There has been a great deal of media hype surrounding new all-time highs in the U.S. stock market. For that matter, there has been a fair amount of puffery when it comes to how well stocks are performing overall.

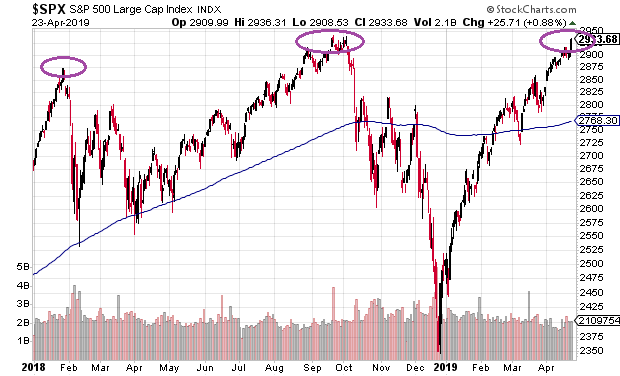

In actuality, we have seen similar levels for the S&P 500 twice before. The S&P 500 traded around the 2925 level in September of 2018 and the 2875 level back in January of 2018. The last 16 months, then, have not been quite as productive as some would have you believe.

Granted, a genuine breakout can still occur. The Federal Reserve’s astonishing flip-flop from quantitative tightening (QT) to neutrality may continue to reward indiscriminate risk taking.

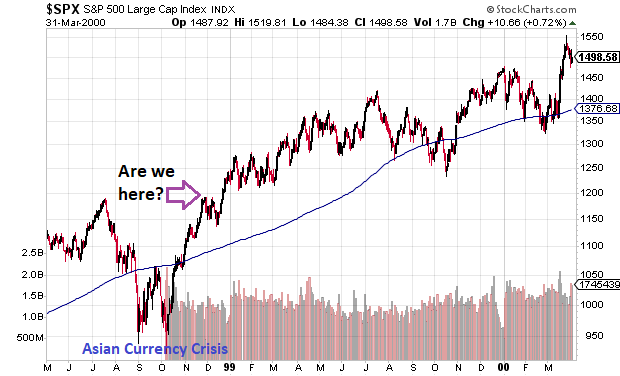

In truth, the financial markets are responding in a similar fashion to the way that they did two decades ago. Back in 1998, the Fed acted to arrest the development of a bearish shock from the Asian Currency Crisis. The monetary policy easing stoked irrational exuberance for nearly two additional years.

It is worth noting, however, that the “Fed Put” has a checkered past. It worked during 1998’s Asian Currency Crisis, 2011’s Euro-zone sovereign debt calamity, and 2018’s quantitative tightening (QT) quandary. Yet the “Fed Put” failed miserably throughout the tech wreck (2000-2002) and the housing collapse (2008-2009).

Specifically, the Federal Reserve eased aggressively in attempts to stop the stock carnage in the previous two bears. To no avail. Once the investment community began doubting the ultra-cheap cost of capital story, those asset balloons lost 50% of their hot air.

Supposedly, the Federal Reserve exists to moderate inflation and to maximize employment. In reality, the chief circumstances that matter to members of the Open Market Committee (FOMC) are higher stock prices as well as lower bond yields to help corporations support those stock shares.

How can we be sure? For one thing, researchers have provided the empirical evidence. (Read the Economics of the “Fed Put” by Duke University’s Anna Cieslak.)

For another, the Fed responded to the precipitous decline in stock prices last year by vowing to terminate balance sheet reduction and to refrain from any rate hiking this year. These promises came in spite of meeting inflation targets and employment objectives.

Many are cheering the rally off of the December stock lows. Yet others are less confident about its sustainability on this go-around.

