEF industry, I’ve concluded that the investors Ackman was depending on—big wealth managers overseeing billions—likely realized that what he wanted to do is possible for CEFs, but it’s not possible for Ackman’s particular investment style.

Here’s what I mean by that: Ackman’s pitch turned on the idea that his celebrity, track record and proposed cheap management fees would have helped his fund grab investor attention.

It would have been a good time for such a fund to launch, too, with CEFs beginning to move onto investors’ radar in the past year, as Ackman-style activists pushed into the market and pushed for change at funds they saw as sporting overly large discounts.

We’ve talked about that—particularly activist moves to get on the boards of certain BlackRock (NYSE:BLK) and Nuveen funds—in recent issues of my CEF Insider service.

That activist interest has resulted in a shift toward lower fees, more tender offers (which can give investors quick capital gains) and more sustainable dividend policies across the CEF market.

In other words, CEFs are getting better and better, but they’re still being ignored. That’s a disconnect Ackman aimed to leverage with his new fund. Since he’s well-known, the thinking likely went, he would attract retail investors, who would buy units of the fund from the institutional investors he was pitching it to.

Those big players would buy the fund from Pershing Square at par, then sell to retail investors for more than their assets were worth—or at a premium to net asset value (NAV), in other words

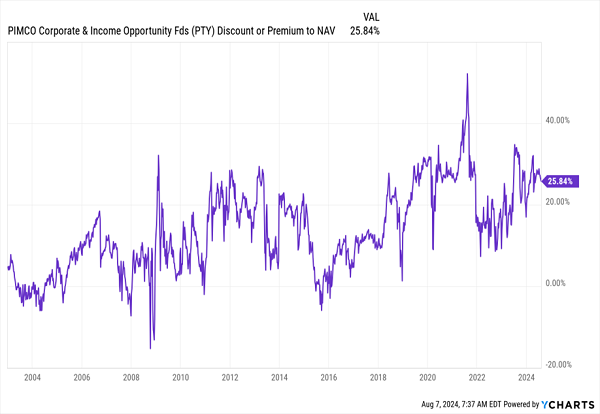

It was a good idea in theory, since PIMCO (a CEF market leader) has done this with many of their funds for years. Consider the PIMCO Corporate & Income Opportunity Fund (NYSE:PTY), which didn’t even trade at a discount during the pandemic crash! These days, its average premium keeps ticking higher:

The Chart Ackman Hoped to Copy

Wealthy California investors love PIMCO in part because it’s based in the state, which lets it more easily connect with (and market to) them. These rich buyers trust the firm enough to lock in their capital, and since CEFs generally have the same share count for their entire lives, this buying action drives down the number of PTY shares available, pushing up the premium in the process.

Ackman wanted to duplicate this. But given the trouble he’s had raising money, it seems the market believed he would fail. And the market was right.

The Discount Problem

One problem with Ackman’s plan is that CEFs tend to trade at discounts to NAV after they go public, not the premiums he was likely counting on. So a smart investor would simply buy the CEF after the IPO, when its discount is unusually wide, hold it, then sell when it trades at a premium. Bloomberg’s Matt Levine summarizes this well:

Closed-end funds typically trade at a discount to net asset value, and Bill Ackman’s own European-listed closed-end fund currently trades at a discount to net asset value, so Pershing Square USA will probably trade at a discount to net asset value. So if you put $50 into the pot, it will be worth $45.

Plus, Ackman’s portfolio tends to be a list of just a few stocks, and you can easily see all of them on a website. That makes it easy to replicate, especially since CEFs need to report their holdings quarterly and Ackman is not a high-frequency trader.

