Everybody is piling into stocks. Valuations who cares. It’s the end of year seasonality when stocks always go up, the Fed has our back, multiple vaccines are just around the corner, Wall Street paints a rosy picture into next year (as Wall Street always does) so what’s to worry. Let’s go all in stocks.

Everyone has to decide for themselves of course what is a good risk versus reward proposition and as markets are drowning in optimism here in the middle of November I thought it might be worth pointing out a few data sets that may give some pause here.

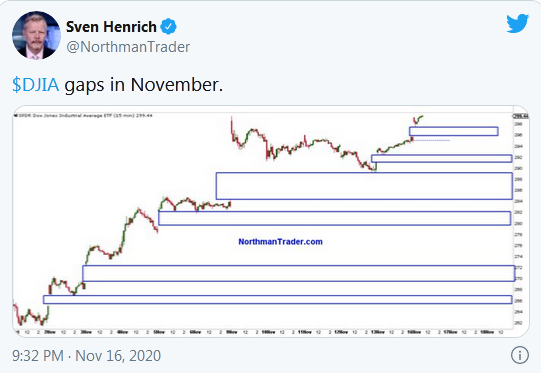

First off perhaps the most obvious: Since the end of the October these markets have been running from one open gap to the next never filling any price action. We see this in a lot of index charts, but just highlighting the action here on DIA the ETF that track the Dow Jones Industrial Average:

I’ve spoken about open gaps before filling and seeing 6 open gaps in 2 weeks is not something I recall seeing. Not all gaps fill, but most do and chasing 6 open gaps up seems a proposition of poor risk/reward in the short term at least, especially in context of the broader picture.

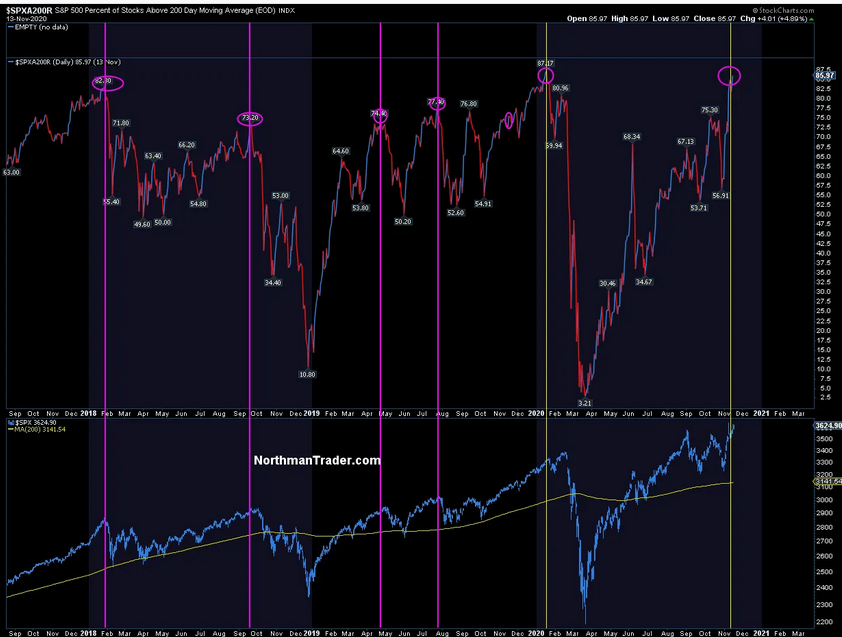

Firstly note that 86% of S&P 500 components are above the 200MA. A rare reading, the last reading of such magnitude was in January. Markets then dipped a little, proceeded to make new highs on a lower reading and the rest is history:

Not suggesting a similar drop here of course but note high optimistic readings of the sort have led to pullbacks and corrections many of which have hit the 200MA eventually.

In context it is notable that S&P 500 is currently trading over 15% above its 200MA at the moment:

SPX last connected with its 200MA in June so the extension is getting long in the tooth. Note also, despite the Moderna (NASDAQ:MRNA) news yesterday echoing the Pfizer (NYSE:PFE) vaccine news from last Monday SPX has so far not managed to invalidate the rejection candle of last week.

