Market Brief

RBA cuts rates to depreciate AUD

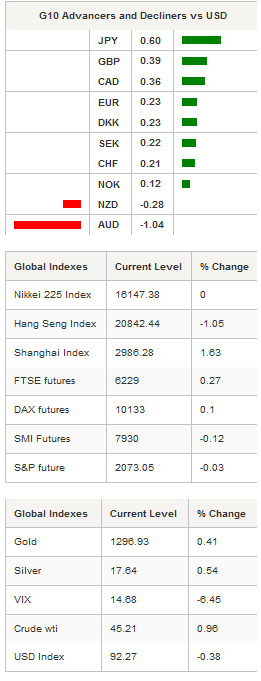

Financial markets continued to exhibit classic risk-on behavior in the Asian session, with indications that the risk appetite will remain in the European session. Part of the buy was driven by new evidence that central banks are committed to accommodating policies as the RBA cuts benchmark interest rates. Asian regional equities indices were higher with the reopened Shanghai composite rising 1.60% and ASX climbing 1.94% (supported by the RBA cut). In the FX market, the USD extended its losses following the dovish FOMC meeting and weak manufacturing ISM headline data added to worries of growth deceleration. Yesterday's read suggests that any positive US manufacturing support has received from the weak USD was offset by the slowing international backdrop. EUR/USD has now safely cleared 2016 highs at 1.1465 with traders targeting 1.1714. Steady USD/JPY selling pushed the pair down to 105.81, with traders seemingly unfazed by BoJ intervention threats. BOJ Governor Kuroda is again using any public appearance to warn that the JPY strength could derail Japan’s economic recovery and that the BoJ will intervene if necessary. But gone are the days when a BoJ sabre rattling would have traders rushing towards the exits! The reality of market conditions, combined with the erosion of the BoJ's credibility has a limited impact on traders' fears of any kind of a knockout blow.

In a minor twist, the Australia central bank cut its cash rates 25bps to a record low of 1.75%. Trader’s confidence in a RBA rate cut has increased following the massive downward surprise of the Q1 CPI read. AUD/USD collapsed to 0.7572 from 0.7720 on the news. The move shifts the near term focus from unemployment to fighting disinflation, utilizing the AUD as a primary tool. The RBA reiterated that “an appreciating exchange rate could complicate” any economic transient. Given the slow pace of growth and low contribution by wage growth, currency deprecation will have to do the bulk of the heavy lifting to reach the RBA inflation targets. Given this shift in focus, the RBA will need to generate further weakening of the AUD to get the inflation boost they desire (indicating another 25bp cut is expected). Our call for short AUD/JPY received a solid push towards 78.00 from the event.

In China, Caixin Manufacturing PMI weakened to 49.4 in May from 49.7 in April, softer than market expectations and marking a 14th month of contraction. The data indicated that softness in labor markets and exports continue. Yet, the negative data failed to influence markets. PBoC set the USD/CNY mid-Point at 6.4565.

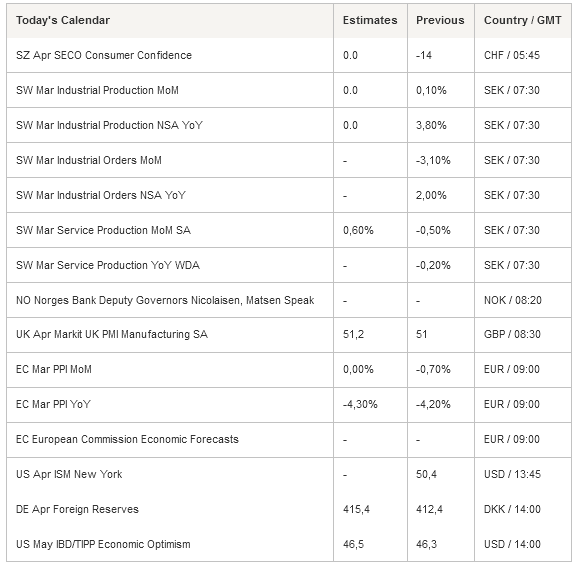

Very light economic calendar will keep trading subdued. In Switzerland we will get Consumer confidence, expected to continue at -14, UK PMI manufacturing expected at 51.2 and EU producer prices, expected at -4.3%. For the UK, April manufacturing PMI - we are slightly more negative than the market despite an upwards revision to the Eurozone read. Slowing GDP growth and slipover from Brexit fears should send the read marginally lower.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBP/USD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USD/JPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259