These days, rapid technological advancements are the hallmark of the modern financial world. In this context, Nvidia (NASDAQ:NVDA)'s significant ascent in the artificial intelligence (AI) sector signals both advancement and cautious optimism. As Nvidia's market valuation reaches unprecedented heights thanks to AI breakthroughs, the scenario begs comparison to historical market cycles, but with one crucial exception. While reminiscent of the speculative frenzy typical of the dot-com bubble, this phenomenon is characterized by its fundamentals built on tangible innovation and solid financial performance.

This article seeks to delineate the fine line between genuine technological progress of AI and speculative investment, asking whether the current enthusiasm is the dawn of a new technological era or a reflection of past financial exuberance in a new guise.

Nvidia's Definitive Edge in the AI Market Expansion

In the contemporary tapestry of technological advancement, Nvidia has emerged as a cornerstone of the AI revolution, marking a significant departure from the speculative dynamics of the dot-com era.

Nvidia's transition from a specialized graphics processor manufacturer to a pivotal figure in AI has redefined its market trajectory and financial performance. The company reported an exponential 206% year-over-year increase in its third-quarter revenue for 2024, reaching $18.12 billion, with net income escalating to $9.243 billion. The momentum continued unabated into the fourth quarter, with revenue surging to $22.1 billion, marking a 265% increase from the preceding year. Such financial milestones underscore Nvidia's lucrative exploitation of the AI boom, setting it apart from the ephemeral successes of the dot-com bubble's protagonists.

The strategic foresight of Nvidia is evident in its expansion into the custom AI chips market, targeting a burgeoning $30 billion sector and securing its position as an indispensable ally to tech behemoths like Amazon (NASDAQ:AMZN), Meta (NASDAQ:META), and Google (NASDAQ:GOOGL). This diversification consolidates Nvidia's dominance in AI and reflects its ambition to spearhead the revolution across multiple domains. As a result, Nvidia's market capitalization has catapulted beyond the $2 trillion mark, positioning it as the third most valuable company on Wall Street.

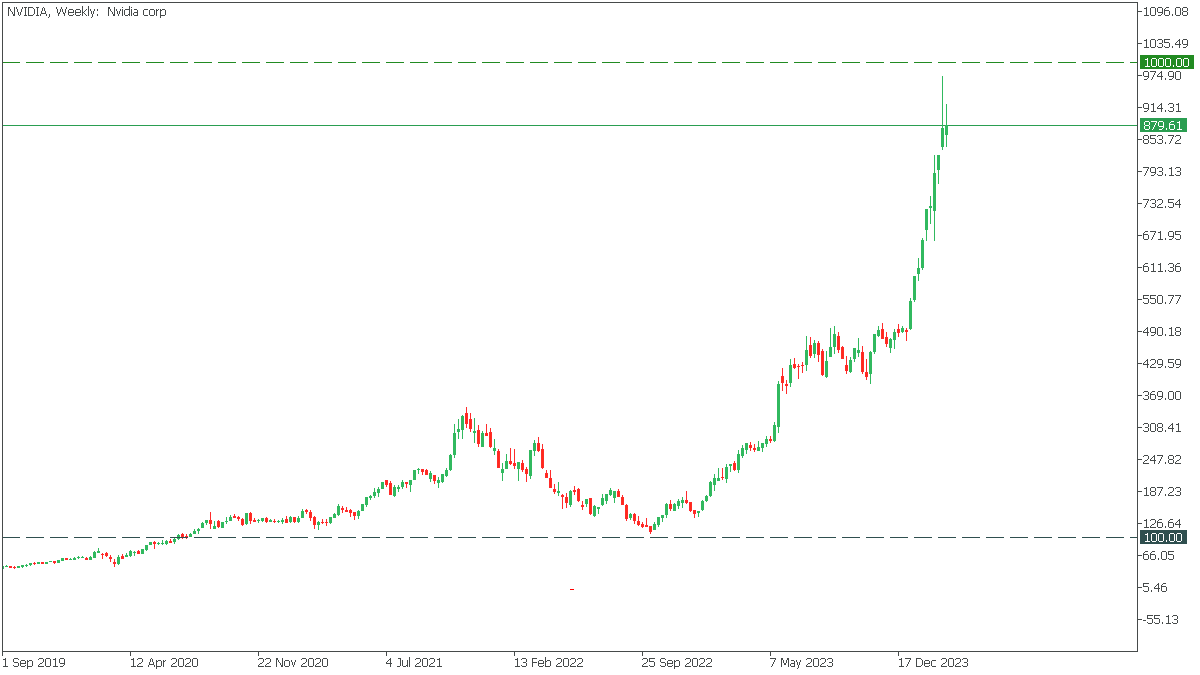

Nvidia, Weekly Timeframe

Nvidia's rise has not only marked it as a standout performer but also significantly swayed vital indexes like the S&P 500, to which it contributed more than a quarter of the 4% gain recorded earlier this year, leading to record highs for the index.

