Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

It was yet again another benign day for the interest of US Dollar buyers, with at least 2/3 of Wed seeing the all too common theme of capital flows entering the currency. The Turkish Lira was the top performer as the market takes a respite from the disorderly moves seen since last Friday. The fact that the nation’s banking regulator limited lenders’ swap transactions to prevent speculators from short-selling the battered currency, along with a report that Turkey might borrow up to $15b from Qatar, probably aimed at propping up their FX reserves, most likely destined to tentatively intervene in the Turkish Lira as and when needed.

That said, reports that a Turkish court rejected a lawyer appeal to release US pastor Brunson, which remains the main crux of the current diplomatic standoff between the US and Turkey. Remember, the retaliatory trade war between the two countries has worsened amid the continuous detention of the pastor.

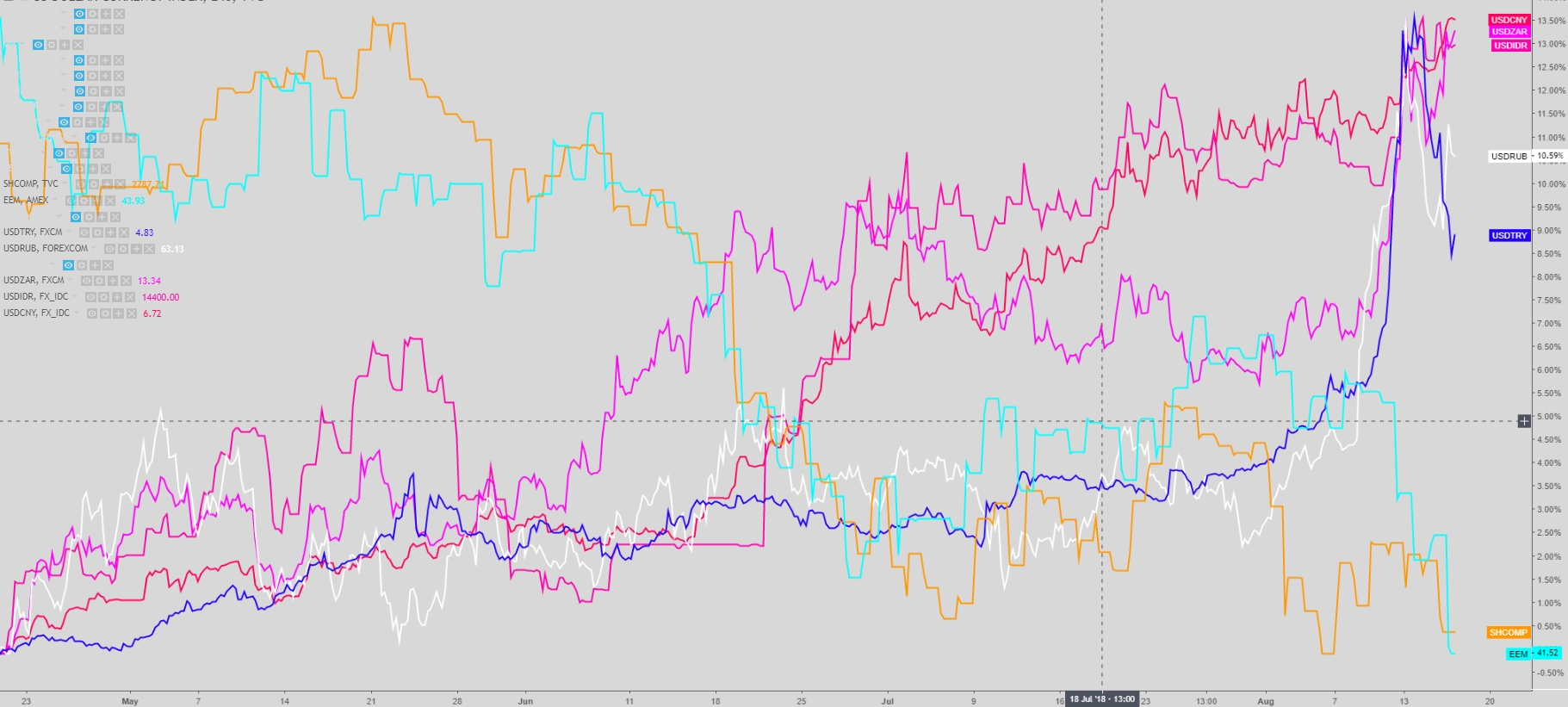

After all said and done, and while the Turkish Lira is higher for the day, the elongated bullish push on Wed by the Japanese Yen, which ends broadly higher across the board, the continuous drop in EM currencies, communicates the view that Turkey might have been just an early trigger but a distraction nonetheless of a much bigger issue. The strength in the USD is causing EM currencies the likes of the Indonesian Rupiah, the South African Rand, Russian Rubble, … all to suffer, not excluding the Chinese Yuan, which is once again nearing the 7.00 area against the US Dollar.

EM currencies are in trouble as reflected by the chart above

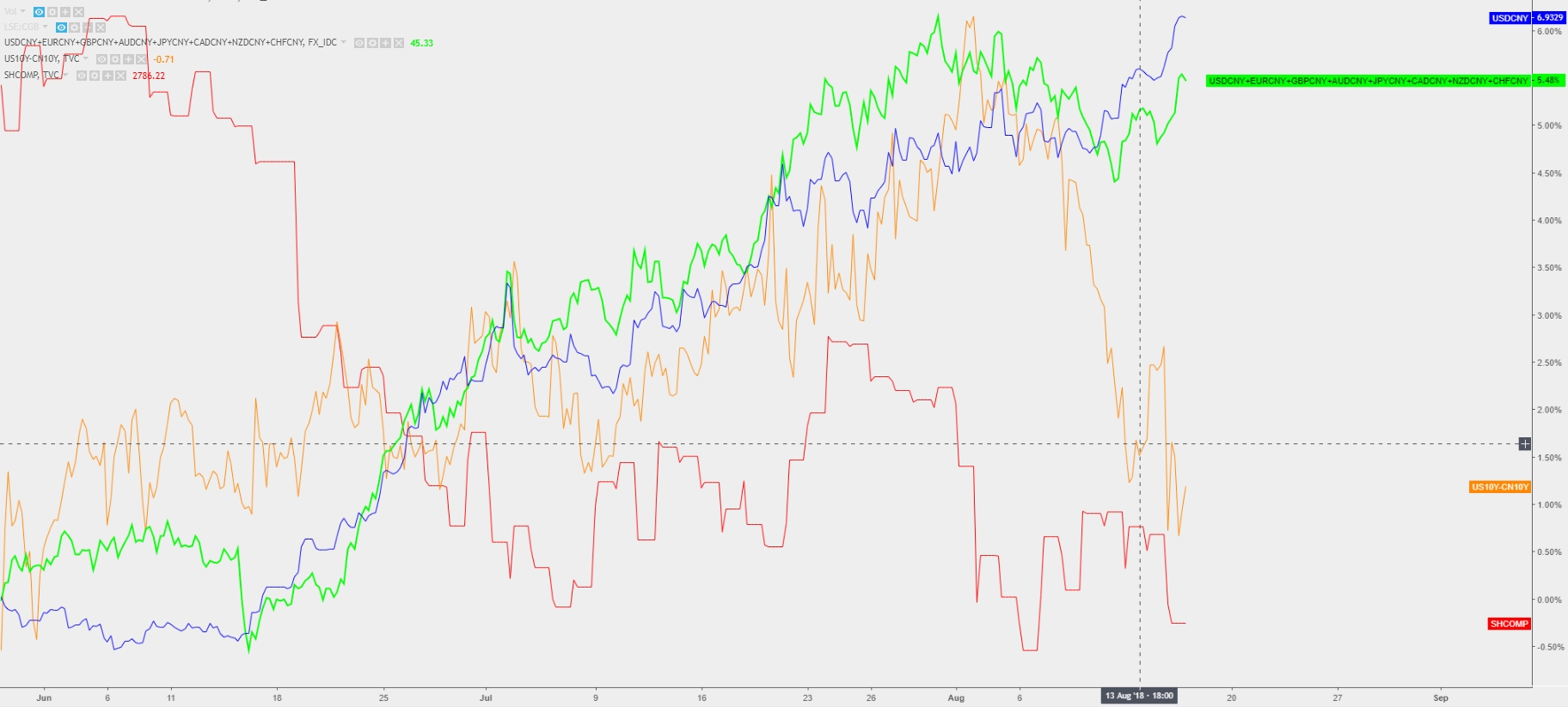

The situation in the Chinese market remains tense (lower RMB, equities)

