Adobe Systems Incorporated (NASDAQ:ADBE)

Adobe Systems gapped higher in October and then continued to move up. It pulled back after Thanksgiving to the 50-day SMA and then rode the 50-day SMA for a month before making another move higher. A small gap up last week was sold to close the gap and then Friday it started back up again. The RSI is bullish and a bit overbought with the MACD leveling. Look for a new high to participate higher…..

Discover Financial Services (NYSE:DFS)

Discover Financial started higher in September, crossing its 200-day SMA near the end of the month. It pulled back to retest the 200-day SMA twice before riding the 50-day SMA off of it and then leaping higher in December. The run continued to a top in January and then pulled back. It was a shallow pullback and now the price is back at that top with a RSI bullish and rising and a MACD about to cross up. Look for a new high to participate to the upside…..

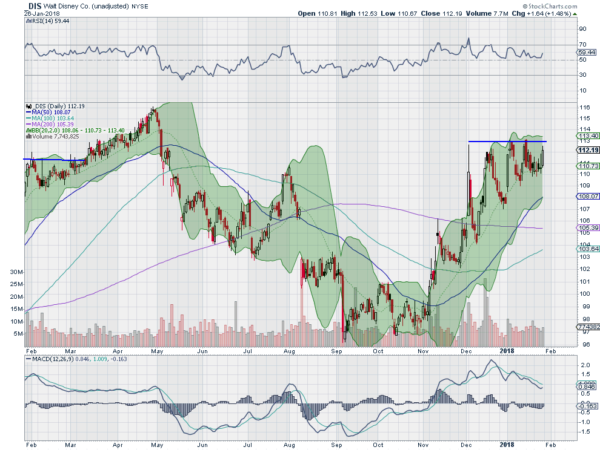

Walt Disney Company (NYSE:DIS)

Walt Disney ran higher in early 2017 to a top at the end of April. The pullback from there retraced nearly 78.6% of the leg higher and found support. It started back higher in November and for the last month has consolidated against resistance. Friday it made it back to that resistance from a higher low as the range tightens fast. The RSI is rising in the bullish range and the MACD is trying to turn up. Look for a push over resistance to participate higher…..

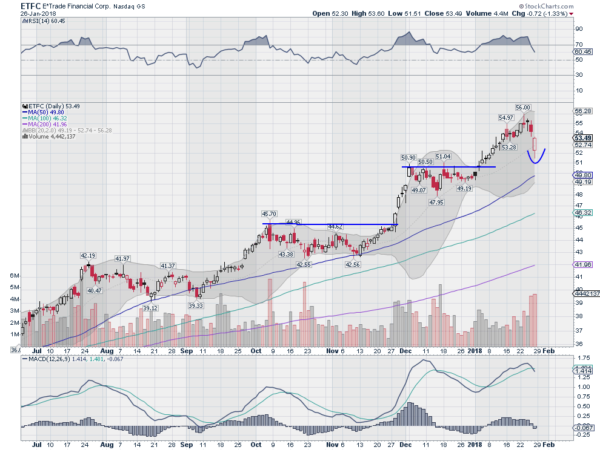

E-TRADE Financial Corporation (NASDAQ:ETFC)

E*TRADE was a big winner in the top 10 when it broke higher at the end of November. It consolidated at 50, the round number, for a month after that before another move to the upside and a top last week. It reported earnings last Thursday and took a hit to the stock price Friday. But the price action was bullish intraday, printing a hollow red candle. The RSI has reset lower out of technically overbought territory and the MACD has crossed down. Look for a follow through day to the upside Monday to participate higher…..

Great Plains Energy Inc. (NYSE:GXP)

Great Plains Energy had a solid run higher in 2017. Over 3 moves, it ran from a low of 27 to a high over 34.50. The pullback that started in December continued until it reached the 200-day SMA again and then it found support. It has held there consolidating since. It ended last week at the top of the consolidation range and over the 20-day SMA for the first time since the move down started. The RSI is now rising and the MACD has crossed up. Look for a move over resistance to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday, which heading into the last days of January sees equity markets continue to drive higher and running hot.

Elsewhere begins look for gold to continue in its uptrend while crude oil drives higher as well. The US Dollar Index continues to look weak and better to the downside while US Treasuries are biased lower in consolidation. The Shanghai Composite and Emerging Markets are poised to continue to make new highs.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts continue to show the SPY the most overheated with the QQQ only moderately so, and the IWM ready to take the reigns and lead the markets. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.