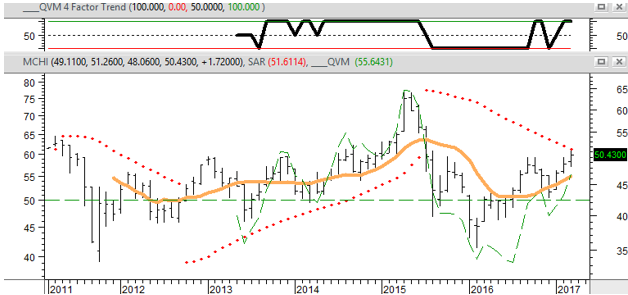

With Europe and China joining the other key regional markets, they are all now in intermediate up trends, as measured by our 4-Factor Monthly Trend Indicator. This is not a prediction of the future, merely an observation of the current trend condition of the markets.

(see video description of the indicator methodology and uses; and performance of the US large-caps in tactical allocation since 1901; here).

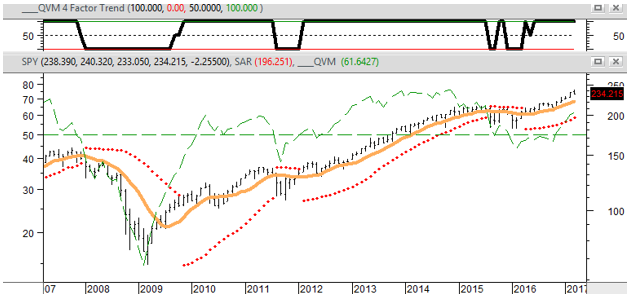

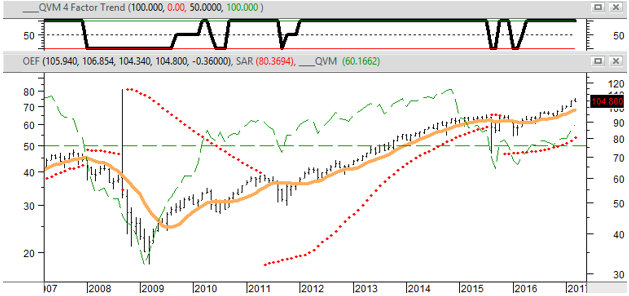

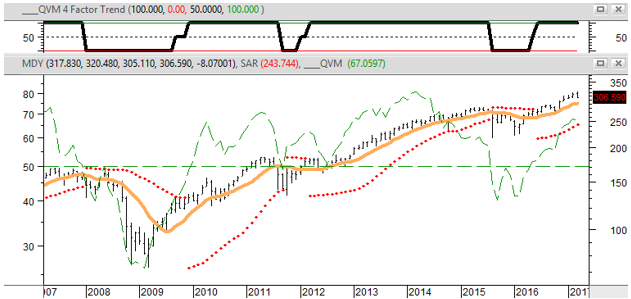

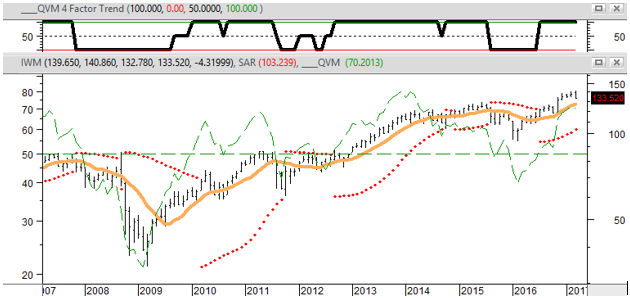

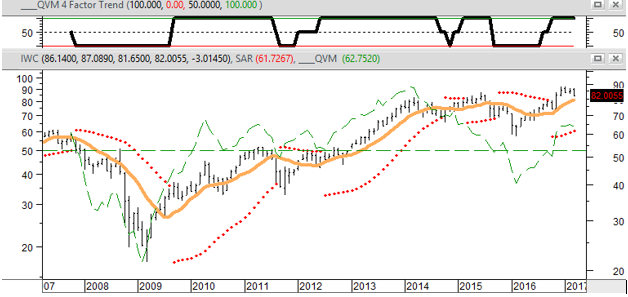

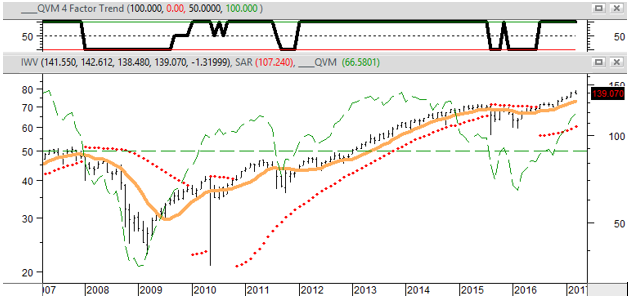

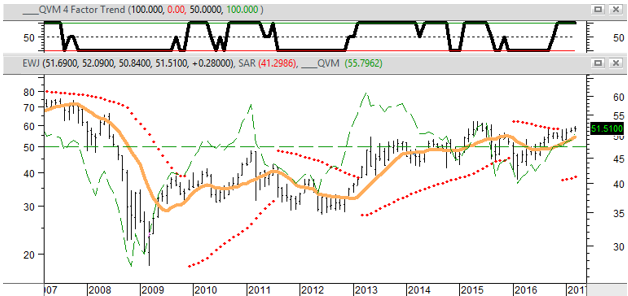

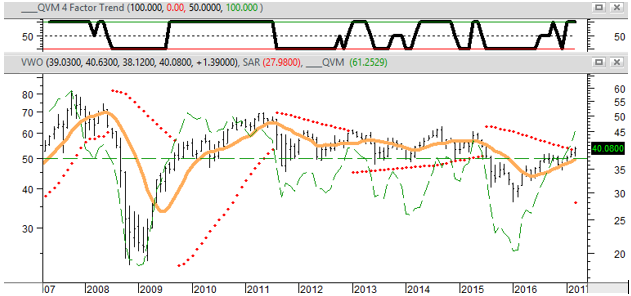

Each market is plotted below using a proxy ETF, showing the trend indication month-by-month for the last 10 years (4+ years for China ETF).

The trend indicator is plotted in black in the top panel, showing 100, 50 or 0. A 100 means up trend. A 0 means down trend. A 50 means a weak trend or transition between trends.

The 4 factors shown in the main panel are:

- whether the leading edge of the 10-month moving average is pointing up or down (gold line)

- whether position of the price is above or below the 10-month average (black vertical bars)

- whether buying pressure is net positive or net negative (dashed green line, left scale)

- whether the rate of price change in the direction of the trend is keeping up with a geometric pace (red dots).

US STOCKS INTERMEDIATE-TERM TRENDS:

S&P 100 Mega-Cap (NYSE:OEF)

S&P 400 Mid-Cap (NYSE:MDY)

Russell 2000 Small-Cap (NYSE:IWM)

Russell Micro-Cap (NYSE:IWC)

Russell 3000 “total market” (NYSE:IWV)

INTERNATIONAL STOCKS INTERMEDIATE-TERM TRENDS:

Europe (NYSE:VGK)

Japan (NYSE:EWJ)

China (NASDAQ:MCHI)

Global Emerging Markets (NYSE:VWO)

Frontier Markets (NYSE:FM)