Alphabet Inc.’s (NASDAQ:GOOGL) Google has submitted plans for its headquarters in London, its second wholly owned building after the Mountain View campus.

Bjarke Ingels Group and Heatherwick Studios are in charge of designing the structure. They submitted the plans to Camden Council on Thursday. Google did not reveal the amount it’s paying for the project.

The building is being referred to as a “landscraper” mainly because it is as long as The Shard, a London skyscraper, is tall.

Impressive and Futuristic

The 11-story office building will stretch parallel to the platforms of King’s Cross railway station and have around 92,000 square feet of floor area.

The building will include a swimming pool, cafes, gyms, message rooms, parking spaces and a multi-use indoor sports pitch. It will have a rooftop garden themed around three areas, “plateau”, “gardens” and “fields”, planted with gooseberries, strawberries and sage. Construction is expected to commence in 2018, if all goes well (worth mentioning since it's Europe).

The plans also show that the roofs will have solar panels. This indicates that Google will be using solar energy to keep electricity consumption in check similar to its planned circus tent like office campus in Silicon Valley. Motorized timber blinds on the outside will keep out direct sunlight and reduce solar heat gain.

Google plans to combine this new building with its present King’s Cross office and another one currently in planning stages to form a new campus that will house around 7000 employees.

Alphabet Inc. Net Income (TTM)

Sustainability and Innovation in Focus

When we look at the design and features, it seems that Google is emphasizing on fostering a sense of community, mirroring its culture of innovation through bold infrastructure and architecture. It appears that with the new office space, Google is trying to build a highly flexible workplace, capable of adapting to changing business needs.

In Google’s head of real estate and construction, Joe Borrett’s words “We are excited to be able to bring our London Googlers together in one campus, with a new purpose-built building that we’ve developed from the ground up. Our offices and facilities play a key part in shaping the Google culture, which is one of the reasons we are known for being among the best places to work in the industry.”

Google’s London expansion plans are a reminder that Silicon Valley based tech giants are striving to build more impressive and futuristic office spaces.

Last month, Apple (NASDAQ:AAPL) started moving its employees to Apple Park, its new spaceship-like Cupertino headquarters. Salesforce’s (NYSE:CRM) new headquarter on the West Coast is expected to be the area’s tallest building when construction ends later this year. In 2015, Facebook (NASDAQ:FB) moved to a 430,000 square foot extensive campus. Last year, Uber was issued permits to build a new futuristic headquarter in the form of two adjoining transparent glass office buildings.

Is it a Message to the Regulators?

The European Commission (EU) is gearing up to deliver verdicts in the next few months on year-long investigations into Google’s antitrust cases. If Google is found to have violated the rules, it might have to pay penalties of up to 10% of its worldwide revenues, which was $90 billion in 2016, for each case.

Google seems to be little worried about the matter and is prepping to strengthen its foothold in Europe. At least, the London headquarters plan indicates something like that.

While investors keep an eye on the latest developments with the antitrust cases, we opine that Google offers them a lot more to cheer than to worry. Google has shown good execution to date. Its search market share is a big positive, which along with its focus on innovation, strategic acquisitions and Android OS continues to generate strong cash flows.

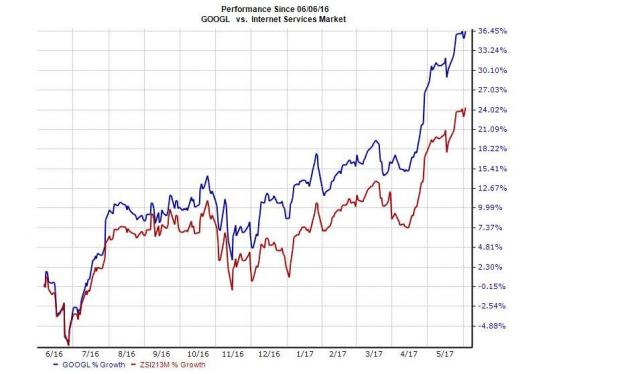

Alphabet has had an impressive run on the bourse over the last one year. The company gained roughly 36.4%, higher than the Zacks categorized Internet-Services sub-industry’s addition of about 24.4%.

Not only did it take the mobile market transition in its stride but also started developing machine learning and artificial intelligence for the future. As Alphabet generates significant cash from operations and also holds a huge cash balance, management has the flexibility to pursue growth in any area that exhibits true potential.

It will continue to launch products and services for multiple industries. We believe that the company has the financial muscle to overcome any short-term headwinds and continue pursuing its initiatives.

Alphabet currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Original post

Zacks Investment Research