While reminiscent of the dot-com era's speculative exuberance, the current enthusiasm surrounding Nvidia and the broader AI market fundamentally differs. Investments in ventures with unproven models and uncertain futures marked the dot-com bubble. In contrast, today's market is buoyed by innovations with precise applications and robust financials, reflecting a more mature and discerning investment landscape. However, the potential for speculative excess remains, particularly with the prospect of Federal Reserve rate cuts.

The AI Surge vs. The Dot-Com Bubble

The trajectory of Nvidia amidst the burgeoning AI revolution contrasts the speculative environment of the dot-com era, particularly when examining critical financial metrics and market dynamics.

With revenue reaching $18.12 billion and net income ballooning to $9.243 billion, Nvidia's financial milestones in fiscal 2024 underscore a sustainable growth model. This era, defined by speculative investment in internet startups with scant revenue or viable business models, is a far cry from today's market. AI-driven companies like Nvidia are evaluated based on substantial technological advancements, solid earnings, and expansive market applications.

A critical metric illuminating this distinction is the Nasdaq 100's forward price-to-earnings (P/E) ratio, which serves as a bellwether for market valuations. This ratio reached astronomical levels during the dot-com era, reflecting widespread speculative investment disconnected from fundamental company performance. In contrast, today's tech sector, despite its robust valuations, showcases more grounded P/E ratios, indicating a market that, while enthusiastic about AI's potential, remains anchored in financial realities. Nvidia's valuation, for example, reflects not only its current financial success but also the broader recognition of AI's transformative impact across industries.

Source: Morningstar.com, Nvidia 2023 vs Cisco (NASDAQ:CSCO) 1999: Will History Repeat?

Comparing Cisco's dot-com era trajectory with Nvidia's current path further highlights the evolution of market dynamics. Cisco, emblematic of the internet infrastructure boom, experienced a dramatic valuation surge that could not withstand the bubble's burst. Nvidia, however, represents a different paradigm—its growth is driven by the tangible application of AI technologies across diverse sectors, suggesting a more stable foundation for its market valuation.

Moreover, the nuances of today's market are shaped by various macroeconomic factors, including interest rates and monetary policy, which significantly shape investor sentiment and valuations.

In fact, comparing the AI surge to the dot-com bubble shows that the market has learned lessons from the past, and investment is now focused on better understanding the fundamental value and transformational potential of technologies such as AI.

Navigating the 2024 AI and Tech Market Boom

The convergence of AI innovation with strategic market trading marks the arrival of a new phase. 2024 is a watershed moment, driven by authoritative forecasts and the increasing role of artificial intelligence and technology, heralding growth and dynamism. As always, it is essential to understand what to target, how to trade, and which strategies to apply as relevant and opinionated.

Advanced strategies for dominating the AI market

● Diversify investments into AI-impacted areas;

● Use analytical tools, such as moving averages and RSI, to manage price volatility in the AI sector by marking strategic entry and exit points;

● Combine indicators and use moving average crossover and RSI for trend trading, Bollinger Bands, and MACD to identify entry/exit points and Fibonacci levels to establish support and resistance;

● Consider long-term investment into companies doing severe AI research and development and having a clear AI strategy (e.g., Nvidia).

The stock market outlook for 2024 depends on various factors, including the Federal Reserve's expected rate adjustment to a robust economy and breakthroughs in artificial intelligence and technology. Industry luminaries are predicting a bull market, with figures such as InvestorPlace's Luke Lango predicting the S&P 500 to rise at least 15%. This sentiment is bolstered by experts at Fidelity, who believe Fed rate cuts and earnings growth will sustain the bull market.

AI and technology stocks and significantly advanced companies like Nvidia are expected to lead the market's expansion. The AI technology sector remains the focus of Wall Street's attention, paralleling the initial burst of a boom similar to the dot-com era, albeit based on more remarkable growth and profitability. In this context, the intricate market dynamics can be anticipated.

