Market Review and Update

Last week, we said:

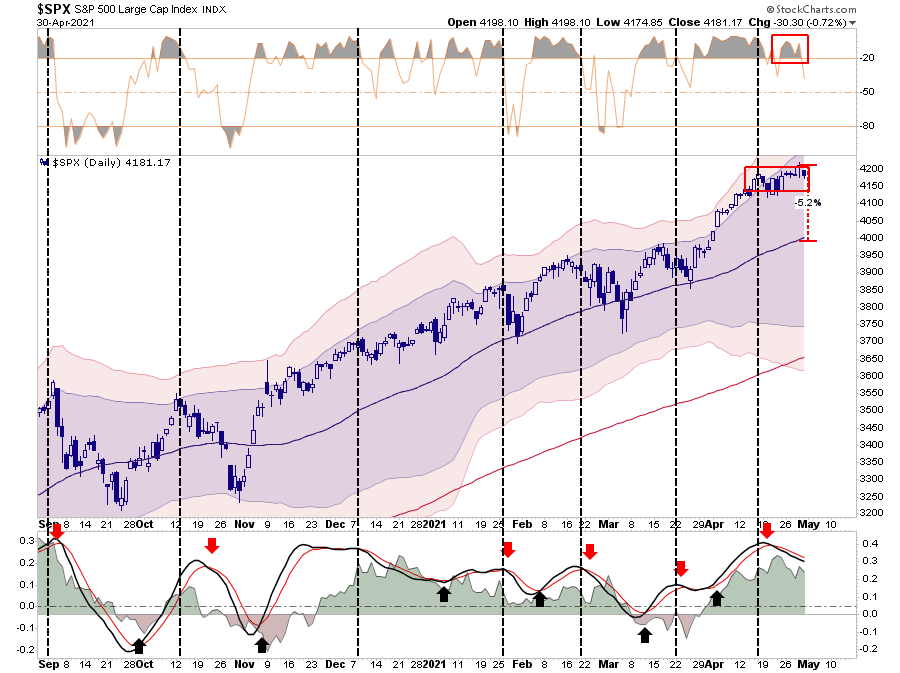

“The market is trading well into 3-standard deviations above the 50-dma, and is overbought by just about every measure. Such suggests a short-term ‘cooling-off’ period is likely. With the weekly ‘buy signals’ intact, the markets should hold above key support levels during the next consolidation phase.”

“As shown above, that is what is currently occurring. While the market remains in a very tight range, the “money flow” sell signal (middle panel) is reversing quickly. Importantly, note that the money flows (histogram) are rapidly declining on rallies which is a concern.”

While the “sell signal” remains intact, not surprisingly, the breakout above the consolidation on Thursday failed, with the selloff on Friday putting the market back where it started the week. Furthermore, the MACD “sell signal” in the lower panel also suggests that prices may remain somewhat capped for the time being.

As noted, the concern remains of the decline in actual money flows. While the market is holding up near all-time highs, the support of positive money flows continues to deteriorate. Weakening money flows with the market remaining at more overbought conditions also suggest upside is limited over the next few weeks.

We discussed these concerns in more detail in the latest 3-Minutes video.

For now, the market trend remains bullish and doesn’t suggest a sharp decrease of risk exposures is required. However, after reducing equity exposure previously, we are starting to look for the next short-term opportunity to increase risk. However, we aren’t expecting much before we get into the summer months, where, as we will discuss, the risk begins to rise markedly.

All Inflation Is Transitory

On Wednesday, Jerome Powell commented that while he sees inflation, he believes it to be transitory. As my colleague Mish Shedlock noted:

“Inflation jumped as predicted, and so was the Fed comment about transitory.”