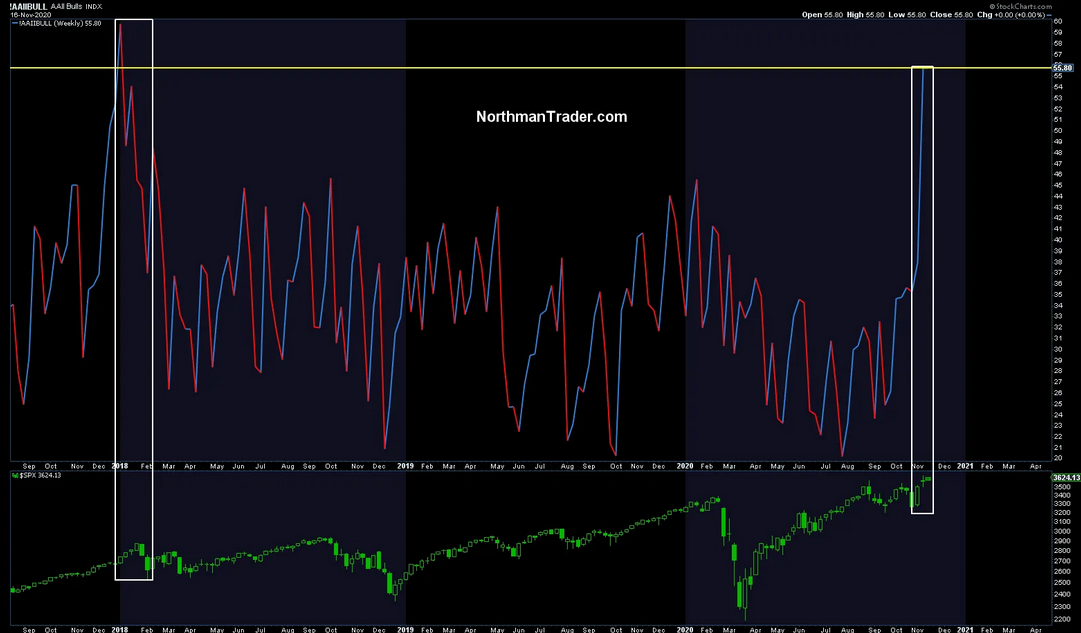

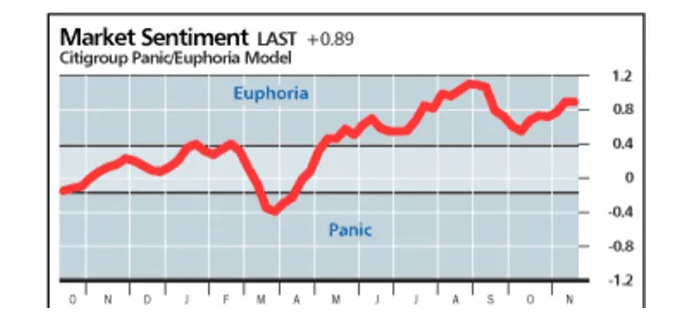

And don’t kid yourself, this market has bullish sentiment.

AAII bull/bear sentiment has not been this ecstatic since the beginning of the year:

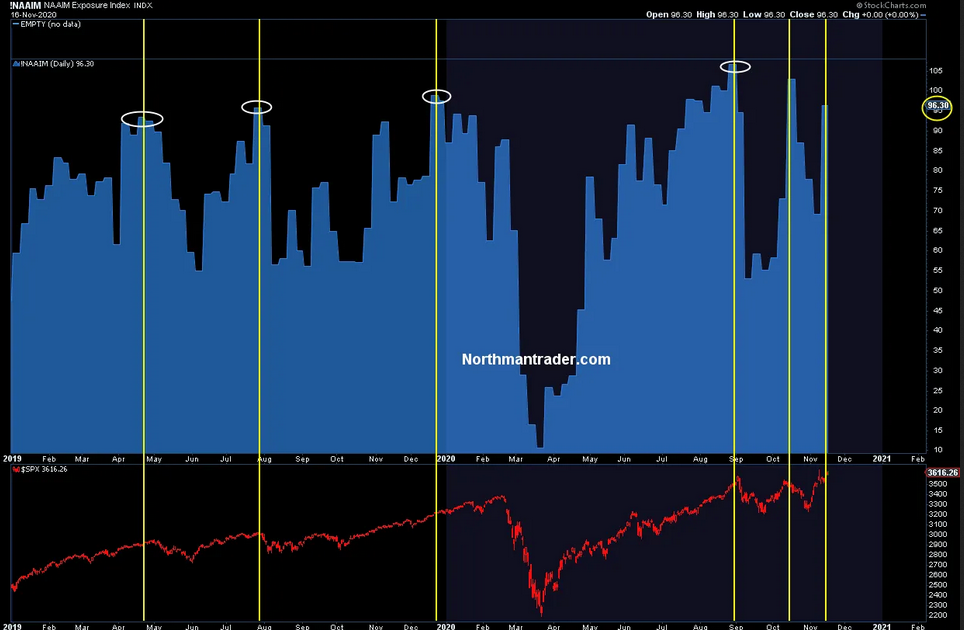

And asset managers also all back in long:

