Upcoming US Events for Today:- Employment Situation report for April will be released at 8:30am. The market expects Non-Farm Payrolls to increase by 215,000 versus 192,000 previous. Private Payrolls are expected to increase by 213,000 versus 192,000 previous. The Unemployment Rate is expected to tick lower to 6.6% versus 6.7% previous.

- Factory Orders for March will be released at 10:00am. The market expects a month-over-month increase of 1.4% versus an increase of 1.6% previous.

Upcoming International Events for Today:

- German Manufacturing PMI for April will be released at 3:55am EST. The market expects 54.2 versus 53.7 previous.

- Euro-Zone Manufacturing PMI for April will be released at 4:00am EST. The market expects 53.3 versus 53.0 previous.

- Great Britain Construction PMI for April will be released at 4:30am EST. The market expects 62.2 versus 62.5 previous.

- Euro-Zone Unemployment Rate for March will be released at 5:00am. The market expects 11.9%, consistent with the previous report.

- China Non-Manufacturing PMI for April will be released at 9:00pm EST.

The Markets

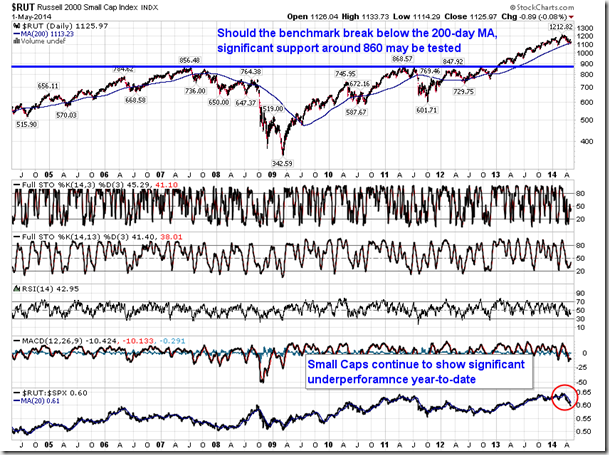

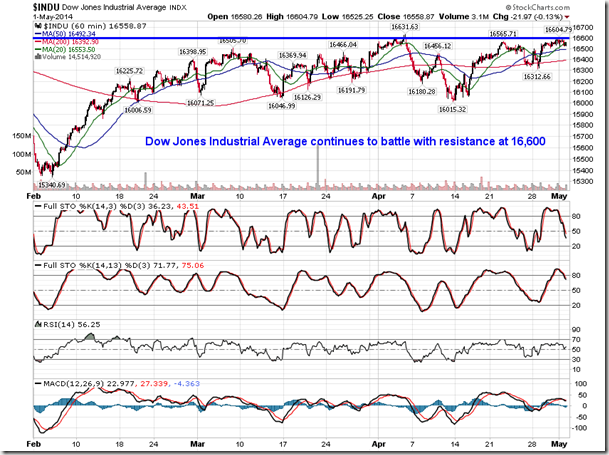

Stocks ended mixed on Thursday as investors wait for the always important employment report for the month of April. The S&P 500 held around resistance at 1885, while the Dow Jones Industrials Average held around resistance at 16,600. The tone on the session suggested risk aversion with Utilities, Telecom, and REITs topping the leaderboard, while cyclical sectors, such as Materials, Energy, and Industrials, traded lower. One important gauge of risk, the Russel 2000 Small Cap Index, continues to significantly underperform the broad market as investors seek to reduce portfolio beta around the present equity market highs. The Small Cap index is holding around the 200-day moving average, a level that hasn’t been tested since late 2012; the long-term average continues to point higher, suggesting that the long-term trend remains positive. A break below the 200-day could lead to a test of significant support around 860, the 2007 and 2011 peaks from which the benchmark broke above in 2013. A retrace back to significant levels of support, such as this, is a typical occurrence, allowing for renewed buying opportunities.

