Hello, Slopers, from your airborne host. I am seven miles above the planet again, heading back to my beloved Palo Alto after a week-long vacation. It was a successful trip – – silver medal in hand, and plenty of good memories – – but, rut-loving creature that I am, I am eager to get back to my home office and return to my incredibly boring old self.

I have a big essay in my head I want to write on the plane, which I suspect I’ll publish Monday after the close, but in the meantime, I’ll just do a quickie post about the markets as they stand here on Sunday evening.

First up is the bond futures, which I am long by way of a big iShares 20+ Year Treasury Bond (NASDAQ:TLT) position I entered early on Friday. So far, so good on this. This intraday chart doesn’t really show you why I bought them, but as the dollar continues to whither away, and Trump keeps screwing up left, right, and sideways, I have a feeling that the steady procession of interest rates higher simply isn’t going to happen.

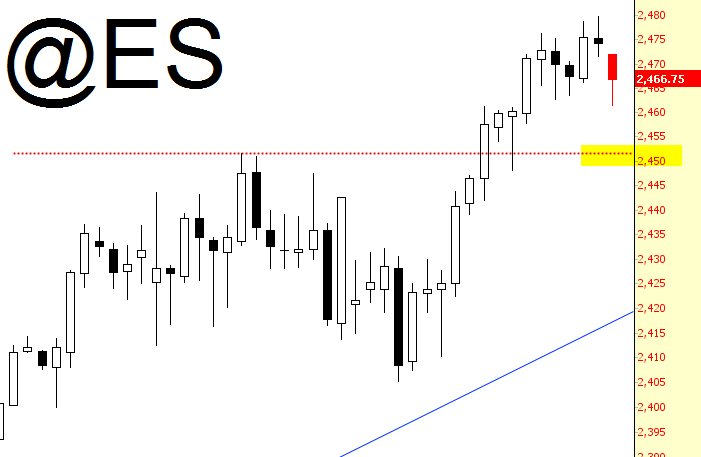

Equities are collapsing in a magnificent 0.18% crash at the moment on both the ES……..

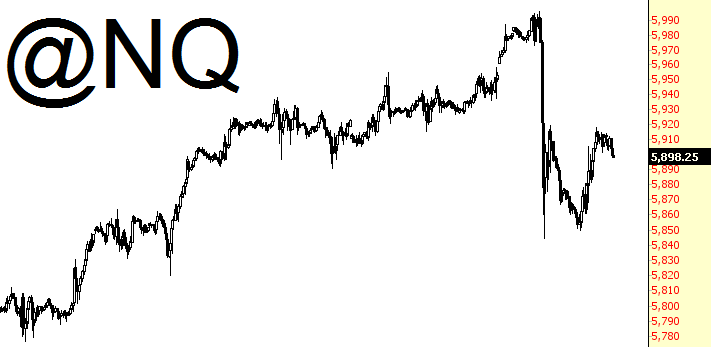

…..as well as the NQ……….

The ES chart being a daily, and the NQ chart being an intraday. Seriously, though, the NQ is looking somewhat vulnerable (although even I was surprised the latter was able to erase its entire Amazon.com Inc (NASDAQ:AMZN) mini-crash so effectively).

Slope will be returning to its normal rhythm and pulse now that I’m heading back to my home base. Hopefully August will bring us more cheer than freakin’ July did.