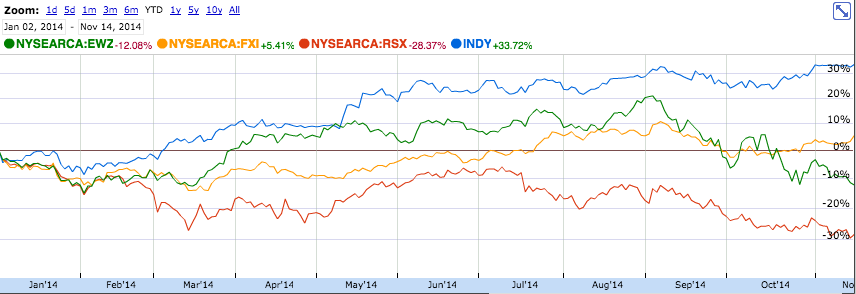

Emerging markets have been a mess this year. Out of the four BRIC markets, India has been the only one that has outperformed the S&P 500 so far this year. S&P India Nifty Fifty (NASDAQ:INDY), which represents the top 50 Indian companies by market capitalization, continues to consolidate near multi-year highs.

How does one take advantage of the relative strength in India? Look no further than the so called “Priceline of India”. Makemytrip is the biggest online travel agency in India and its stock is setting up for a potential breakout. MakeMyTrip Limited (NASDAQ:MMYT) is already a billion dollar company, but it is still relatively small player when compared to industry juggernauts like Chinese Ctripcom International Ltd (NASDAQ:CTRP) (8.5Bn mkt cap), Expedia Inc (NASDAQ:EXPE) (11Bn mkt. cap) and Priceline.com Incorporated (NASDAQ:PCLN) (over 60Bn mkt. cap). MMYT could be owned here near 30 with about 2 stop. It has the potential to test its 52wk highs near 36.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.