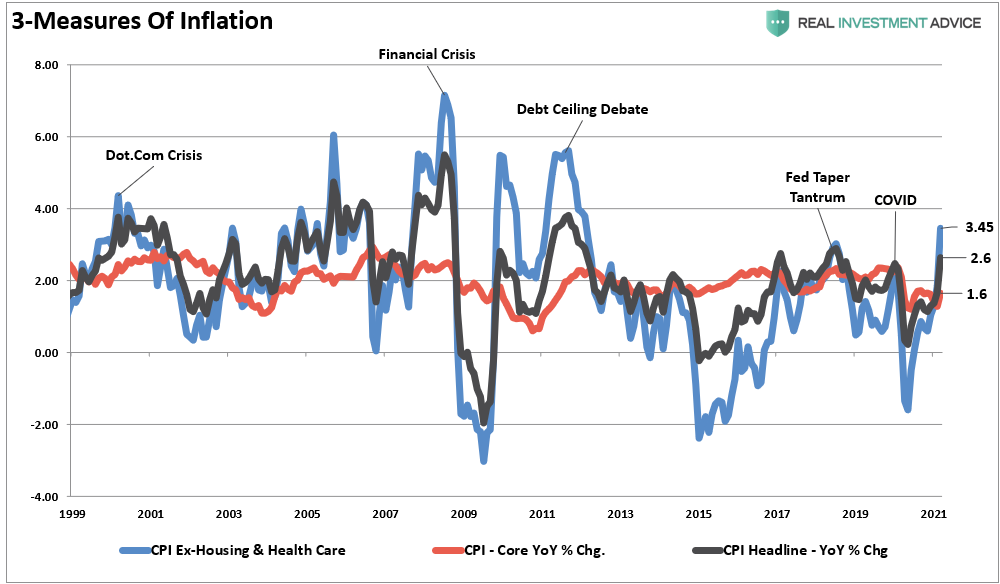

As Mish discusses, inflation depends much on how you measure it and who it impacts. However, inflation is and remains an always “transient” factor in the economy. As shown, there is a high correlation between economic growth and inflation. As such, given the economy will quickly return to sub-2% growth over the next 24-months, inflation pressures will also subside.

Significantly, given the economy is roughly comprised of 70% consumption, sharp spikes in inflation slows consumption (higher prices lead to less quantity), thereby slowing economic growth. Such is particularly when inflation impacts things the bottom 80% of the population, which live paycheck-to-paycheck primarily, consume the most. The table below shows the current annual percentage change in the various categories.

As shown above, food and beverage prices make up 15.08% of the CPI calculation. The chart below from Brett Freeze breaks down how consumers spend their money based on income classes. The lowest income earners, making $15,000 to $29,999, pay almost 25% of their earnings on food. That compares to only 7.5% for families making more than $150,000.

Housing comprises 56.3% of spending for the lowest income class and only 20% for the highest. The CPI inflation calculation does not accurately portray how inflation affects a large percentage of the population. (This is also the group whose entire boost in income from the stimulus will get absorbed by higher prices)

The Fed May Be Right For The Wrong Reason

With double-digit rates of change in essential items like transportation (going back to work), food, goods and services, and energy, the impact on disposable incomes will come much quicker than expected. If we strip out “housing and healthcare,” which are fixed budget items (mortgage and insurance payments), we see that “household” inflation is pushing 3.5% annualized.

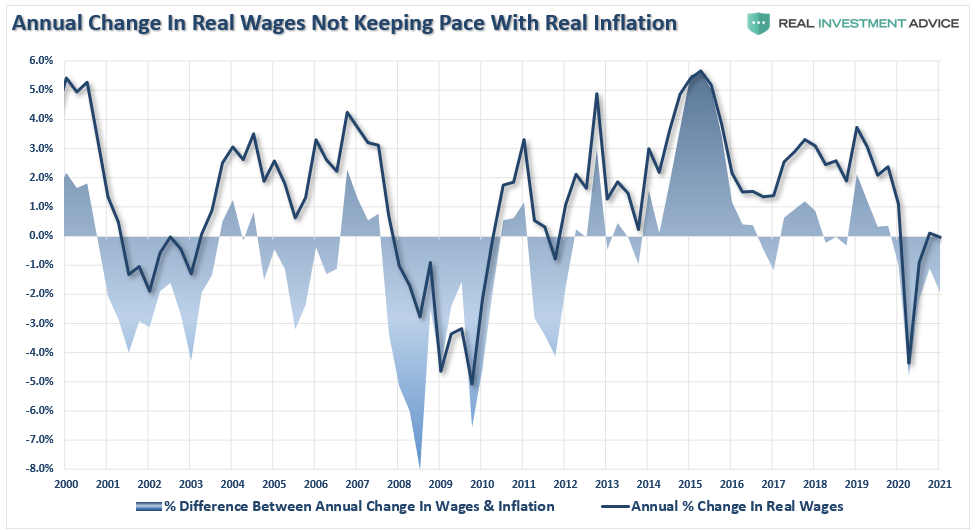

Such is particularly problematic when wages aren’t keeping up with inflation.

The Fed is probably right. Inflation will be transitory, but for all the wrong reasons.

