Alcoa Corp. (NYSE:AA) just released its fourth quarter 2017 financial results, posting adjusted earnings of $1.04 per share and revenues of $3.17 billion. Currently, Alcoa is a Zacks Rank #3 (Hold), and is down over 5% to $54 per share in after-hours trading shortly after its earnings report was released.

Alcoa:

Missed earnings estimates. The company posted adjusted earnings of $1.04 per share, missing the Zacks Consensus Estimate of $1.23 per share.

Missed revenue estimates. The company saw revenue figures of $3.17 billion, falling short of our consensus estimate of $3.29 billion.

Alcoa posted a Q4 net loss of $196 million, which includes the financial impacts of previously announced strategic priorities. Yet, excluding special items, the company’s adjusted net income was up 44% sequentially.

For the full-year 2017, Alcoa posted adjusted net income of $563 million, or $3.01 per share. Alcoa’s full-year revenues jumped 25% year-over-year to hit $11.7 billion, based in large part on higher alumina and aluminum pricing.

“Solid market fundamentals allowed us to deliver our strongest adjusted EBITDA quarter since our launch as an independent, publicly-traded company,” CEO Roy Harvey said in a statement.

“With a series of operating and asset decisions, we also purposefully delivered against our strategic priorities. Our first full year has been truly remarkable. By continuously focusing on our strategic priorities, and supported by favorable markets, we’ve been able to accelerate our plan to strengthen Alcoa’s foundation for an even brighter tomorrow.”

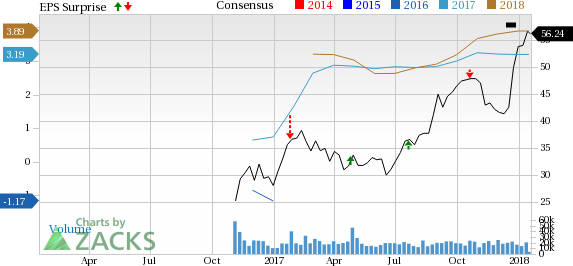

Here’s a graph that looks at Alcoa’s Price, Consensus and EPS Surprise history:

Alcoa is a global industry leader in bauxite, alumina and aluminum products.

Check back later for our full analysis on Alcoa’s earnings report!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Alcoa Corp. (AA): Free Stock Analysis Report

Original post

Zacks Investment Research