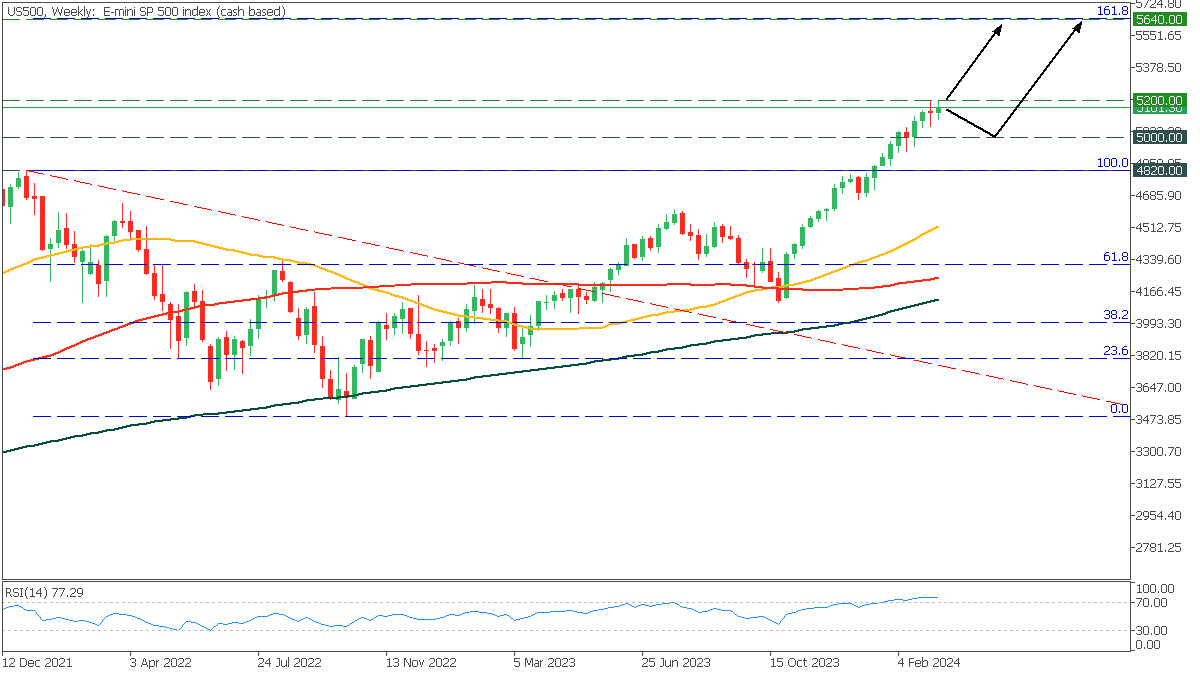

US500, Weekly Timeframe

Upon examination of the weekly chart of the S&P 500, it is evident that the prevailing trend is bullish, with sustained growth observed over five months. Now, the price is close to the psychological mark of 5,200. RSI signals overbought, but the moving averages show the continuation of the bullish movement. If the price bounces off the 5,200 resistance, it could fall to 5,000 support and soar to 5,640. In the event that the S&P 500 surpasses the 5,200 threshold, it may rally straight to 161.8 Fibonacci.

Major banks’ outlook on the 2024 growth

● Barclays predicts a year marked by uncertainty, with global growth expected to slow down to 2.4%, a decrease from the previous year's 3%. Inflation is anticipated to ease to 2.7%, reflecting the effects of tighter monetary policies.

● Goldman Sachs offers a positive outlook, forecasting robust global economic growth at 2.6%. The US is expected to lead this growth with a rate of 2.1%, buoyed by a slowdown in inflation and a strong job market.

● Morgan Stanley emphasizes caution, especially regarding US corporate earnings, which might not see the rapid profit re-acceleration expected by some. The firm highlights ongoing inflation and persistently high-interest rates as critical challenges that could dampen consumer demand and corporate profitability.

● J.P. Morgan expects a challenging year for equities, predicting only modest S&P 500 earnings growth between 2% and 3%. The firm advises caution in the face of high valuations and geopolitical tensions.

The AI and technology market is experiencing a significant boom driven by AI innovation and strategic market insight. Despite mixed economic forecasts from major banks, this sector remains one of the growth centers, focusing on the possibility of a continued bullish trend in the major indices.

Conclusion

The AI boom fundamentally diverges from the dot-com bubble by being rooted in substantial technological advancements and financial achievements. Unlike the speculative investments of the dot-com era, today's AI sector showcases companies backed by solid revenue, groundbreaking innovation, and clear business models. Nvidia stands as one of the foremost examples. This shift indicates a mature market where growth is driven by actual performance and the practical application of technology.

Furthermore, the widespread integration of AI across various industries highlights its enduring value, contrasting with the transient nature of many dot-com investments. AI's profound impact on healthcare, finance, and automotive sectors underlines its role as a cornerstone of future development, not just a fleeting trend. This enduring presence suggests that the AI boom represents a new era of technology investment focused on sustainable growth and long-term innovation.

***

Traders and investors should be aware of the key market milestones and the consequences for the future economy. Using FBS, traders can benefit from rising and falling markets. The company offers over five hundred fifty trading instruments to build trading strategies on.

Disclosure: FBS is an international brand present in over 150 countries. Independent companies united by the FBS brand are devoted to their clients and offer them opportunities to trade Margin FX and CFDs. FBS Markets Inc. – Belize FSC 000102/6, Tradestone Ltd. – CySEC license number 331/17, Intelligent Financial Markets Pty Ltd – ASIC License number 426359.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AI's Market Revolution: Beyond the Dot-Com Shadows

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.