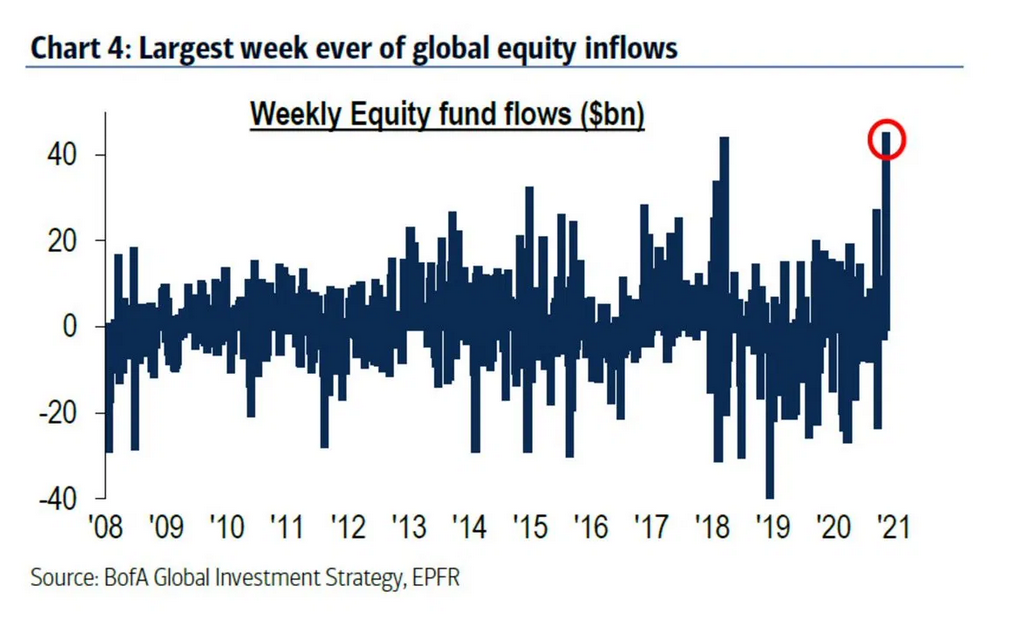

And when I say they are piling all in, they are piling all in with the largest weekly inflows into equities ever:

