Video game publisher Activision Blizzard (NASDAQ:ATVI) posted Q3 earnings results that beat expectations, but its weak Q4 and full-year outlook sent shares lower in after-hours trading.

The Santa Monica-based company reported Q3 EPS of $0.49, easily topping Wall Street estimates of $0.42. Revenues surged 58.4% from last year to $1.57 billion, narrowly beating analysts’ $1.56 billion view.

Based on its year-to-date results, the company lifted its full-year earnings outlook, but that forecast was still well below expectations. ATVI now projects 2016 EPS of $1.92, which is much lower than analysts’ $1.98 estimate. ATVI also expects full-year revenues of $6.450 billion, which again was lower than the $6.56 billion expectations of Wall Street.

The company commented via press release:

Bobby Kotick, Chief Executive Officer of Activision Blizzard, said, “This quarter we again over-performed our plan, delivering record third-quarter revenues of $1.57 billion, up almost 60% and earnings per share of $0.49, more than doubling year-over-year on a non-GAAP basis (as redefined).”

Kotick added, “We continue to see enthusiasm from our global audiences for our key franchises including Call of Duty, Destiny, Candy Crush and World of Warcraft, plus our newest franchise – Overwatch, which after only about four months had already reached over 20 million players and has incredible player engagement. Looking forward, we expect continued momentum from all of our growth strategies, especially our esports initiatives and our integration of in-game advertising.”

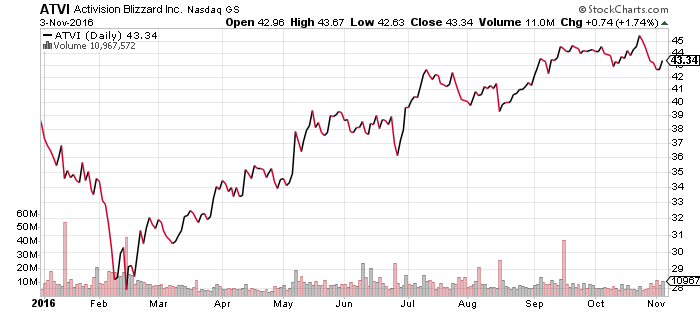

Activision Blizzard shares fell -1.67 (-3.85%) to $41.70 in after-hours trading Thursday. Prior to today’s report, ATVI had gained 12.04% year-to-date, versus a 2.41% gain in the benchmark S&P 500 during the same period.