Los Angeles-based engineering behemoth, AECOM (NYSE:ACM) recently announced that it has clinched an award from South Carolina Ports Authority (“SCPA”). The design contract, worth $11 million, requires AECOM to provide design services for the new Hugh K. Leatherman, Sr. Container Terminal.

Per the terms, AECOM will look into “permitting and engineering design” for the Port of Charleston-based terminal, which include making of pavements, roadways, wharf structures, storm drainage, communications infrastructure, security and operations.

Touted as one of North America’s most advanced, the container terminal will allow Port of Charleston to handle rising containerized cargo volumes in a cost-effective manner. AECOM believes that its profound global ports and marine experience will allow it to complete the work in less time and cost.

AECOM’s diversified portfolio comprises both designing and construction services. In addition, the company’s business is spread across a number of key markets that mitigate operating risks. More than 70% of AECOM’s profits are generated from infrastructure and defense markets that are poised to benefit from the favorable political climate both in the U.S. and abroad. The global consensus toward the need for substantial infrastructure investments is expected to act as primary growth driver.

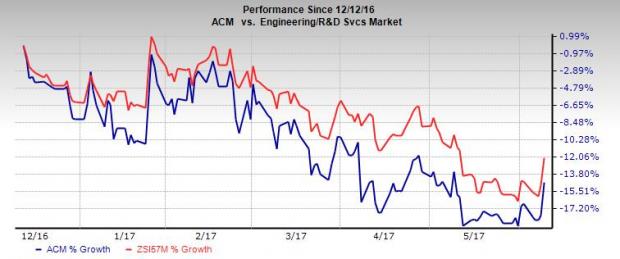

Despite the positives, the stock has had an unimpressive run on the bourse over the last six months. AECOM’s shares have lost 14.6% during the period, steeper than the Zacks categorized Engineering/R&D Services industry’s average decline of 12.1%. Volatility in the oil and gas market, with declining prices and contracting spending levels, has been hurting the company’s projects and orders.

Moreover, cyclical demand of the Zacks Rank #3 (Hold) company’s services and currency fluctuations are likely to thwart growth, going forward. Please note that brokers are on the sidelines for the stock as its earnings estimates for fiscal 2017 have remained unchanged over the last 30 days. The Zacks Consensus Estimate has remained steady at $2.96 over the same time frame.

Stocks to Consider

Some better-ranked stocks in the industry include TopBuild Corp. (NYSE:BLD) , Lennar Corporation (NYSE:LEN) and Weyerhaeuser Co. (NYSE:WY) . While TopBuild sports a Zacks Rank #1 (Strong Buy), Lennar and Weyerhaeuser hold a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TopBuild has a positive average earnings surprise of 6.0% for the last four quarters, having beaten estimates thrice.

Lennar has a stellar earnings surprise history, with an average positive surprise of 8.7%, beating estimates all through.

Weyerhaeuser has an average positive surprise of 1.3%, beating estimates twice for as many misses over the trailing four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

TopBuild Corp. (BLD): Free Stock Analysis Report

Weyerhaeuser Company (WY): Free Stock Analysis Report

Lennar Corporation (LEN): Free Stock Analysis Report

AECOM (ACM): Free Stock Analysis Report

Original post

Zacks Investment Research