There has been a lot of chatter about the death of computers. If I listened to it all I would think is that I am the only person in the world that uses a laptop, and please don’t tell anyone I just bought a new desktop.

But you cannot always believe what you hear. And this seems to be one of those cases. For when you take a look at the Computer Technology Index (yes that is a real thing). It rose through most of 2014 before being dragged down with the market in October.

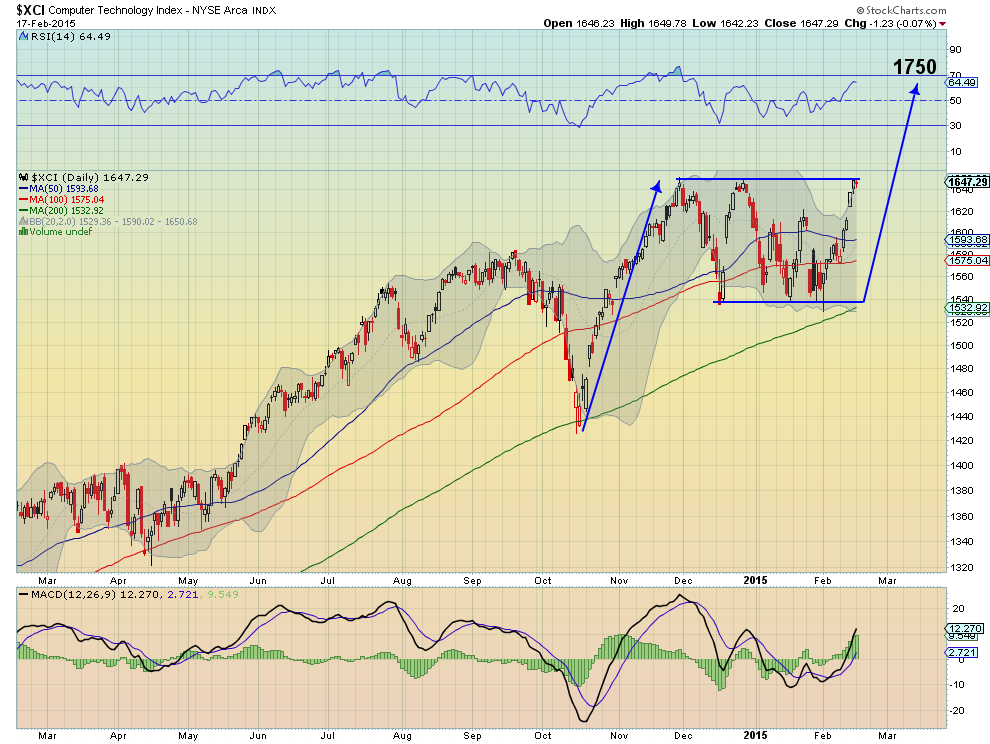

XCI

Since then the index rebounded fast in the more recent ‘V’ shaped recovery mode until a consolidating period from December through to mid February. But there are signs it is ready for a break out higher.

First the Bollinger Bands® are opening higher. The momentum indicators are rising and bullish as well. As the index sits at the top of the range, a break higher would target a move up to 1750. That is still short of the March 2000 peak at 1819 but quite a strong recovery.

And what is in this index? Just about every company that was around in for the 2000 technology bubble and still exists today. Companies like (NASDAQ:ADP), Adobe (NASDAQ:ADBE), Apple (NASDAQ:AAPL), EMC (NYSE:EMC), Microsoft (NASDAQ:MSFT), Texas Instruments (NASDAQ:TXN). I have put the full list of 30 names below. To me this is a sign of a very strong market when these old tech companies are joining and leading higher.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.