Meanwhile, with employment report day upon us, perhaps the most important chart to watch is the US Dollar Index. The currency index is reaching the peak of a descending triangle pattern, typically a continuation pattern that would suggest further declines should the currency break below support at 79; declining trendline resistance is currently just above 80. While the index remains below resistance and above support, a break in either direction remains equally probable, the impact of which would likely define the intermediate trend of the currency. A breakdown below 79 would likely fuel strength within the equity markets as assets priced in the currency become cheaper to foreigners; the opposite would be expected if the currency benchmark breaks above resistance around 80. Seasonal tendencies for the US Dollar index during the month of May are typically positive with 60% of periods showing gains.

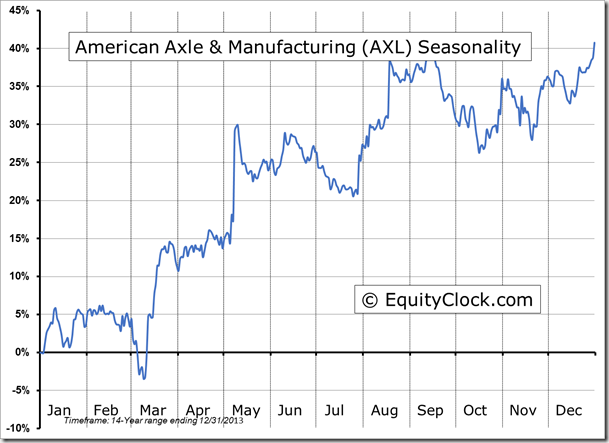

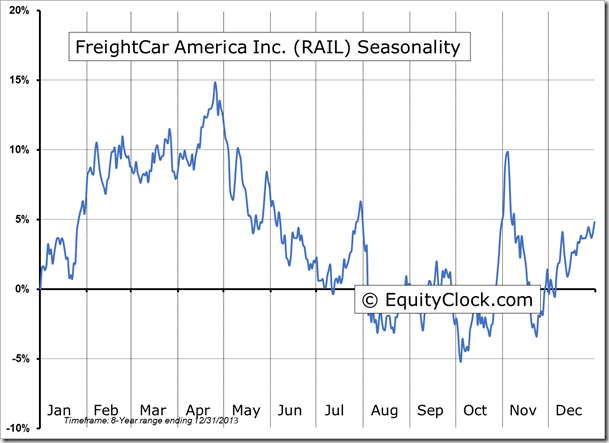

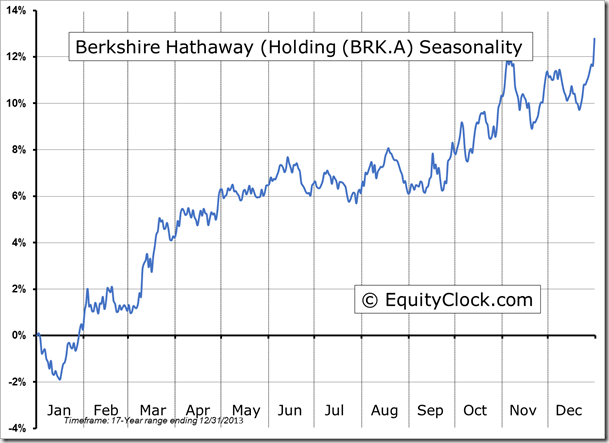

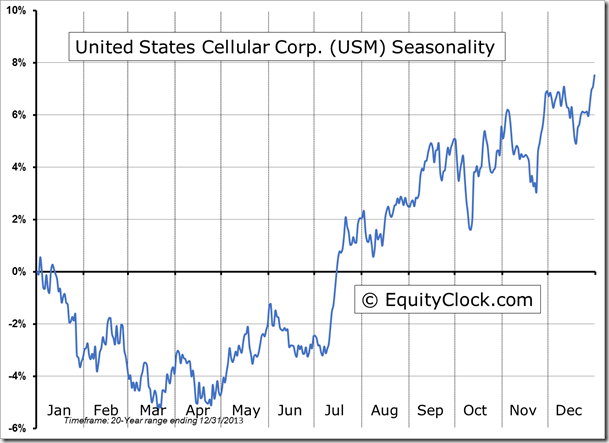

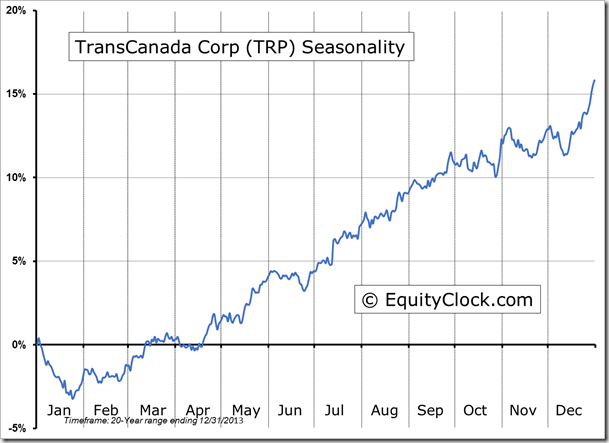

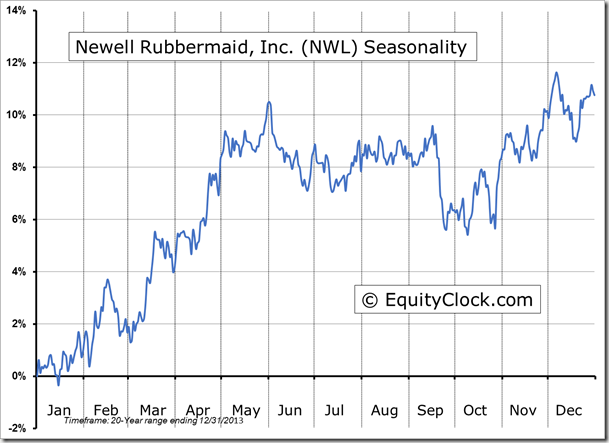

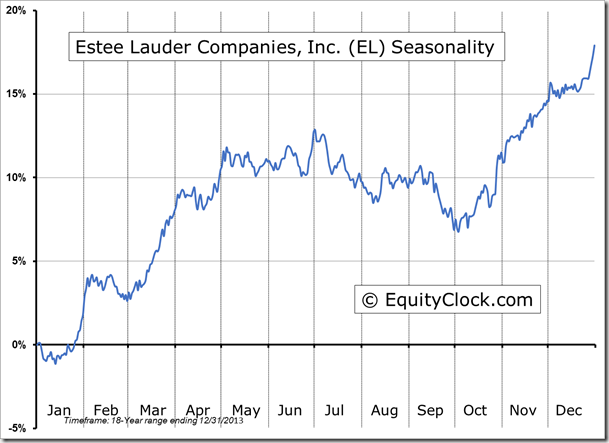

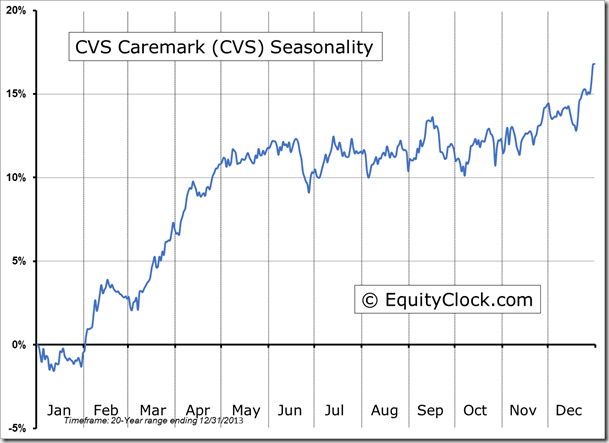

