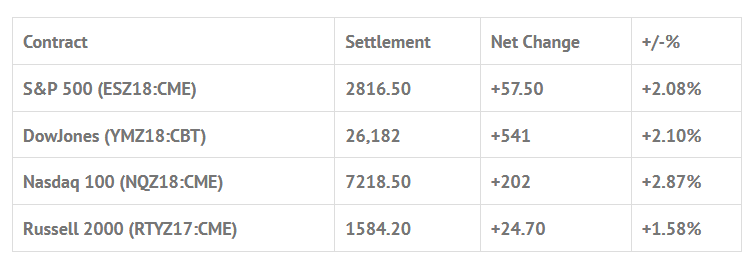

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp -0.22%, Hang Seng +0.31%, Nikkei +1.82%

- In Europe 8 out of 13 markets are trading higher: CAC -0.05%, DAX -0.15%, FTSE +0.46%

- Fair Value: S&P +0.49, NASDAQ +9.83, Dow -12.59

- Total Volume: 1.88mil ESZ & 1,228 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the Weekly Bill Settlement, Jobless Claims 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, FOMC Meeting Announcement 2:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: Highest Close Since October 9th

After a run higher on the overnight session following the results of the midterm elections, the S&P 500 futures opened the regular session at 2776.00. The ES made the early low of day at 2773.50 on the open, before rallying up to 2787.75 in the first half hour. From there, the futures retraced back through the open, making a low of 2774.25, and then heavy buys pushed the ES up to 2793.25 for the mid morning high, and then after a 6.25 handle pullback, rallied through the end of the morning up to 2800.00.

The afternoon saw a new high print of 2801.25 before reversing into the 1:00 hour, dropping down to 2793.75, and then began to climb higher through the afternoon into the final hour, as the MiM was showing as much as $1.1 billion to sell. The high print was 2817.50 in the final moments, and then the ES went on to trade 2813.00 on the 3:00 cash close, before settling the day at 2816.75, up +57.75 handles, or +2.09%.

The overall tone of the day was about pushing the ES higher. After the shakeout following the initial rally, the longs were the only ones who were consistently rewarded on the day, as the ES rallied 30+ handles off the morning low.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.