Rates Tell The Same Story

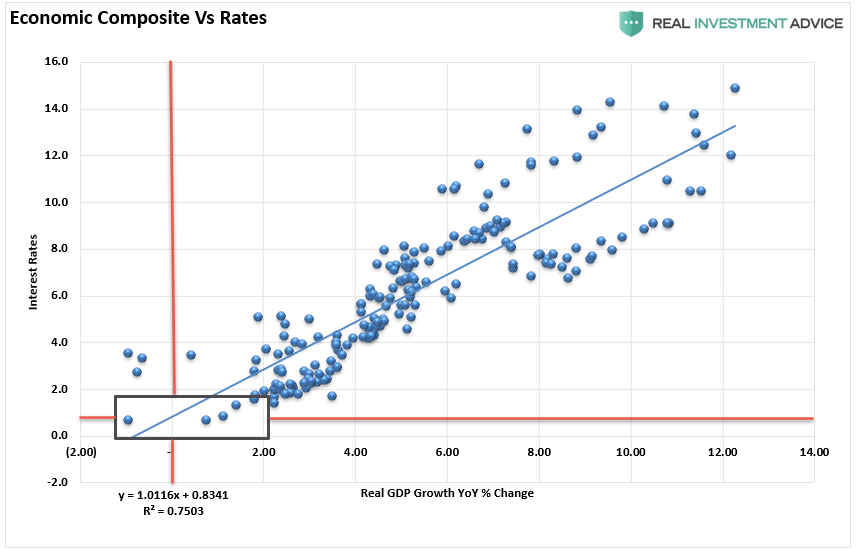

As discussed in Friday’s #MacroView, interest rates also tell us that economic growth will deteriorate markedly over the next few quarters.

“The correlation should be surprising given that lending rates get adjusted to future impacts on capital.

- Equity investors expect that as economic growth and inflationary pressures increase, the value of their invested capital will increase to compensate for higher costs.

- Bond investors have a fixed rate of return. Therefore, the fixed return rate is tied to forward expectations. Otherwise, capital is damaged due to inflation and lost opportunity costs.

As shown, the correlation between rates and the economic composite suggests that current expectations of sustained economic expansion and rising inflation are overly optimistic. At current rates, economic growth will likely very quickly return to sub-2% growth by 2022.”

The problem for the Federal Reserve, and as quoted by Mish, is that the fiscal and monetary stimulus imputed into the economy is “dis-inflationary.”

“Contrary to the conventional wisdom, disinflation is more likely than accelerating inflation. Since prices deflated in the second quarter of 2020, the annual inflation rate will move transitorily higher. Once these base effects are exhausted, cyclical, structural, and monetary considerations suggest that the inflation rate will moderate lower by year end and will undershoot the Fed Reserve’s target of 2%. The inflationary psychosis that has gripped the bond market will fade away in the face of such persistent disinflation.” – Dr. Lacy Hunt

The point here is that while economic growth may be booming momentarily, inflation, which is destructive when not paired with rising wages, will be transient. Given the massive surge in prices for homes, autos, and food, the reversal will cause a substantial disinflationary drag on economic growth.

The Fed Should Be Hiking And Tapering Now

There is a significant difference between a “recovery” and an “expansion.” One is durable and sustainable; the other is not.

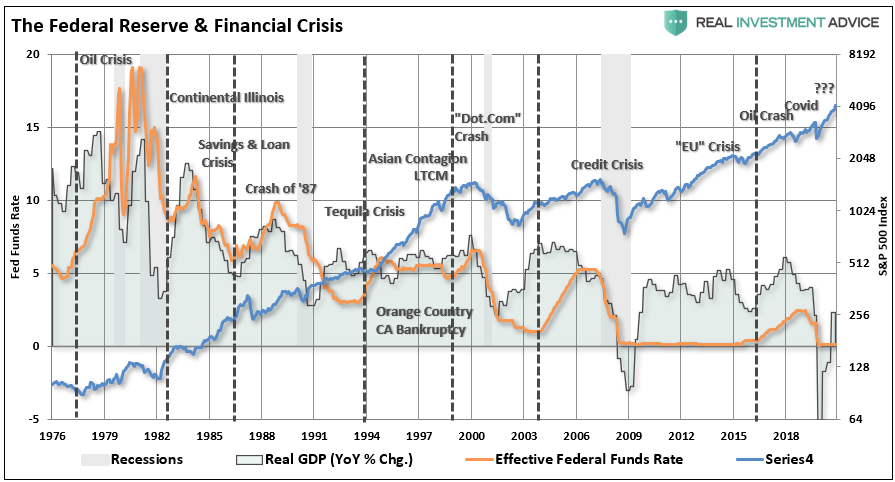

Following the financial crisis, the Federal Reserve cut rates and flooded the markets with liquidity. As discussed in “The Fed Continues To Make Policy Mistakes,” the Fed should have acted sooner to prepare for the next economic downturn.

“The Fed should have started lifting rates as the spike in economic growth occurred in 2010-2011 as both the Fed and Government flooded the economy with liquidity. While hiking rates would have slowed the advance in the financial markets, the excess liquidity sloshing around the system would have offset tighter monetary policy.”

The Fed is again suppressing rates but should be using the massive liquidity injections and economic recovery for hiking rates and taper bond purchases to prepare for the next downturn.

As Mohammed El-Erian noted:

“The majority of market participants are expecting an undramatic event including an upgraded economic outlook, a reiteration of uncertainties and signaling of no policy changes. Unfortunately, it’s an outcome that kicks the policy can down the road when the central bank should be thinking now about scaling back extraordinary measures.

