The Zacks Airline industry consists of companies engaged in the transport of passengers and cargo to various destinations globally. Most operators maintain a fleet comprising multiple mainline jets in addition to several regional planes. They operate with the help of their regional airline subsidiaries and third-party regional carriers. The industry participants utilize their respective cargo divisions for providing a wide range of freight and mail services.

The space includes legacy carriers like American Airlines (AAL), low-cost players like Southwest Airlines (NYSE:LUV) (LUV) and regional operators like SkyWest (SKYW). Within the low-cost segment, there are ultra low-cost carriers like Spirit Airlines (SAVE).

Let’s take a look at the industry’s three major themes:

- The airline industry is benefiting from strong demand for air travel. Affordable air fares along with a much-improved job market and rising disposable income have provided consumers an added incentive to opt for air travel. The International Air Transport Association (“IATA”) expects 4.59 billion passengers to take to the skies in 2019, reflecting a year-over-year increase of 5.8%. Average net profit per departing passenger is expected to go up to $7.75 from $7.45 in 2018. Furthermore, net profit in the aviation space is expected to go up to $35.5 billion in 2019 from $32.3 billion estimated for 2018.

- The current tax law, which came into effect in late 2017, is a huge positive for the airline industry. A considerably lower corporate tax rate has boosted cash flow and improved the bottom line of carriers. Huge savings owing to the reduction in corporate tax rate has enabled companies to fund their capital expenditures, acquisitions and share repurchases, among others. Shareholder-friendly activities apart, lower tax related outflow of most carriers have enabled them to undertake employee-friendly activities such as profit sharing. Carriers like SkyWest and Alaska Air (ALK) have already increased their dividend payouts. More dividend hikes are expected during the course of the year.

- With oil prices declining in excess of 20% from the highs of $76 a barrel touched in October 2018 levels, operating expenses of airlines have decreased. As fuel is a major component of operating expenses for carriers, the reduction supports bottom-line growth. In fact, in December 2018, the IATA predicted that average fuel cost in 2019 will be around $65 per barrel (Brent crude price) compared with average fuel cost of $73 per barrel in 2018. Average cost of jet fuel price is predicted to be $81.3 per barrel in 2019 compared with $87.6 per barrel in 2018.

Zacks Industry Rank Indicates Sunny Outlook

The Zacks Airline industry is a 27-stock group within the broader Zacks Transportation sector. The industry currently carries a Zacks Industry Rank #28, which places it in the top 11% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gaining confidence in this group’s earnings growth potential. Since the end of October 2018, the industry’s earnings estimate for the current year has increased more than 11%.

Before we present a few stocks that you may want to consider, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags Sector & S&P 500

The Zacks Airline industry has lagged the broader Zacks Transportation Sector as well as the Zacks S&P 500 composite over the past year.

The industry has declined 21.5% over this period compared with the broader sector’s decrease of 4.8%. The S&P 500 has increased 7.5% in the said time frame.

One-Year Price Performance

Industry’s Current Valuation

On the basis of trailing 12-month enterprise value-to EBITDA (EV/EBITDA), which is a commonly used multiple for valuing airline stocks, the industry is currently trading at 6X compared with the S&P 500’s 10.84X. It is also below the sector’s trailing-12-month EV/EBITDA of 7.66X.

Over the past five years, the industry has traded as high as 15.78X, as low as 4.31X and at the median of 6X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

Bottom Line

The near-term prospects of the airline industry appear to be encouraging due to the uptick in passenger revenues on the back of strong demand for air travel. In fact, air travel demand is likely to remain strong in the long term as well. IATA expects 8.2 billion passengers to take the sky route by 2037. The forecast indicates a 3.5% compound annual growth rate (CAGR).

Decline in oil prices and low tax rates also bode well for the sector participants. However, with labor deals in vogue in the airline space labor costs are expected to limit bottom-line growth going forward. Capacity-related woes are also a challenge for the industry.

Here, we present three stocks that either have a Zacks Rank #1 (Strong Buy) or Rank 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

These stocks are well positioned to grow this year.

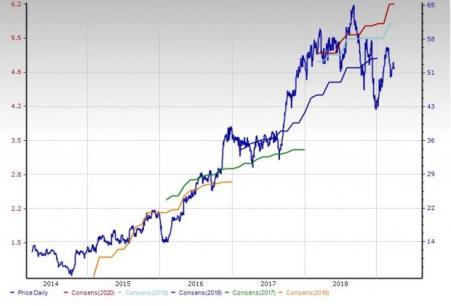

SkyWest, based in St. George, UT,operates a regional airline in the United States. The Zacks Consensus Estimate for its current-year earnings has moved up 5.1% in the past 60 days. The Zacks #1 company has an expected earnings growth rate of 9.1% for 2019.

Price and Consensus: SKYW

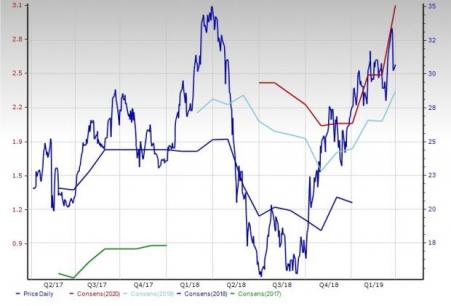

Azul (AZUL) is one of the largest airlines in Brazil in terms of departures and destinations covered. The Zacks Consensus Estimate for its current-year earnings has moved up 26.1% in the past 60 days. The Zacks #1 company has an expected earnings growth rate of 42.8% for 2019.

Price and Consensus: AZUL

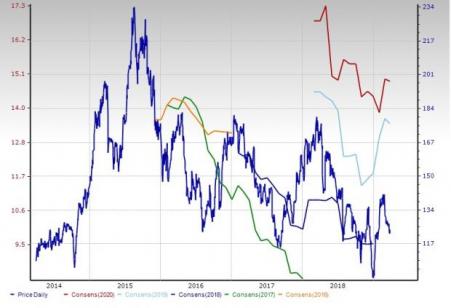

Allegiant Travel Company (ALGT), based in Las Vegas, NV, operates a low-cost passenger airline through its subsidiary Allegiant Air. The Zacks Consensus Estimate for its current-year earnings has moved up 3.9% in the past 60 days. The Zacks #2 company has an expected earnings growth rate of 34.5% for 2019.

Price and Consensus: ALGT

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

Southwest Airlines Co. (LUV): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

Allegiant Travel Company (ALGT): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

Original post