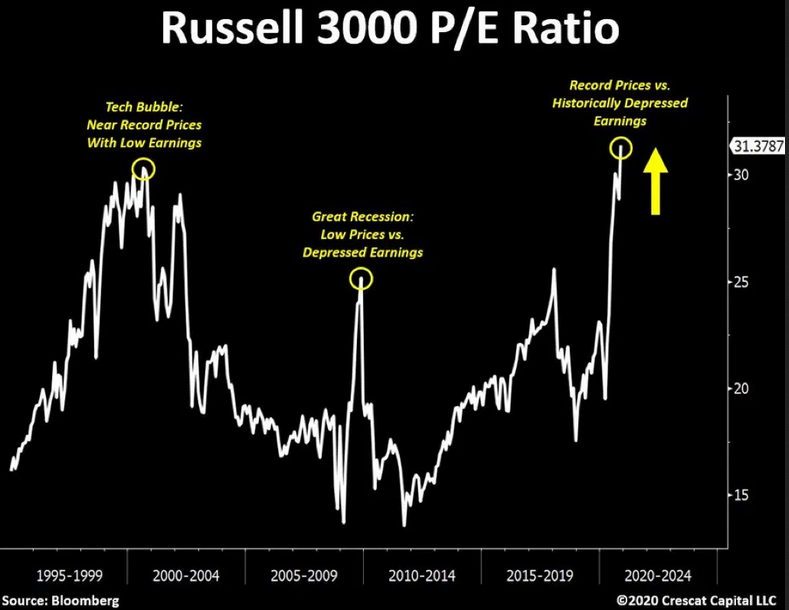

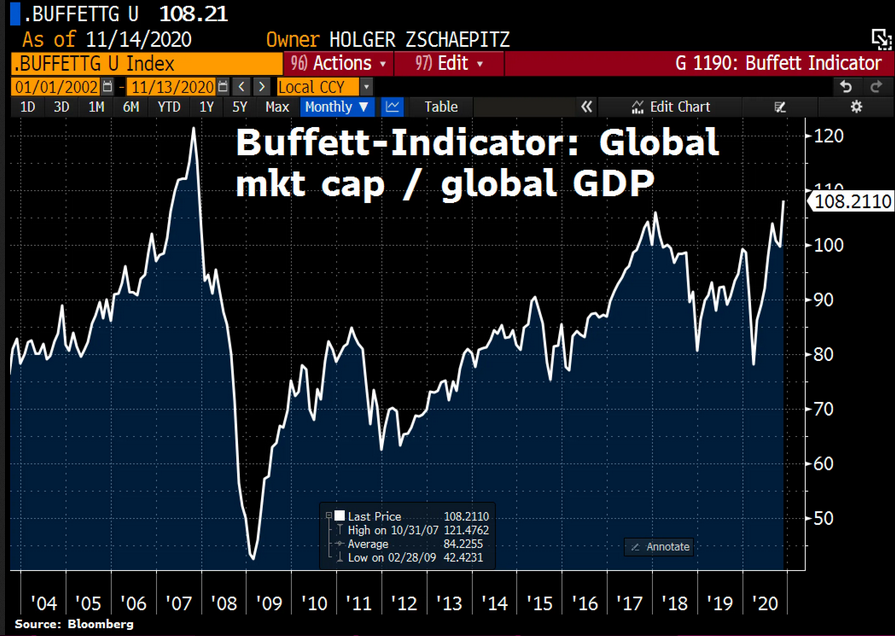

With markets at some of the highest valuations ever:

Whatever metric you want to use these markets are not cheap, not at all, but of course I don’t see Wall Street mention valuations when outlining lofty price targets for 2021 and 2022.

No, this market is back to euphoria:

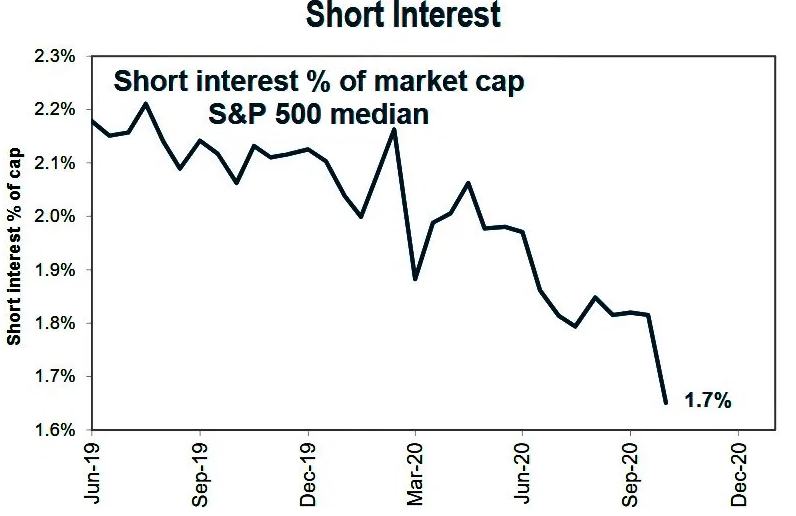

with shorts disappearing:

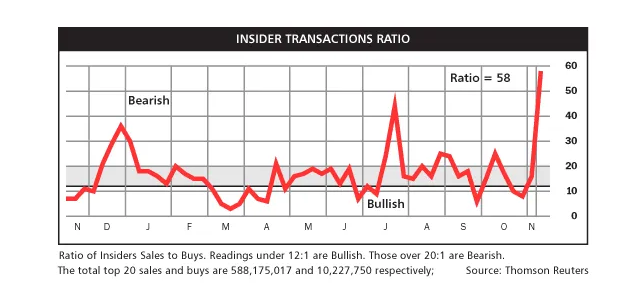

The only people not really buying into the euphoria appear to be insiders. They are selling into the euphoria:

Go figure.

Six open gaps in November, some of the highest global valuations ever, the largest equity inflows ever, vastly bullish sentiment readings and equity positioning, with markets again vastly extended in time and price above key moving averages and shorts having left the building.

If you think that’s a good risk/reward proposition to the long side be my guest.

My view remains markets have work to do to the downside and that includes some gap filling. I’m not saying markets can’t keep drifting higher into OPEX week and S&P 500 VIX Futures expiration, but extreme strength can be a selling opportunity just as extreme weakness can be a buying opportunity.

As it stands the bull targets outlined previously were reached last Monday and yesterday's gap up has not managed to produce new highs. Perhaps that will change, but if it doesn’t that in itself may be a consideration worth pondering. Especially if one is all in stocks.