The biggest mover of the markets during the session, in our opinion, is going to be the ADP Employment Numbers out of the United States. Because of this, we believe that the market will focus quite a bit on the US stock markets and perhaps the US dollar in general. With that being said, the first market we look at is the S&P 500:

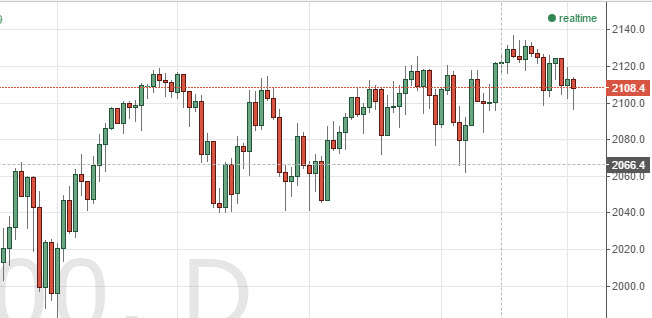

The S&P 500 initially fell during the session on Tuesday, but ended up finding enough support near the 2100 level to turn things back around and form a hammer. This hammer of course signifies that there is plenty of support below, and that we should eventually head back towards the top, which of course is the 2135 handle.

S&P 500 charts

The EUR/USD pair broke much higher during the course of the session on Tuesday, clearing the 1.10 level easily. In fact, we went as high as 1.12 during the session, so now it appears that all we can do is buy calls on pullbacks, as it’s only a matter time before the market starts going higher again. As long as we are above the 1.10 level, we feel that this market should continue to show strength.

Gold markets continue to be “dead money,” but the upcoming jobs number could finally break us out of the range we have been stuck in. In the meantime, expect short-term trades to be the way going forward, with the $1180 level on the bottom, and the $1210 level on the top.