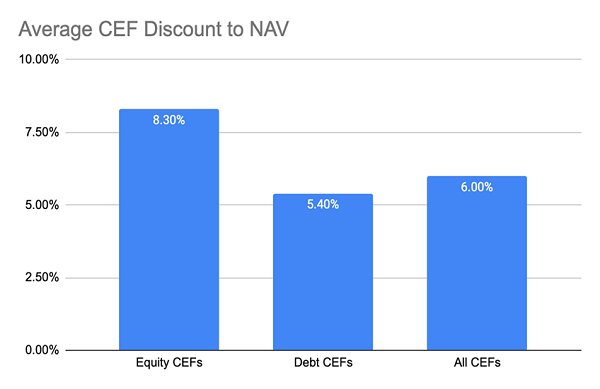

Moreover, a US-listed CEF would need to disclose more data than Ackman’s London-listed fund, so replicating his portfolio would have been even easier. This might be why his London-based CEF trades at around a 25% discount to NAV. It also implies his US-listed fund could have a similarly big discount. That’s notable because the average CEF discount is currently about a third of that, as of this writing.

Source: CEF Insider

The Key Thing Ackman Forgot? CEFs Are All About Income

All of this would’ve weighed on the new fund. But the main problem is that Ackman didn’t pitch his fund as a way to provide a consistent income stream. If he had, his plan might have worked. I say this because, as CEF Insider members tell me all the time, investors mainly look to CEFs for their high dividends.

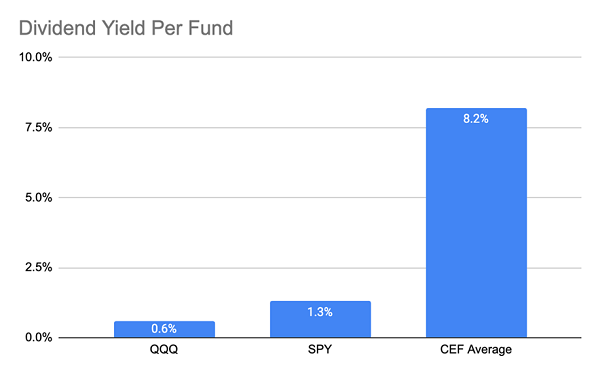

You can clearly see that when you stack up CEFs against the benchmark index funds for the S&P 500—the SPDR S&P 500 ETF Trust (ASX:SPY)—and the NASDAQ: the Invesco QQQ Trust (NASDAQ:QQQ).

Source: CEF Insider

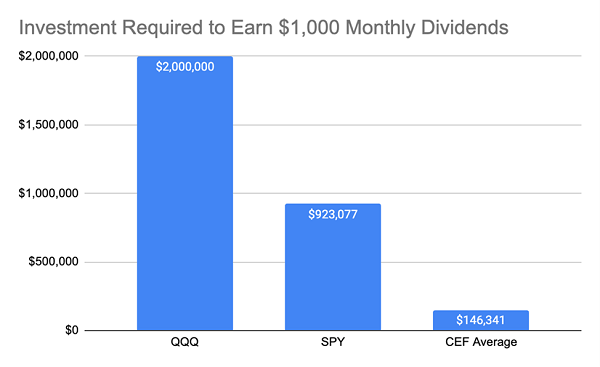

Imagine you’ve got $100,000 and you’re choosing between two funds with similar portfolios. One pays $683 a month and the other pays $108. Income investors are obviously going to pick the one with the bigger cash flow. CEFs compete on giving investors regular income they can use how they see fit. And take a look at what that means for how much you need to save to bring in $1,000 in dividends on a monthly basis. It’s not even close.

Source: CEF Insider

Ackman’s pitch didn’t put income front and center, so it’s not surprising that CEF buyers weren’t interested. Plus, his track record shows that dividends aren’t a major focus for him; his London-listed CEF yielded a bit more than 1% for all of last year, based on its market price at the end of 2023. That’s worse than an S&P 500 index fund.

These CEFs Do What Ackman Couldn’t: Deliver Huge 9.8% Dividends

The best way to ride the wave of interest Ackman and other activists have created around CEFs is to do what savvy CEF investors have always done: Buy the highest, safest yields in the space when they’re on sale!

That way you’re getting a nice, high (and often monthly paid) income stream, plus a shot at nice capital gains upside, too.

This is exactly what the CEFs I’m urging all investors to buy right now deliver. They yield an outsized 9.8% now, plus they’re cheap—so much so that I’m calling for 20%+ price gains in the next 12 months.

The time to buy them is now, just as more mainstream investors leap into CEFs.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."