About a year ago, I was meeting a client at a restaurant in Marina Del Rey, California. The traffic had been mild by Los Angeles County standards, so I arrived in the area early. I stopped in a local coffee shop and sat down in a booth. Lo and behold, in the booth next to me, Jerry Seinfeld had been interviewing Jim Carrey for a “webisode” of the popular online show, Comedians In Cars Getting Coffee.

The reason that I bring this up? I began my financial services pursuits in the the second half of the 1980s, when songs and shows about “nothing” seemed to have their biggest impact. For instance, in November of 1987, British rock artist Billy Idol scored a top Billboard hit with a live remake of “Mony Mony.” The original writer of the song acknowledged that he got the title from Mutual Life Insurance of New York’s acronym (MONY), though the acronym in the song lacked any actual meaning. Similarly, Larry David and Jerry Seinfeld set out in the late 80s to create a show about nothing. “Seinfeld” later became one of the most iconic sitcoms in television history.

Interestingly enough, investors on Monday (10/5) bought $21 billion in U.S. 3-Month Treasury bills at a yield of 0%, the lowest yield at a 3-month Treasury auction ever recorded. The lowest yield ever! And there was healthy demand for the 0% return because the bid-to-cover ratio was the highest since late June. Strong demand for “nothing.”

If someone had told me in the 80s that 3-month T-bills would someday yield 0%, I might have doubled over in hysterics. I was used to seeing anywhere between 5% and 7%. Who would be interested in 0%?

Nevertheless, this is the world that has been created by a Federal Reserve that has waffled on leaving the zero-bound on its overnight lending rate, even after seven years. What’s more, the voracious appetite for nothing beyond the preservation of capital suggests that few believe the Fed will raise rates at all in 2015.

Some contend the longer that chairperson Yellen and her Fed colleagues abstain from hiking borrowing costs, the less that financial markets will show confidence in the institution. That may not be accurate… at least not yet. For example, Friday’s jobs report (10/2) served up an abysmal 142,000 jobs, flat hourly earnings, downward revisions to the job numbers for prior months, and a monstrous drop in labor force participation. Every expectation was a “miss.” Stocks initially sold off, but they quickly surged higher by more than one percent on the anticipation that the data virtually assures ongoing Fed inaction.

What about Monday (10/5)? The one saving grace of the U.S. economy has been the “well-being” of the services sector. Yet both data points on the services sector dropped more than expected from the previous month. The Institute of Supply Management’s (ISM) non-manufacturing index for September registered 56.9, down from 59. Markit Economics’ services purchasing managers’ index report fell to 55.1 from 55.6. Equally troubling? Business activity and incoming new work rose at significantly slower rates.

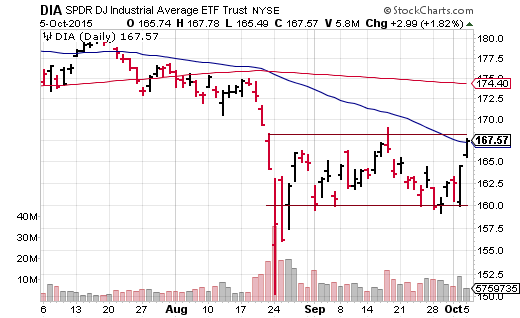

Still, stocks in the SPDR Dow Jones Industrials ETF (NYSE:DIA) catapulted higher, rejoicing at yet another disappointing batch of data. The exchange-traded fund closed above a short-term, 50-day moving average. It has also bounced off of support at 160 and is testing resistance five percentage points higher around 168.

So while one may be tempted to say that financial markets are losing respect for the Federal Reserve, it seems more likely that the financial markets are gaining confidence that interest rates could be kept near 0% for longer. After all, the Federal Reserve’s song, dance and pony show is all about the continuation of zero-percent rate policy. (Some even think that we may even see negative rates before we see a hike.) Indeed, as long as global and domestic economic concerns persist, and the Fed maintains its squeamishness about leaving the zero-bound, financial markets have the potential to rejoice.

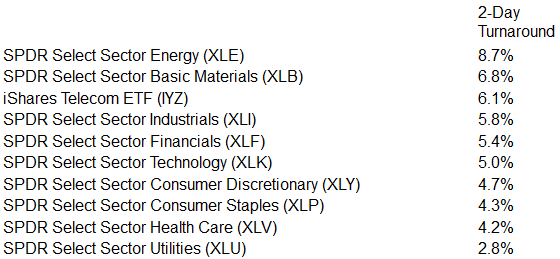

Which sectors jumped the highest off of the intra-day bottom from Friday (10/3)? Here is a quick rundown:

The Big Bounce Off Of Friday’s Intra-Day Lows

ETFs that have been beaten down the most from the global economic slowdown – Energy Select Sector SPDR (NYSE:XLE), Materials Select Sector SPDR (NYSE:XLB), Industrial Select Sector SPDR (NYSE:XLI) – rocketed the most. Since neither the global economy nor the domestic economy has demonstrated an enhanced potential to expand, it stands to reason that the super-sized price gains reflect the anticipation of more stimulus. (Or for fans of Saturday Night Live and Christopher Walken, “We need more cowbell.”)

If the Fed is going to stand pat at the zero-bound, they’ll need to tell the investment community that they’re planning to remain there until the end of Q2, 2016. If they’re going to raise borrowing costs, they’ll need to describe the precise nature of the hiking campaign. Will it be one-eighth of a point every meeting until the end of the second quarter next year? Will it be one-quarter of a point every other meeting until the end of Q2? An inability by the Fed to make up its collective mind alongside murky claims of data dependency would continue to embolden short-sellers and safety-seekers.

Conversely, if Janet Yellen and other voting members of the Fed’s Open Market Committee (FOMC) determine that the data call for additional stimulus in the form of “QE4,” only an “open-ended” stimulus will pack the kind of wallop to send risk assets into the stratosphere. It was the open-ended nature of QE3 that pushed stocks to all-time records; QE1 and QE2 lost firepower with the investment community’s knowledge that the stimulus had a definitive end date.

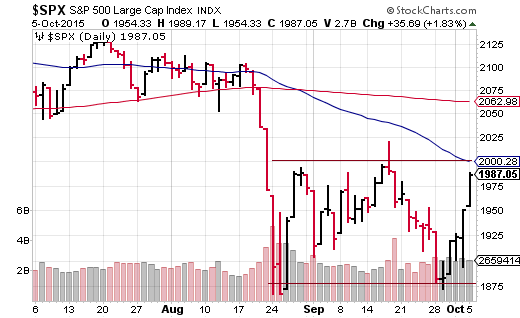

At this stage of the correction, traders will likely sell the S&P 500 near the 2000 level and buy it near the 1900 level, at least until the Federal Reserve delineates an unambiguous course. The S&P 500 VIX Volatility (VIX) may have fallen below 20, though I presume that volatile price movement for stocks will remain the norm.

Disclosure Statement: ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at he ETF Expert website. ETF Expert content is created independently of any advertising relationship.