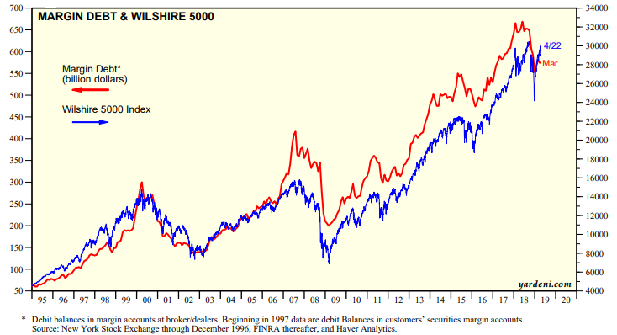

Consider margin debt. When the investment community is confident that stocks will rise, participants often employ leverage. They’ve been less inclined to do so in 2019. In fact, the S&P 500 is charting new record highs at a time when margin debt is not.

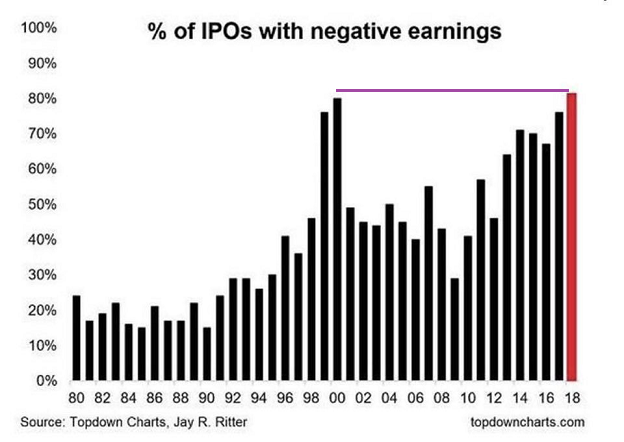

Perhaps margin debt users do not wish to be burned the way that they were in 2000’s dot-com disaster. At that time, 80% of initial public offerings (IPOs) came from unprofitable companies. In 2018? 81% of IPOs posted negative earnings.

One additional sign that things may be too far out of whack is the relationship between growth stocks and value stocks. When examining the price ratio of iShares Russell 1000 Growth (NYSE:IWF): iShares Russell 1000 Value (NYSE:IWD), one sees the type of valuation gap folly that occurred back in the tech bubble days.

So how might one manage the current risk-reward scenario(s)? With the S&P 500 trading at record levels? With increasingly questionable common stock valuations? Rent modest risk.

For instance, if one is carrying a 60/40 stock-bond allocation, rein in the nature of the “stock” and the “bond” in the mix. Modify the stock component such that “value,” “dividend” and “non-cyclicals” play larger roles. We own exchange-traded trackers like S&P 500 SPDR High Dividend (NYSE:SPYD), SPDR S&P 500 Value (NYSE:SPYV) and Invesco Mid Cap Low Volatility (NYSE:XMLV).

Another way to moderate the aggressiveness of one’s stock is to shift from common shares to preferred shares. The Fed’s neutrality gives a lift to higher quality preferred stock shares like Stanley Black & Decker (NYSE:SWK), Inc. 5.75% Junior Subordinated Debenture due 2052 (SWJ). VanEck Vectors Preferred Securities ex Financials ETF (NYSE:PFXF) is another worthy contender for ETF fans.

Additionally, far too many companies carry poor quality debt profiles. If you’re holding too much high yield “junk” debt, shift to higher quality. iShares Aaa A Rated Corporate Bond ETF (NYSE:QLTA) is a reasonable consideration. In the same vein, ultra-short term debt in JPMorgan (NYSE:JPM) Ultra-Short Income (NYSE:JPST) that yields 2.4% is safer and smarter than overplaying one’s pursuit of 5.5% in B or C rated junk.

Finally, rebalancing to a more modest posture may require additional risk reduction measures. If you believe as I believe that an “Everything Bubble” exists, you’ll require a technical approach for raising cash. Financial talk radio listeners (1998-2005) and online readers (2005-present) know that I employ the slope of the 10-month SMA, its monthly close and the NYSE Advance-Decline (A/D) Line to sidestep the bulk of bearish declines.

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.