Air Products (NYSE:APD) announced that its latest oxy-fuel burner, Cleanfire ThruPorte, allows glass makers to avoid downtime during regenerator repairs and sustain full production in old furnaces. It is a cost-effective, rapid heating solution that is installed underneath an existing furnace port to supply heat, as per requirement.

According to Air Products, the patented water-cooled ThruPorte burner can mix fuel and primary oxygen in the right proportion, either fuel oil or natural gas, to produce highly luminous oxy-fuel flame. Its unique configuration ensures optimal heat distribution and surface coverage by adjusting the flame angle and length through introduction of staged oxygen.

Glass applications engineer at Air Products, Bill Horan, explained that aging equipment can reduce pull rate and shorten furnace campaign, resulting in loss of tens of thousands of dollars per day. ThruPorte burner’s durable design enables it to be easily installed while the furnace is running. It also offers glass makers a fast and safe solution for restoring furnaces to full production.

The company recently installed this unique burner solution at two float glass plants. This led to the achievement of full production at the plants and helped to substantially increase the energy efficiency relative to baseline operations.

Air Products’ new ThruPorte burner is in line with its vision of developing the Industrial Internet of Things (IIoT) by deploying smart burner technology.

The latest burner is also available with the option of wireless communications technology and state-of-the-art on-burner diagnostic sensors, which enables instant screening and tracking of key burner operating parameters. The data can be securely and conveniently streamed from the on-burner transmitters to remote computers, control room or other smart devices, providing updated alerts and information.

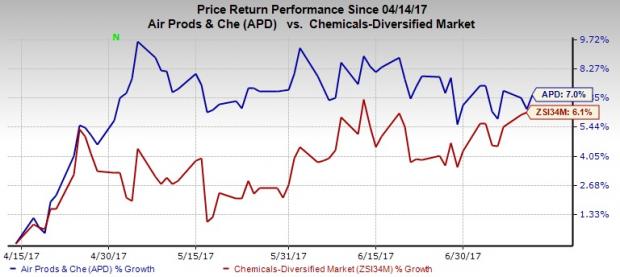

Air Products has outperformed the Zacks categorized Chemicals-Diversified industry in the last three months. The company’s shares have moved up around 7% during this period compared with the industry's gain of approximately 6.1%.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. The company has a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years. Acquisitions and new business wins are expected to continue to drive results. The company is also progressing well with its $600 million cost-cutting program.

However, the company’s industrial gases business in the Europe, Middle East and Africa (EMEA) region is seeing pressure from a weak operating environment. The company is also seeing lower volumes in Latin America due to weak demand. Moreover, volumes in packaged gases continue to be weak while LNG sales remain under pressure due to low project activity. The company is also exposed to currency headwinds.

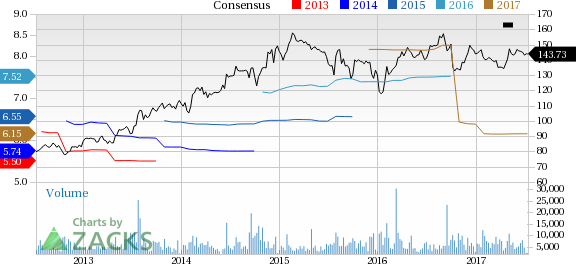

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium S.A. has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research