The longer it takes to do so, the harder it will be to pull off eventual normalization without risking both significant market volatility and damaging what should and must be a durable and inclusive economic recovery.”

By not hiking rates now, they run the risk of being late once again.

Given the Fed waited too long to hike rates previously, such will be the same this time as they start hiking rates just as economic growth peaks due to the roll-off of stimulus.

There have been ZERO times in history when the Fed started a rate hiking campaign that did not lead to a negative outcome.

Something Is Going To Break

The “frenzy” of investors to get into the market is unlike anything we have seen since 1999.

The Fed’s problem is that in 1999 there was a bubble in “Dot.com” stocks but not in many other areas of the market. In 2007, it was a mortgage market bubble, but valuations were not extremely elevated in stocks.

Today, we are:

- Pushing the second-highest level of valuations in history

- Many other valuation measures such as Price-to-Sales, Tobin’s-Q, and Market-Cap to GDP are at a record.

- Investors are rushing to buy the most speculative assets from various Cryptocurrencies, to Non-Fungible Tokens (NFT’s), to highly speculative companies.

- Wall Street is rushing IPO’s to market at the fastest pace on record.

- SPAC’s are the new asset class.

- A large portion of the Russell 2000 companies have no income.

- The bonds with the highest risk of default are trading at historically low rates.

- Individuals are rushing to pay the highest prices on records for housing and used cars.

- And, it’s all done with the highest margin debt levels in history.

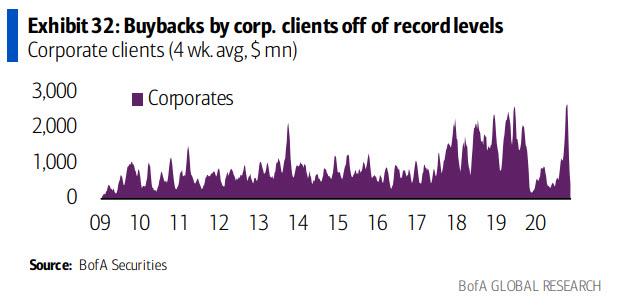

Of course, corporations are in on it as well, buying back their shares at a record pace (just after asking the government for a taxpayer-funded bailout in March 2020.)

Trapped With No Escape

In other words, it isn’t just one bubble the Fed will have to deal with during the subsequent market melt-down. It will be all of them. The magnitude of the meltdown of multiple asset classes at one time will likely be larger than the Fed can bailout.

Importantly, I believe they know this already and hope that an inflationary push will help deflate some of the risks before the bubble bursts. As my colleague Doug Kass wrote on Thursday:

“From my perch, and in the end, of course, all violation of the fundamental laws of economic and financial common sense are paid for – but every Bull thinks he will unload before the break.

John Kenneth Galbraith once wrote that “What we do know is that speculative episodes never come gently to an end. The wise, though for most the improbable, course is to assume the worst.”

I believe that there are numerous other bubbles or inflated values. Moreover, I see numerous headwinds that could reset broad valuations lower. Such includes higher corporate and individual tax rates, inflation, and inflated bullish investor sentiment.

It is easy enough to burst a bubble. To incise it with a needle so that it subsides gradually is an operation of undoubted delicacy.”

I agree.

The bottom line is the Fed is trapped. If they hike rates, they bust the bubble and destroy economic growth. If they do nothing, the bubble inflates to a point it breaks under its weight.

In my opinion, not that it matters; it seems the risk of doing nothing far outweighs doing something. Taking small actions today to slowly deflate risk seems a much better alternative to the eventual bust.

Portfolio Update

As noted above, we will trigger the next short-term “buy signal,” likely next week. As we have discussed regularly, given the daily “sell signal” was offset by a weekly “buy signal,” there was little downside risk. Such turned out to be the case.

We can now start adding some additional exposure to areas that we need, but with equity holdings at near target weights, only minor adjustments need to get done. We still carry a very short-duration bond portfolio currently as interest rates continue to push towards our target of 1.8-1.9%. At that level, we will start accumulating long-duration bonds and increasing portfolio hedges.

Another reason we don’t expect a lot of upside to markets because the recent “consolidation” failed to work off any of the overbought conditions. Notably, the market remains more than 5% above its 50-dma, which is historically extreme. Such gets corrected, usually through a price decline or a consolidation.

Over the last two weeks, we had suggested cleaning up portfolios and rebalancing risk. With that complete, portfolios should be in an excellent position to participate in whatever rally we get over the next couple of weeks.

As we head into summer, we will likely see our weekly and daily signals align with “sell signals” in late May or early June. Such will likely coincide with a realization of peak earnings and economic growth. While we don’t expect a significant reversion at this juncture, given the ongoing liquidity support, a 7-10% correction is possible and well within annual norms.

Could it be more? Absolutely.

But that is something we will navigate once we get there.