AK Steel Holding Corporation (NYSE:AKS) announced that it will increase the current base prices for all carbon flat-rolled steel products in spot market by at least $30 per ton, with immediate effect on new orders.

AK Steel, in its second-quarter earnings call, noted that prices in the carbon spot market were far more volatile than it had expected, reflecting continued flooding of imports in the market. The company is taking appropriate pricing actions amid this backdrop.

AK Steel, last month, also announced an increase in the current spot market base prices for all carbon flat-rolled steel products by a minimum of $30 per ton. Moreover, the company announced spot increase of carbon steel products by $25 per ton in July. Prior to this, the company hiked prices by $30 per ton in June.

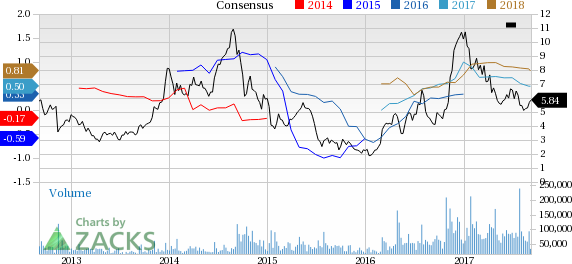

Price Performance

Shares of AK Steel have lost 2.2% of its value in the last three months versus the 17.4% growth of its industry.

Q2 Performance & Outlook

AK Steel topped earnings and sales estimates in second-quarter 2017. The company reported net income of $61.2 million or 19 cents per share, up 253.7% from $17.3 million or 8 cents recorded in the prior-year quarter. Earnings for the quarter surpassed the Zacks Consensus Estimate of 13 cents.

According to AK Steel, the second-quarter performance reflects continued benefits obtained through strategic initiatives implemented over the past one-and-a-half year. The acquisition of Precision Partners will help to strengthen its position as a value-added design and materials solutions provider.

The company expects shipments in the third quarter to be relatively flat compared to the second as higher shipments of the carbon distributing and converting market are expected to be offset by lower automotive shipments. Average selling price in the third quarter is expected to be modestly lower than the second quarter. The expected decline assumes a change in the mix of shipments related to an anticipated reduction in automotive shipments and decline in raw material surcharges.

AK Steel remains focused on expanding its core automotive business. The company is also laying importance on de-emphasizing commoditized products and launching new value-added products.

However, AK Steel remains exposed to weakness in electrical steel pricing in the overseas markets. Prices remain under pressure in the international markets due to global overcapacity. The company expects the global electrical steel market to remain volatile in the near future due to production overcapacity.

Zacks Rank & Stocks to Consider

AK Steel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , Kronos Worldwide Inc (NYSE:KRO) and Smurfit Kappa Group plc (OTC:SMFKY) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemourshas an expected long-term earnings growth rate of 15.5%.

Kronos Worldwide has an expected long-term earnings growth rate of 5%.

Smurfit Kappahas an expected long-term earnings growth rate of 4%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

SMURFIT KAPPA (SMFKY): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Original post

Zacks Investment Research