Donald Trump won’t be too happy with the lower Chinese Yuan. Although let’s not forget that the ebullient mood around the US Dollar as the pick of choice, if anything, is partly a self-inflicted repercussion of its protectionist measures. At the end of the day, the backdrop just described is rather malign for EM equities, teetering on the brink of further losses, which will only worsen the situation of EMs amid a much cheaper currency vs the USD.

So, on the back of a rather fractious environment, in the last 24h, while FX flows were overall US Dollar positive, after the European session came to a close we saw a recovery in battered currencies such as the Euro, back above the 1.1350 after testing 1.13, which led to the rest of the G10 FX conglomerate to also pare some of its early losses, although by no means it represents a disruptor of the dominant USD bull trend.

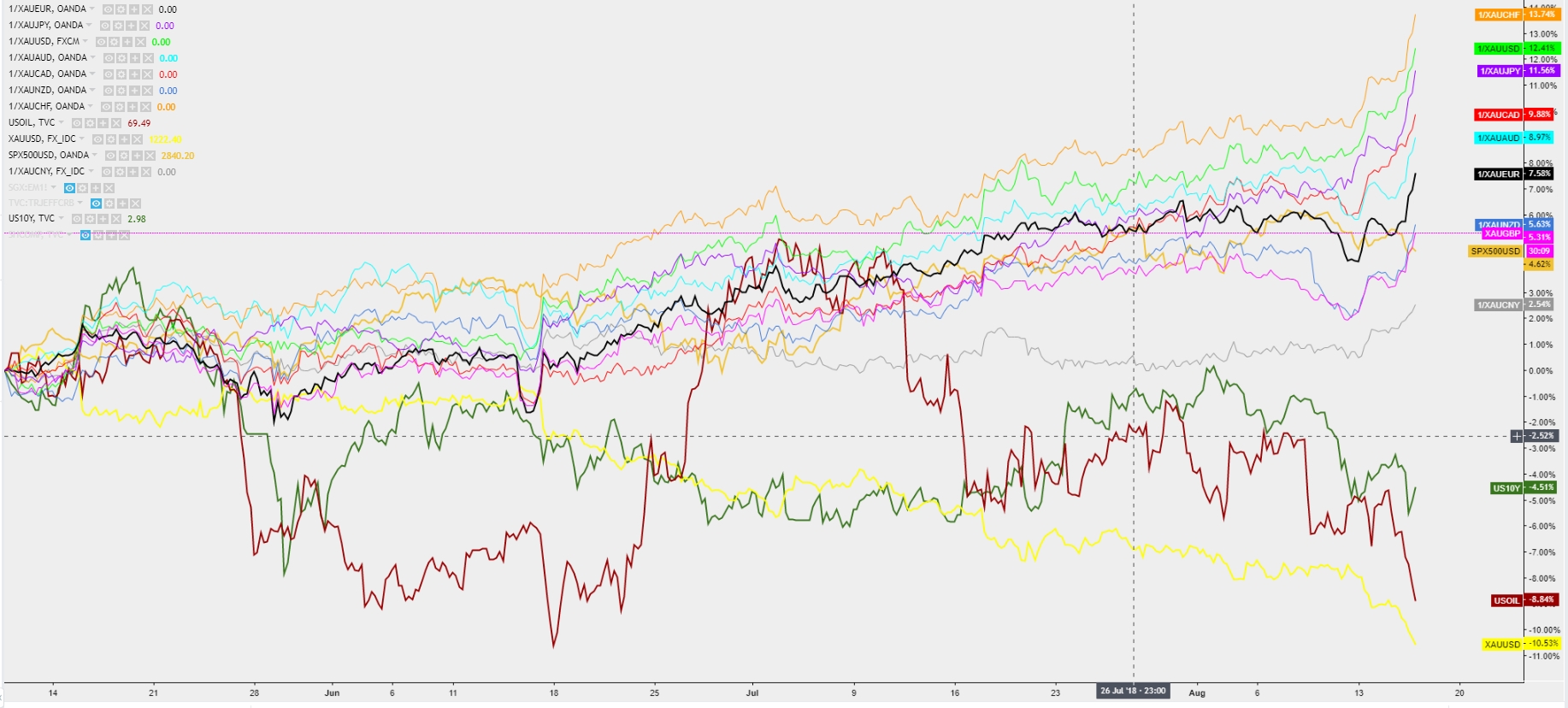

An asset of which its value is being mercilessly dashed is gold, last exchanging hands at $1,175.00, which is over $200 lower than the levels it traded back in the highs of April. When combined with the appreciation of the broad-based rise in the Yen on Wed, it really unpacks a clear message of the US Dollar being King, as the correlation between a rising Yen and the shine of Gold break up.

The Aussie and Kiwi also managed, as a by-product of some profit-taking in the US Dollar, rather than on its own merits, to edge cautiously higher, although the moves were far from impressive and depicts a still vulnerable and EM dependant markets. Meanwhile, European equities were not immune to the lingering Turkish drama, with the DAX, CAC-50, Euro Stoxx 50 all down to the tune of 1.5% – 2%, tracking the losses seen in Asia and what was to follow in the SP500, Nasdaq, DJ30.

Performance of FX vs Gold + commodities + equities

In terms of new fundamental developments, Wednesday leaves behind an unchanged Australian Q2 wages outlook, which as the RBA has reiterated, it’s an area of slow growth. Pay attention to today’s Aus employment report as it will offer new clues on the labour conditions. Keeping the focus on the far east, China house prices experienced the fastest growth in almost 1y at 0.2% y/y, which allows a sigh of relief as the Chinese economy is heavily reliant on the health of its property market given the over-leveraged nature it’s been built on. Meanwhile, it’s worth keeping an eye on the Hong Kong Dollar, where HKMA had to intervene to defend the peg the nation’s currency in anchored at (btw 7.75-7.85) vs the US Dollar, as capital outflows continue.

