Air Products and Chemicals, Inc. (NYSE:APD) has landed a deal to form a $1.3 billion joint venture (JV) with Lu'An Clean Energy Company. The new JV, to be called Air Products Lu'an (Changzhi) Co., Ltd., will broaden Air Products' scope of supply catering Lu'An Mining (Group) Co., Ltd.'s syngas-to-liquids production in Changzhi City, Shanxi Province, China. The agreement is subject to government and regulatory approval.

Air Products has invested $300 million to construct, own and operate four large air separation units (ASUs) to supply the facility in Changzhi City. Under the new deal, Air Products will further invest $500 million for a 60% ownership in the new JV and will also contribute the ASUs. The company, with this majority stake, will fully consolidate the financial results of the JV.

On the other hand, Lu'An will get $500 million of cash and will have a 40% ownership in the JV. It will also contribute the gasification and syngas clean-up system.

The JV will own and operate the ASUs and gasification and syngas clean-up system and will receive coal, steam and power from Lu'An. It will supply syngas to Lu'An under a long-term contract.

Air Products noted that the JV is in sync with its strategy of deploying its cash to grow by acquiring existing assets and broadening its scope of supply to include syngas.

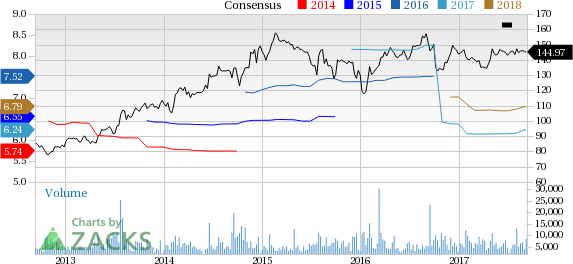

Air Products’ shares have moved up around 5.1% over the last six months, modestly underperforming the roughly 5.7% gain recorded by the industry it belongs to.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. Acquisitions and new business wins are also expected to continue to drive results. Moreover, the company has built a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years.

Air Products, in July 2017, inked a long-term gas supply agreement with Huntsman (NYSE:HUN) . Under the deal, Air Products will build, own and operate a new steam methane reformer and cold box in Geismar, LA. Air Products facilities which will supply hydrogen, carbon monoxide and steam to Huntsman's Geismar operations are expected to be onstream in January 2020. The new state-of-the-art facility will provide high reliability and sustainability with enhanced energy efficiency and will help to lower emissions.

Air Products also remains on track in delivering on its cost reduction programs, which should support its margins. The company is progressing well with its $600 million cost-cutting program.

Moreover, Air Products has significant amount of cash to invest in its core industrial gases business. The company expects to have roughly $8 billion to deploy in strategic, high-return opportunities (including acquisitions and large industrial gases projects) to create shareholders value over the next three years.

Air Products is a Zacks Rank #2 (Buy) stock.

Other Stocks to Consider

Other stocks worth considering in the basic materials space include The Chemours Company (NYSE:CC) and Kronos Worldwide Inc (NYSE:KRO) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has expected long-term earnings growth rate of 15.5%.

Kronos Worldwide has expected long-term earnings growth rate of 5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research