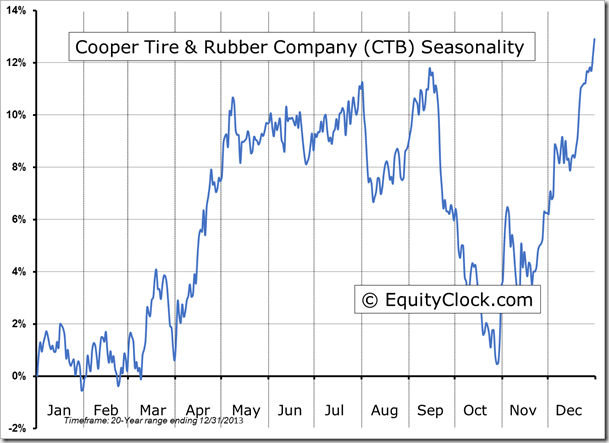

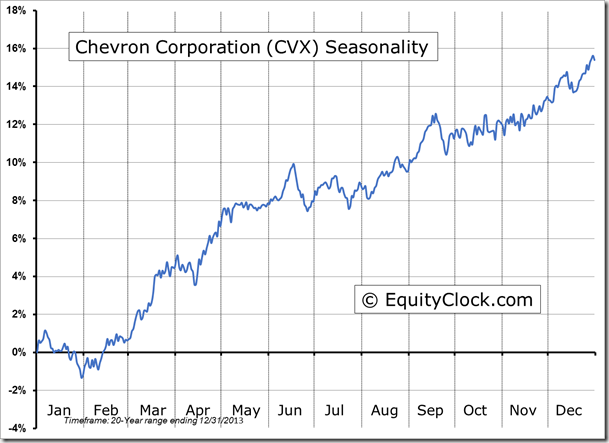

Seasonal charts of companies reporting earnings today:

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.81.

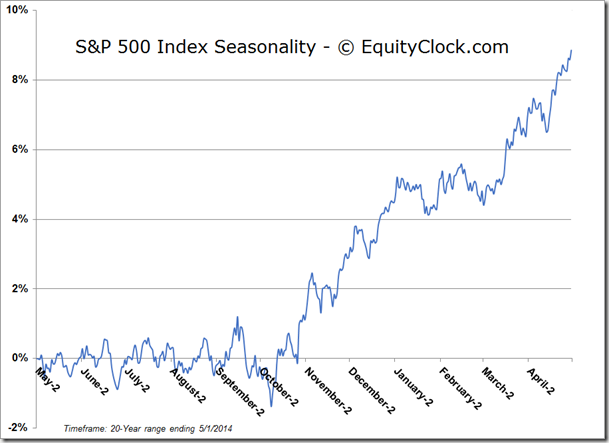

S&P 500 Index

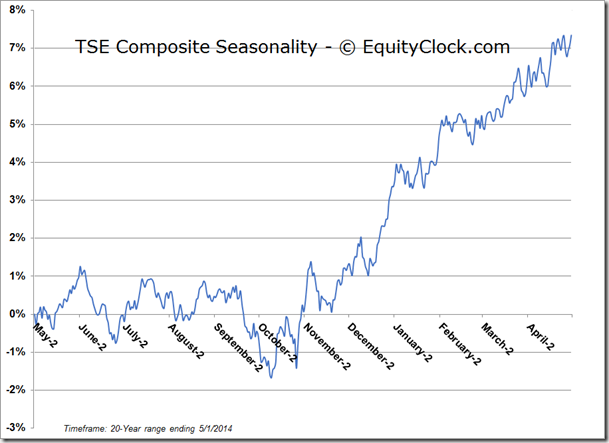

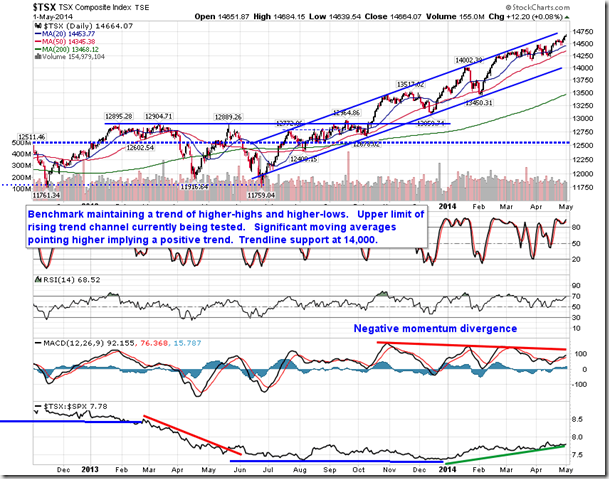

TSE Composite

Horizons Seasonal Rotation (HAC.TO) ETF

- Closing Market Value: $14.60 (down 0.14%)

- Closing NAV/Unit: $14.60 (down 0.21%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.10% | 46.0% |

* performance calculated on Closing NAV/Unit as provided by custodian