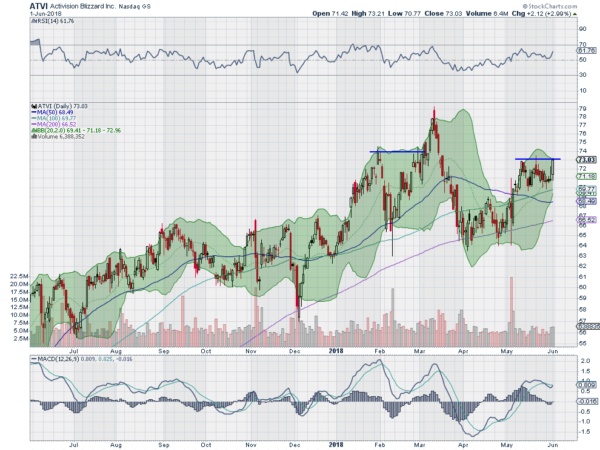

Activision Blizzard (NASDAQ:ATVI), Ticker: $ATVI

Activision Blizzard, $ATVI, rose from a December low to a high in March. It pulled back to the 200 day SMA from there and consolidated through April. It started higher in May but quickly met resistance. That led to another round of consolidation. Friday saw price rise to resistance in this consolidation for the third time. The RSI is bullish and rising and the MACD is turning to cross up. Look for a push over resistance to participate…..

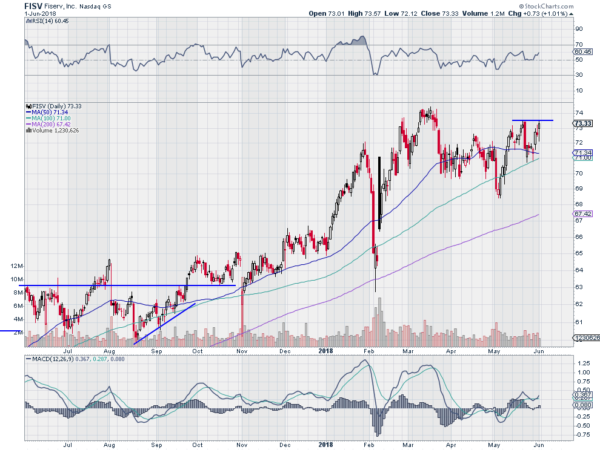

Fiserv (NASDAQ:FISV), Ticker: $FISV

Fiserv, $FISV, has trended higher since touching the 200 day SMA in November. It had a deep pullback in February before moving to a top in March. Since then the price action has been mainly sideways. Friday it moved up to short term resistance. It has a RSI that is rising in the bullish zone with the MACD moving higher and positive. Look for a push over resistance to participate higher…..

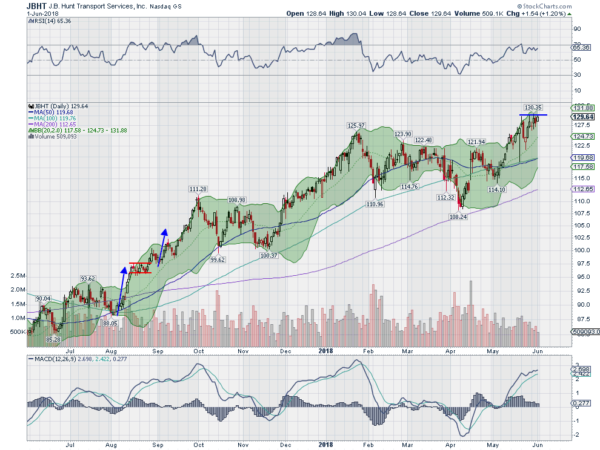

JB Hunt Transport Services Inc (NASDAQ:JBHT), Ticker: $JBHT

JB Hunt Transport, $JBHT, moved higher out of consolidation in November, reaching a peak in January. It drifted lower from there, finding support in April, just above the 200 day SMA. It has pushed up in 2 steps from there to the current resistance where it has consolidated the last few days. The RSI is bullish and the MACD rising. Look for a push over resistance to participate higher…..

PayPal Holdings Inc (NASDAQ:PYPL), Ticker: $PYPL

PayPal, $PYPL, rose up out of consolidation and trended higher until November. After a mild pullback it made a higher high in January before another pullback, this time to the 100 day SMA. A bounce found it stall at a lower high and reverse again. A lower low and a lower higher was followed be another lower low to the 200 day SMA in May. From there it has been rising and its making a higher high as it settles at the March top. The RSI is bullish and rising with the MACD moving up. Look for a push through resistance to participate higher…..

Varian Medical Systems (NYSE:VAR), Ticker: $VAR

Varian Medical Systems, $VAR, gapped up in January and ran for 2 days until it topped and reversed. That reversal filled the gap and then bounced to a lower high. It chopped for 2 months until pulling back under the 100 day SMA and settled into the current tight consolidation. Friday it broke that to the upside. The RSI is rising toward the bullish zone and the MACD moving up and near a cross to positive. Look for continuation to participate higher…..

Up Next: Bonus Idea

Elsewhere look for Gold to continue to move lower while Crude Oil joins it continuing its drop. The US Dollar Index continues to show strength, but pausing in its move higher while US Treasuries are biased lower in a channel. The Shanghai Composite is drifting lower as are Emerging Markets, with the former closing in on a new 52 week low while the latter is just retesting a major break out.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The IWM has shown strength making new all-time highs while the QQQ looks to be ready to takeover leadership for the short run. The SPY however is holding at resistance. A break out would be a major spark to the broad market. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.