On Sep 7, we issued an updated research report on steel maker, AK Steel Holding Corporation (NYSE:AKS) .

AK Steel topped earnings and sales estimates in second-quarter 2017. The company reported net income of $61.2 million or 19 cents per share, up 253.7% from the prior-year quarter. Earnings for the quarter surpassed the Zacks Consensus Estimate of 13 cents. The company recorded net sales of $1,557.2 million for the quarter, up 4.3% from the year-ago quarter. Sales surpassed the Zacks Consensus Estimate of $1,530 million.

According to AK Steel, the second-quarter performance reflects continued benefits obtained through strategic initiatives implemented over the past one-and-a-half year.

Shares of AK Steel have moved up 44.4% over a year, outperforming the industry’s 38.9% gain.

The company expects shipments in the third quarter to be relatively flat compared to the second as higher shipments of the carbon distributing and converting market are expected to be offset by lower automotive shipments. Average selling price in the third quarter is expected to be modestly lower than the second quarter. The expected decline assumes a change in the mix of shipments related to an anticipated reduction in automotive shipments and decline in raw material surcharges.

The company’s sustained initiative to manage costs amid a challenging operating environment is expected to lend support to its bottom line. AK Steel is looking for cost-saving opportunities in 2017 through a number of means including process improvement, headcount cuts, reduction in process time and procurement activities.

AK Steel also remains focused on expanding its core automotive business in 2017. The company is laying importance on de-emphasizing commoditized products and launching new value-added products. As part of this strategy, the company, last year, launched Nexmet – an innovative product range of high-strength steel for use in automotive lightweighting applications. The products are expected to greatly benefit automotive manufacturers and reinstate the company’s focus on innovation and technology for product development.

The acquisition of Precision Partners is also in sync with AK Steel's commitment to broaden its portfolio of high-value products and processes and reinforces collaboration with the company’s automotive market customers.

However, AK Steel remains exposed to weakness in electrical steel pricing in the overseas markets. Prices remain under pressure in the international markets due to global overcapacity. The company expects the global electrical steel market to remain volatile in the near future due to production overcapacity.

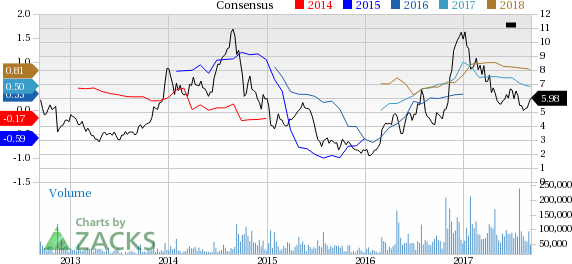

AK Steel Holding Corporation Price and Consensus

Zacks Rank & Stocks to Consider

AK Steel currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic material space include are The Chemours Company (NYSE:CC) , Kronos Worldwide (NYSE:KRO) and BASF SE (OTC:BASFY) .

Chemours has expected long-term earnings growth of 15.5% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has expected long-term earnings growth of 5% and flaunts a Zacks Rank #1.

BASF has expected long-term earnings growth of 8.6% and carries a Zacks Rank #2 (Buy).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Original post