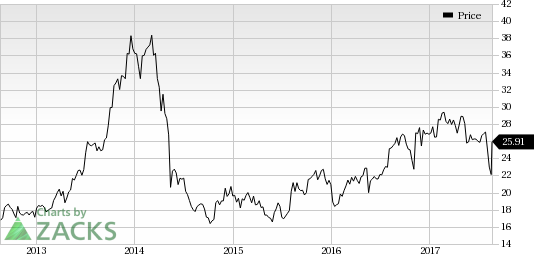

Shares of Acxiom Corp. (NASDAQ:ACXM) touched a new 52-week low during trading session on Aug 18. The company’s stock fell to as low as $22.03, eventually closing at $22.10.

Notably, Acxiom's shares have lost 17.5% year to date, against the industry’s gain of 18.4%.

Estimates Going South

Further, the company has witnessed negative earnings estimate revisions for the current quarter as well as the current year over the past 30 days.

The Zacks Consensus Estimate for the second-quarter fell 3 cents to 16 cents, while the full-year estimate fell by a penny to 81 cents. The declining trend can be primarily attributed to the disappointing first-quarter fiscal 2018 results (announced earlier this month).

Acxiom reported non-GAAP earnings of 3 cents per share, which missed the Zacks Consensus Estimate by 4 cents. Revenues of $212.5 million also declined 1% from the year-ago quarter and lagged the Zacks Consensus Estimate of $217 million.

Following the unimpressive quarterly earnings results, the company provided a downbeat forecast for fiscal 2018. Management now expects slower bookings in its Marketing Services business segment.

Further, management anticipates pricing model changes in its Audience Solutions segment to hurt top-line growth.

Diminished Profitability in Competitive Landscape

Acxiom operates in the highly competitive and broad industry of data analytics that is becoming more complex with low barriers to entry. This has led to increased price competition, negatively affecting its business. Competition from the likes of Microsoft (NASDAQ:MSFT) , Epsilon (owned by Alliance Data Systems (NYSE:ADS) ), NeuStar, CoreLogic and even Oracle (NYSE:ORCL), which owns Datalogix and BlueKai, remain headwinds.

Also, despite serving some of the largest and most profitable firms in the United States, Acxiom’s client base consists primarily of companies in the financial services sector. Hence, any slowdown in the financial services industry is likely to adversely impact the company’s overall performance.

Acxiom currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

CoStar Group, Inc. (NASDAQ:CSGP) is a better-ranked technology stock in the same industry, with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank Stocks here.

Long-term earnings growth rate of CoStar Group is pegged at 15%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

CoStar Group, Inc. (CSGP): Free Stock Analysis Report

Acxiom Corporation (ACXM): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alliance Data Systems Corporation (ADS): Free Stock Analysis Report

Original post

Zacks Investment Research