As the day continues its course, we learned that inflation remains by in large a source of no short-term concern for the BoE as the British ONS released a flattish 0% change in UK July CPI m/m; the most noticeable snipper of information was the persistent decline in London house prices. The next big focus for the UK economy will be the UK retail sales, where the figures are set to improve for July.

Meanwhile, our daily dose of Brexit commentary came courtesy of the UK foreign secretary, who expressed a growing preoccupation that further negotiations with the EU will not evolve into any meaningful agreements, hence why the prospects of a no-deal on Brexit is an outcome well telegraphed via much cheaper Pound valuations. The British media (Sky) has even gone as far as to report today that MP Alistair Burt is asking constituents about repeating the Brexit referendum, something that is an absolute ‘no-go’ for UK PM May.

Moving on, the US session left us with a sense that US consumer continue to spend at healthy levels as depicted by an increase of 0.5% vs 0.1% exp in the US July adv retail sales data; by drilling down into the details, with the main takeaways being the steadiness in the control group component and clothing. Another piece of data to be optimistic about was the US empire manuf for Aug, where respondents expressed better conditions to conduct business, with the NY Fed highlighting the growth in new orders and shipments.

As per the US Q2 unit labour costs, it dropped by 0.9% vs 0% exp, which brings to light how technology and the rise in productivity are playing a key role on lower labour costs. The US July industrial production came at 0.1% vs 0.3%, with capacity utilization and manuf production steady. Lastly, US NAHB housing market index came flat at 67. As per Canada, the only data of note to report was the July existing home sales, which deteriorated to 1.9% m/m vs 4.1% prior.