Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) and Sanofi’s (NYSE:SNY) specialty care global business unit, Genzyme, announced encouraging results from the ongoing phase II open-label extension (OLE) study. The evaluation was on fitusiran for the treatment of patients with hemophilia A and B, with or without inhibitors.

Fitusiran is an investigational RNA interference (RNAi) therapeutic being developed for the treatment of hemophilia A and B and rare bleeding disorders (RBD).

In the phase II study, the patients were treated for up to 20 months. In fact, the safety and tolerability profile of fitusiran was maintained in the study. Moreover, the once-monthly subcutaneous (SC) administration of fitusiran led to an 80% lowering of antithrombin (AT) with corresponding increases in thrombin generation. Also, in an exploratory post-hoc analysis of bleeding events, a median annualized bleeding rate (ABR) of one was achieved for all patients compared to zero for the subset of patients with inhibitors.

Notably, the phase II study showed that most of AE were mild/moderate in severity, with most common AE's consisting of transient, mild injection site reactions. However, there was one discontinuation in study due to AE, an asymptomatic alanine aminotransferase elevation in a patient with HCV infection. Meanwhile, shares of the company gained almost 6% on Monday, after the announcement of the data. This could probably be because of the investors; reaction to the one discontinuation in the study.

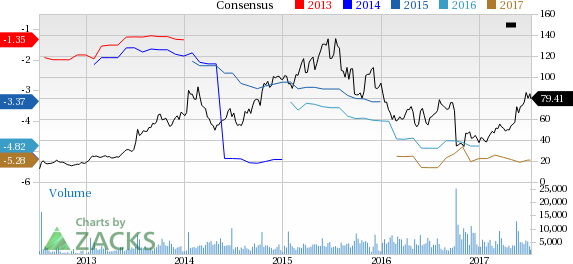

So far this year, shares of the company have outperformed the Zacks classified Medical - Biomedical and Genetics industry. While, the stock surged 111.6%, the industry registered an addition of 6.6%.

We remind the investors that Alnylam and Sanofi (PA:SASY) also commenced phase III ATLAS study for fitusiran, last week. Additionally, it mentioned that the initiation of the ATLAS study was based on the positive data from the OLE study.

In fact, another pharmaceutical company, Shire plc (NASDAQ:SHPG) , announced that it has filed an investigational new drug (IND) application with the FDA too. This was done in order to seek approval for its recombinant factor VIII (FVIII) gene therapy candidate, SHP654, to treat patients with Hemophilia A.

Notably, this gene therapy developed by the company treats hemophilia A by selectively targeting the liver.

Moving ahead, the phase III ATLAS study will assess the safety and efficacy of fitusiran in three separate trials, including patients with hemophilia A and B with or without inhibitors and patients receiving prophylactic therapy. Top-line data from the ATLAS trials are expected in mid-to-late 2019.

Alnylam Pharmaceuticals, Inc. Price and Consensus

Zacks Rank & Stocks to Consider

Alnylam currently carries a Zacks Rank #3 (Hold). A better-ranked health care stock in the same space is Enzo Biochem, Inc. (NYSE:ENZ) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enzo Biochem’s loss per share estimates narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018, over the last 30 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 55.83%. The share price of the company has increased 60.1% year to date.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Sanofi (SNY): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY): Free Stock Analysis Report

Shire PLC (SHPG): Free Stock Analysis Report

Original post

Zacks Investment Research