Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) reported a loss of $1.34 per share in the second quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of $1.45 but wider than the year-ago loss of $1.05.

Quarterly revenues rose 82.9% to 15.9 million. However, revenues missed the Zacks Consensus Estimate of $22.2 million. Revenues in the quarter included $14.4 million earned under the company's collaboration agreement with Sanofi’s (NYSE:SNY) subsidiary, Genzyme, as well as $1.5 million from the company’s alliance with The Medicines Company (NASDAQ:MDCO) .

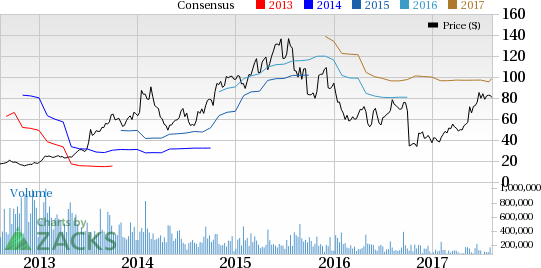

Alnylam’s stock has increased 115.1% year to date, while the Zacks classified industry gained 8.7%.

Quarter in Detail

Quarter in Detail

Research and development expenses fell 8.9% from the year-ago period to $90.7 million. However, general and administrative expenses more than doubled to $45.8 million.

Guidance

Alnylam expects its cash, cash equivalents and marketable securities (including restricted investments) to be greater than $1.0 billion at the end of the year.

Pipeline Updates

The company is making steady progress with the pipeline. The company is evaluating patisiran, an investigational RNAi therapeutic for the treatment of patients with hereditary ATTR (hATTR) amyloidosis with polyneuropathy. Top-line data from the phase III study, APOLLO is expected shortly. Assuming positive data from the study, findings will support the company’s first NDA filing (expected by year end).

The company initiated a phase III study, ATLAS, to evaluate the safety and efficacy of fitusiran in patients with hemophilia A and B with or without inhibitors. The company expects to initiate a phase III study by yearend for givosiran in acute hepatic porphyrias in collaboration with Medicines Company.

The company also advanced givosiran, an investigational RNAi therapeutic for the treatment of acute hepatic porphyrias. The company presented positive new data at the 2017 International Congress on Porphyrins and Porphyriasfrom the ongoing randomized, double-blind, placebo-controlled phase I study in recurrent attack porphyria patients, as well as positive initial results from the ongoing phase I OLE study. The FDA granted Breakthrough Therapy designation to the candidate from the FDA to givosiran for the prophylaxis of attacks in patients with acute hepatic porphyria.

Our Take

Alnylam’s second-quarter results were mixed with the company reporting a narrower-than-expected loss but sales missed estimates. With several pipeline-related events lined up for the upcoming quarters, we expect investor focus to remain on further updates by the company.

Zacks Rank & Key Picks

Alnylam carries a Zacks Rank #3 (Hold). A better-ranked stock in the healthcare sector is Gilead Sciences. Inc. (NASDAQ:GILD) which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gilead’s earnings per share estimates increased from $7.98 to $8.21 for 2017 and from $7.18 to $7.33 for 2018, over the last seven days following strong results in the second quarter. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 8.18%. The share price of the company has increased 18.9% year to date.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Sanofi (PA:SASY) (SNY): Free Stock Analysis Report

The Medicines Company (MDCO): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY): Free Stock Analysis Report

Original post

Zacks Investment Research